Question: using the balance sheet, income statement and the additional info provided in the brookstone cash flow, complete the cash flows for Brookstone. You should use

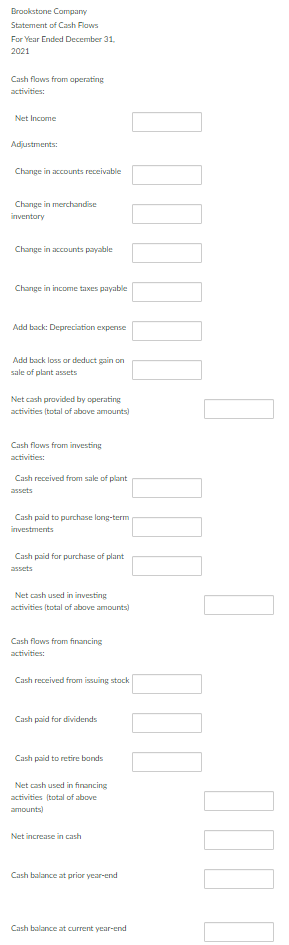

using the balance sheet, income statement and the additional info provided in the brookstone cash flow, complete the cash flows for Brookstone. You should use the INDIRECT method for determining cash flows from opertating activities. Changes in current assets and liabilities could be increases or decreases. Please be sure to reflect your adjustment as positive or negative as appropriate.

using the balance sheet, income statement and the additional info provided in the brookstone cash flow, complete the cash flows for Brookstone. You should use the INDIRECT method for determining cash flows from opertating activities. Changes in current assets and liabilities could be increases or decreases. Please be sure to reflect your adjustment as positive or negative as appropriate.

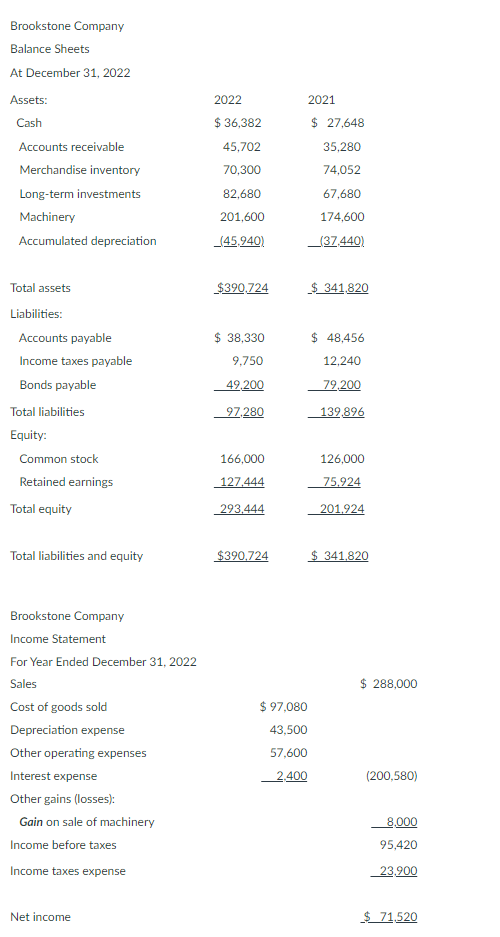

Brookstone Company Balance Sheets At December 31, 2022 \begin{tabular}{lrc} Assets: & \multicolumn{1}{c}{2022} & 2021 \\ Cash & $36,382 & $27,648 \\ Accounts receivable & 45,702 & 35,280 \\ Merchandise inventory & 70,300 & 74,052 \\ Long-term investments & 82,680 & 67,680 \\ Machinery & 201,600 & 174,600 \\ Accumulated depreciation & (45,,40) & (37,40). \end{tabular} Total assets Liabilities: Brookstone Company Income Statement For Year Ended December 31, 2022 Sales Cost of goods sold Depreciation expense Other operating expenses Interest expense Other gains (losses): Gain on sale of machinery Income before taxes Income taxes expense $390,724$341,820 Net income $288,000 $97,080 43,500 57,600 2,400 (200,580) 8,00095,42023,900 $71.520 Brookstone Compary Statement of Cash Flaws For Year Ended December 31. 2021 Cash flaws from aperating sctivities: Net Income Adjustments: Change in accounts receivable Change in merchand inventory Change in accounts payable Change in income taxes payable Add back: Depreciotion expense Add back loss ar deduct gain on sale of plant assets Net cash provided by cperating sctivities (total of abave amounts) Cash flaws from investing sctivities: Cash received from sale of plant assets Cash poid to purchase long-term investments Cash poid for purchase of plant assets Net cash used in investing activities (total of above amounts) Cash flaws from financing sctivities: Cash received from issuing stock Cash poid for dividends Cash poid to retire bonds Net cash used in firancing sctivities (total of above amounts) Net increase in cash Cash balance at pricr year-end Cash balance at current year-end Brookstone Company Balance Sheets At December 31, 2022 \begin{tabular}{lrc} Assets: & \multicolumn{1}{c}{2022} & 2021 \\ Cash & $36,382 & $27,648 \\ Accounts receivable & 45,702 & 35,280 \\ Merchandise inventory & 70,300 & 74,052 \\ Long-term investments & 82,680 & 67,680 \\ Machinery & 201,600 & 174,600 \\ Accumulated depreciation & (45,,40) & (37,40). \end{tabular} Total assets Liabilities: Brookstone Company Income Statement For Year Ended December 31, 2022 Sales Cost of goods sold Depreciation expense Other operating expenses Interest expense Other gains (losses): Gain on sale of machinery Income before taxes Income taxes expense $390,724$341,820 Net income $288,000 $97,080 43,500 57,600 2,400 (200,580) 8,00095,42023,900 $71.520 Brookstone Compary Statement of Cash Flaws For Year Ended December 31. 2021 Cash flaws from aperating sctivities: Net Income Adjustments: Change in accounts receivable Change in merchand inventory Change in accounts payable Change in income taxes payable Add back: Depreciotion expense Add back loss ar deduct gain on sale of plant assets Net cash provided by cperating sctivities (total of abave amounts) Cash flaws from investing sctivities: Cash received from sale of plant assets Cash poid to purchase long-term investments Cash poid for purchase of plant assets Net cash used in investing activities (total of above amounts) Cash flaws from financing sctivities: Cash received from issuing stock Cash poid for dividends Cash poid to retire bonds Net cash used in firancing sctivities (total of above amounts) Net increase in cash Cash balance at pricr year-end Cash balance at current year-end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts