Question: Using the attached information file, Calculate (1) the weekly paycheck for each staff person and (2) total cost of payroll for the organization for the

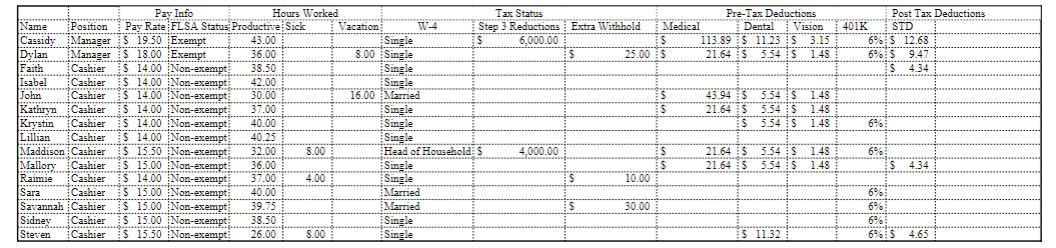

Using the attached information file, Calculate (1) the weekly paycheck for each staff person and (2) total cost of payroll for the organization for the week. Information you will need: Hourly rate of pay Pay status (exempt or non-exempt) Productive and non-productive hours worked State of Missouri and federal income tax rates based on filing status. Social Security tax (employer and employee) Medicare tax (employer and employee) Pre- and post- tax insurance deductions W-4 withholding details (e.g., single, head of household, etc) W-4 holding reductions/increases 401(k) matching – max of 3% (half of employee contribution to 6%) Employer contribution of $80.77 per week to medical insurance

Pay Info Name Position Pay Rate FLSA Status Productive Sick Cassidy Manager $19.50 Exempt 43.00 Dylan Manager $ 18.00 Exempt 36.00 38.50 Cashier S 14.00 42.00 Cashier $ 14.00 Non-exempt Non Non-exempt Non-exempt Cashier $ 14.00 14.00 Non-exempt Krystin Cashier S 14.00 Non-exempt Cashier $ 14.00 30.00 37.00 ********* Kathryn 40.00 Lillian Cashier S 14.00 Non Non-exempt 40.25 Maddison Cashier ES 15.50 Non-exempt 32.00 *********** ********** $ 15.00 Non-exempt 36.00 Mallory Cashier Raimie Cashier S 14.00 Non-exempt *********** Sara Cashier S 15.00 Non-exempti Savannah Cashier S 15.00 Non-exempt Sidney Cashier ES 15.00 Non-exempt 37.00 40.00 39.75 ********* Steven Cashier S 15.50 Non-exem Faith vassa Isabel John m Hours Worked 38.50 26.00 8.00 4.00 8.00 Vacation W-4 Single 8.00 Single Single Single 16.00 Married Single Single Single Head of Household S Single Single Married Tax Status Step 3 Reductions Extra Withhold ES 6,000.00 Married Single Single 4.000.00 S 25.00 $ 10.00 Medical S 30.00 ES ES S S Pre-Tax Deductions Dental Vision 401K 113.89 S 11.23 S 21.64 $ 5.54 $ 43.94 $ 21.64 $ ES 21.64 $ 21.64 $ 5.54 $1.48 5.54 $ 1.48 S 5.54S 1.48 5.54 $ 5.54 $ 3.15 1.48 ES 11.32 1.48 1.48 6% $12.68 6% $ 9.47 $ 4.34 6% Post Tax Deductions STD 6% ES 4.34 6% 6% 6% $ 4.65

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Payroll Calculation for ABC Corporation This document provides a detailed breakdown of the weekly payroll calculations for each staff member at ABC Corporation along with the total cost of payroll for ... View full answer

Get step-by-step solutions from verified subject matter experts