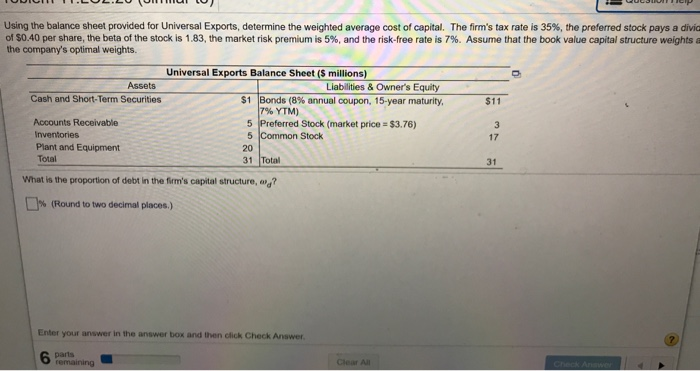

Question: Using the balance sheet provided for Universal Exports, determine the weighted average cost of capital. The firm's tax rate is 35%, the preferred stock pays

Using the balance sheet provided for Universal Exports, determine the weighted average cost of capital. The firm's tax rate is 35%, the preferred stock pays a divi of $0.40 per share, the beta of the stock is 1.83, the market risk premium is 5%, and the risk-free rate is 7%. Assume that the book value capital structure weights the company's optimal weights Assets Cash and Short-Term Securities $11 Universal Exports Balance Sheet (5 millions) Liabilities & Owner's Equity $1 Bonds (8% annual coupon, 15-year maturity. 17% YTM) 5 Preferred Stock (market price = $3.76) 5 Common Stock 20 31 Total Accounts Receivable Inventories Plant and Equipment Total What is the proportion of debt in the firm's capital structure, ang? % (Round to two decimal places.) Enter your anwwer in the answer box and then click Check Answer 6 cm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts