Question: Using the attached financials for Apple and Ring Central, answer the following questions: 1) Based on the data in the financial statements, which company is

Using the attached financials for Apple and Ring Central, answer the following questions:

1) Based on the data in the financial statements, which company is most likely using a Differentiation Advantage Strategy?

2) What data can you see in the financial statements that support your answer to #1?

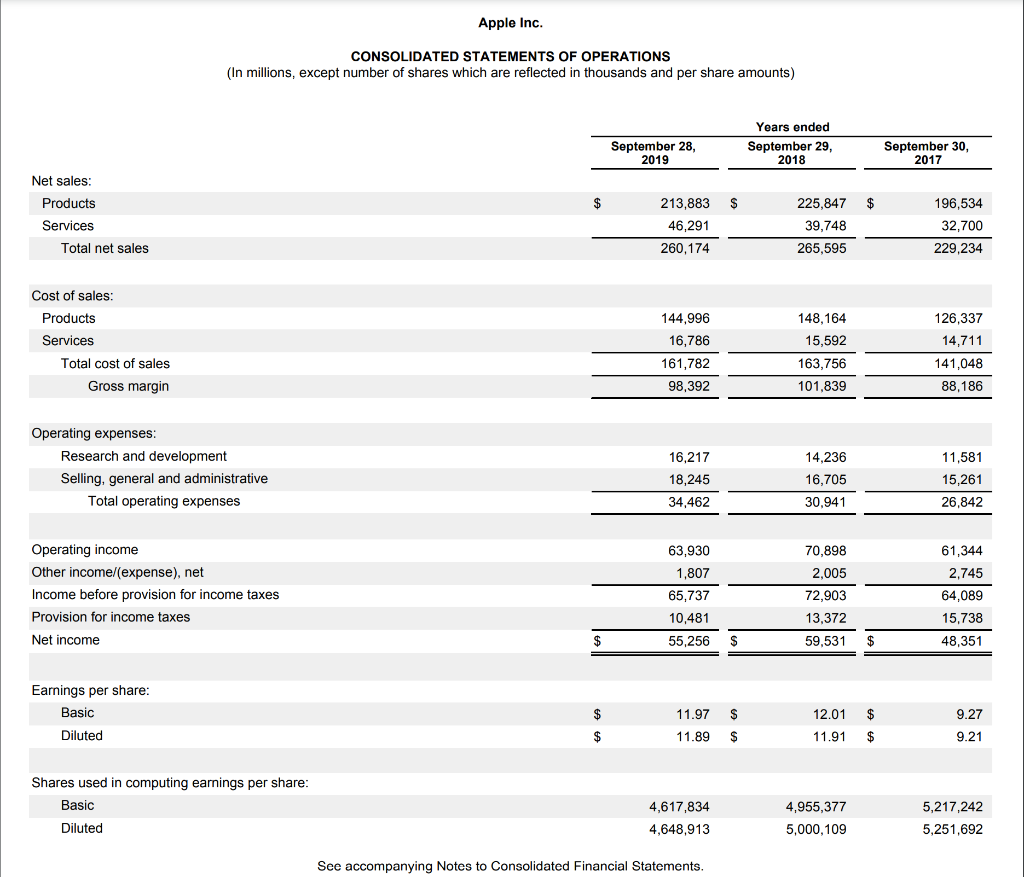

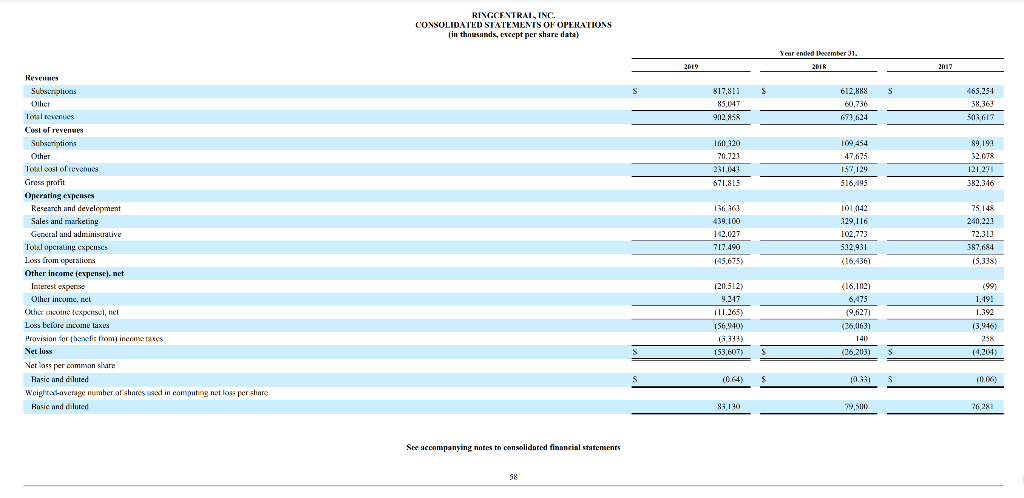

SECURITIES AND EXC COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 28, 2019 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-36743 : Apple Inc. (Exact name of Registrant as specified in its charter) California (State or other jurisdiction of incorporation or organization) 94-2404110 (I.R.S. Employer Identification No.) One Apple Park Way Cupertino California (Address of principal executive offices) 95014 (Zip Code) (408) 996-1010 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Trading Title of each class symbol(s) Name of each exchange on which registered Common Stock, $0.00001 par value per share AAPL The Nasdaq Stock Market LLC 1.000% Notes due 2022 The Nasdaq Stock Market LLC 1.375% Notes due 2024 The Nasdaq Stock Market LLC 0.875% Notes due 2025 % The Nasdaq Stock Market LLC 1.625% Notes due 2026 The Nasdaq Stock Market LLC 2.000% Notes due 2027 The Nasdaq Stock Market LLC 1.375% Notes due 2029 The Nasdaq Stock Market LLC 3.050% Notes due 2029 % The Nasdaq Stock Market LLC 3.600% Notes due 2042 The Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None ( Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No 0 Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No O Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (5232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes No O Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) September 28, Years ended September 29, 2018 September 30, 2017 2019 $ $ $ 196,534 Net sales: Products Services Total net sales 213,883 46,291 260,174 225,847 39,748 265,595 32,700 229,234 Cost of sales: Products Services Total cost of sales Gross margin 144,996 16,786 161,782 98,392 148,164 15,592 163,756 101.839 126,337 14,711 141,048 88,186 Operating expenses: Research and development Selling, general and administrative Total operating expenses 16,217 18,245 14,236 16,705 30,941 11,581 15,261 26,842 34,462 Operating income Other income/expense), net Income before provision for income taxes Provision for income taxes Net income 63,930 1,807 65,737 70.898 2,005 61,344 2,745 64,089 15,738 48,351 72,903 13,372 59,531 10,481 $ 55,256 $ Earnings per share: Basic $ 11.97 $ $ 12.01 11.91 9.27 9.21 Diluted $ 11.89 $ $ Shares used in computing earnings per share: Basic Diluted 4,617,834 4,648,913 4,955,377 5,000,109 5,217,242 5,251,692 See accompanying Notes to Consolidated Financial Statements. UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended december 31, 2019 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For transition period from Commission File Number: 001-36089 RingCentral, Inc. (Exact name of Registrant as specified in its charter) Delaware (State or oder judiction af in TN ) 94-3322814 (L.R.S. Employer Ni Na 20 Davis Drive Belmont, California 94002 (Address of principal executive offices) (650) 472-4100 (Registrant's tekphone number, including arca code) Title of each class Class A Common Stock par value S0.0001 Securities registered pursuant to Sation 