Question: Using the attached worksheet to answer: What is the ROA and ROE for SIFI Bank? How would you characterize the performance of the bank vis--vis

Using the attached worksheet to answer:

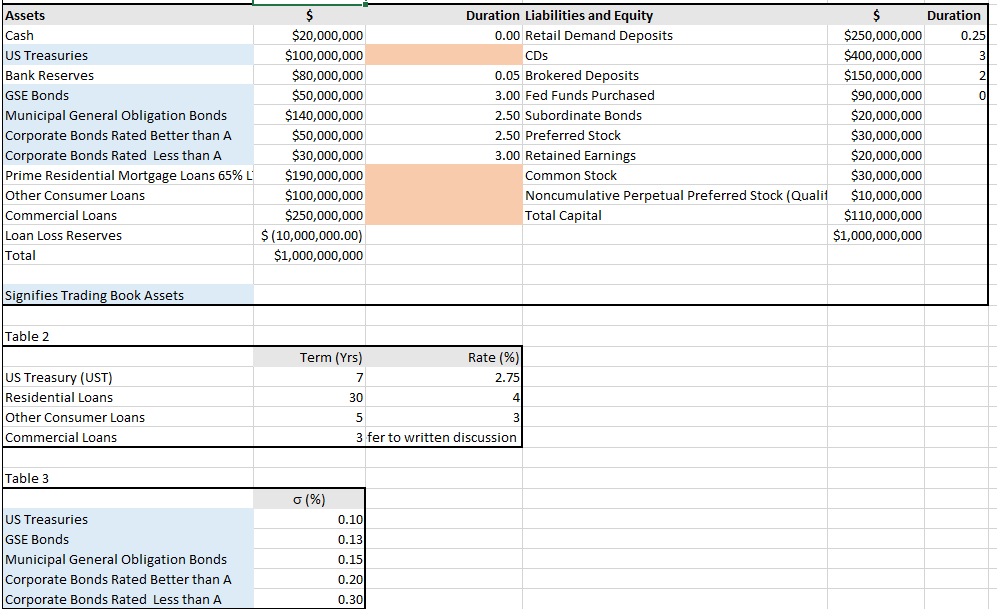

- What is the ROA and ROE for SIFI Bank?

- How would you characterize the performance of the bank vis--vis what you see from recent QBP trends for banks? Who would a representative peer bank be in your opinion?

- What is the difference between HFI and AFS assets?

- How would you describe the composition of liabilities? What might be some of the considerations for this composition?

- What is the purpose of the banks loan loss reserve?

Assets Cash Duration Liabilities and Equity $ Duration $20,000,000 0.00 Retail Demand Deposits $250,000,000 0.25 $400,000,000 $100,000,000 US Treasuries CDs Bank Reserves $80,000,000 $50,000,000 $150,000,000 0.05 Brokered Deposits 2 GSE Bonds $90,000,000 3.00 Fed Funds Purchased 0 Municipal General Obligation Bonds $140,000,000 2.50 Subordinate Bonds $20,000,000 $50,000,000 Corporate Bonds Rated Better than A Corporate Bonds Rated Less than A Prime Residential Mortgage Loans 65% L Other Consumer Loans $30,000,000 2.50 Preferred Stock $30,000,000 3.00 Retained Earnings $20,000,000 $30,000,000 $190,000,000 Common Stock $100,000,000 Noncumulative Perpetual Preferred Stock (Qualif $10,000,000 $110,000,000 $1,000,000,000 Total Capital $250,000,000 Commercial Loans Loan Loss Reserves $(10,000,000.00) $1,000,000,000 Total Signifies Trading Book Assets Table 2 Term (Yrs) Rate (%) US Treasury (UST) Residential Loans 2.75 30 4 Other Consumer Loans 5 3 fer to written discussion Commercial Loans Table 3 (%) 0.10 US Treasuries GSE Bonds 0.13 Municipal General Obligation Bonds 0.15 0.20 Corporate Bonds Rated Better than A Corporate Bonds Rated Less than A 0.30 Assets Cash Duration Liabilities and Equity $ Duration $20,000,000 0.00 Retail Demand Deposits $250,000,000 0.25 $400,000,000 $100,000,000 US Treasuries CDs Bank Reserves $80,000,000 $50,000,000 $150,000,000 0.05 Brokered Deposits 2 GSE Bonds $90,000,000 3.00 Fed Funds Purchased 0 Municipal General Obligation Bonds $140,000,000 2.50 Subordinate Bonds $20,000,000 $50,000,000 Corporate Bonds Rated Better than A Corporate Bonds Rated Less than A Prime Residential Mortgage Loans 65% L Other Consumer Loans $30,000,000 2.50 Preferred Stock $30,000,000 3.00 Retained Earnings $20,000,000 $30,000,000 $190,000,000 Common Stock $100,000,000 Noncumulative Perpetual Preferred Stock (Qualif $10,000,000 $110,000,000 $1,000,000,000 Total Capital $250,000,000 Commercial Loans Loan Loss Reserves $(10,000,000.00) $1,000,000,000 Total Signifies Trading Book Assets Table 2 Term (Yrs) Rate (%) US Treasury (UST) Residential Loans 2.75 30 4 Other Consumer Loans 5 3 fer to written discussion Commercial Loans Table 3 (%) 0.10 US Treasuries GSE Bonds 0.13 Municipal General Obligation Bonds 0.15 0.20 Corporate Bonds Rated Better than A Corporate Bonds Rated Less than A 0.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts