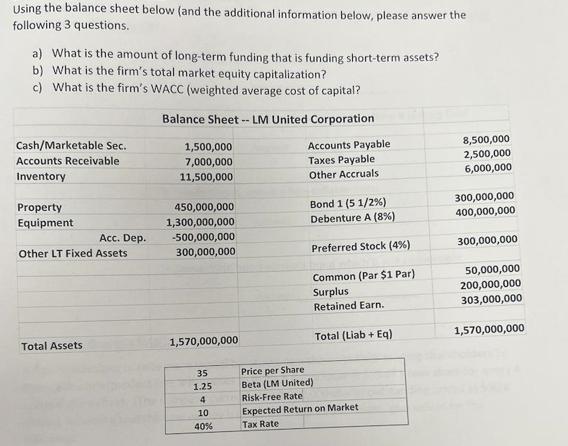

Question: Using the balance sheet below (and the additional information below, please answer the following 3 questions. a) What is the amount of long-term funding

Using the balance sheet below (and the additional information below, please answer the following 3 questions. a) What is the amount of long-term funding that is funding short-term assets? b) What is the firm's total market equity capitalization? c) What is the firm's WACC (weighted average cost of capital? Balance Sheet -- LM United Corporation Cash/Marketable Sec. Accounts Receivable Inventory Property Equipment Acc. Dep. Other LT Fixed Assets Total Assets 1,500,000 7,000,000 11,500,000 450,000,000 1,300,000,000 -500,000,000 300,000,000 1,570,000,000 35 1.25 4 10 40% Accounts Payable Taxes Payable Other Accruals Bond 1 (5 1/2 %) Debenture A (8%) Preferred Stock (4%) Common (Par $1 Par) Surplus Retained Earn. Total (Liab + Eq) Price per Share Beta (LM United) Risk-Free Rate Expected Return on Market Tax Rate 8,500,000 2,500,000 6,000,000 300,000,000 400,000,000 300,000,000 50,000,000 200,000,000 303,000,000 1,570,000,000

Step by Step Solution

There are 3 Steps involved in it

a The amount of longterm funding that is funding shortterm assets can be measured by calculating the companys working capital financed by longterm funds Longterm funds typically include longterm debt ... View full answer

Get step-by-step solutions from verified subject matter experts