12(b) of the Act Trading Symbolis) RNG Name of each exchange on which registered New York Stock Exchange Securities registered pursuant to section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No a Indicate hy check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15d) of the Act. Yes No ] Indicale by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months or for such shoxler period that the registrant was reyuired to lile such reports), and (2) tras been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T232.405 of this chapter) during the preceding 12 months (ar for such shorter period that the registrant was required to submit such files) Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, an emerging growth company See the definitions of luge nccelerated filer," "accelerated filer" "smaller reporting company," and "emerging growth company in kule 126-2 of the Exchange Act Lange accelerated filer Accelerated filer Non-accelerated like Smaller reporting company Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting Standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant is a shell company is defined in Rule 126-2 of the Act). Yes No The aggregate market value of voting stock held hy non-affiliates of the Registrant ce lune 28, 2019, based on the closing price of $114 92 for shares of the Registrant's common stock ns reported by the New York Stock Exchange, was approximately $8.4 billion Shares of common stock held by cach cecutive officer, director, and their afilisted hakkas have been excluded in that such person may be ckemed to be aliliales. This determination of aliliale status is not necessarily a conclusive determination for other purposes As of February 19, 2000, there were 76,065,062 shares of Class A common stock and 11,039.473 shares of Class .common stock outstanding DOCUMENTS INCORPORATED BY REFERENCE Information required in response to Part III of Form 10-K (Items 10, 11, 12, 13 and 14) is hereby incorporated by reference to portions of the Registrant's Proxy Statement for the Annual Meeting of Stockholders to be held in 2020. Such Proxy Statement will be filed by the Registrant with thu Securities and Exchange Commission no later than 120 days after the end of the Registrant's fiscal year ended December 31, 2019. RINGCENTRAL, INC. CONSOLIDATED STATEMENTS OF OPERATIONS in thousands, except per share data) Year ended December 31. 2018 2019 2017 S S S 817,813 85,147 902.3 612,888 60,736 673,624 465,254 38,363 503.617 160.120 70.721 231043 671,85 109,454 47,675 157,129 516,195 89.193 32.078 121 271 362.316 156967 Revenues Subscriptions Diler Total revenues Cost of revenues Subscriptions Other Total cost of revenues Gross profit Operating expenses Research and development Sales and marketing General and administrative Total operating expenses Loss from operations Other income (expense.net Interest expose Other income, nel Other Llumce, nel Loss before income laxes Provision for benefit from income taxes Net luss Net loss per common share Rasic and diluted Weighta average number of shores set in computing net loss per share Rosie and diluted 439.100 142.027 717.490 (45,675) 101042 329,116 102,773 512,931 (16,436) 75.148 240.22.1 72.313 387.684 (5,338) (99 1,191 ! 1.392 120.512) 9.217 111.265) ( (56,940) 0,393) (53,607) (16,1021 6,475 (9,627) (36,0631 140 (26,203) (3,946) 25 S 14,204) S $ S 0.00) 83,130 79.500 76,281 See accompanying notes to consolidated financial statements 58

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts