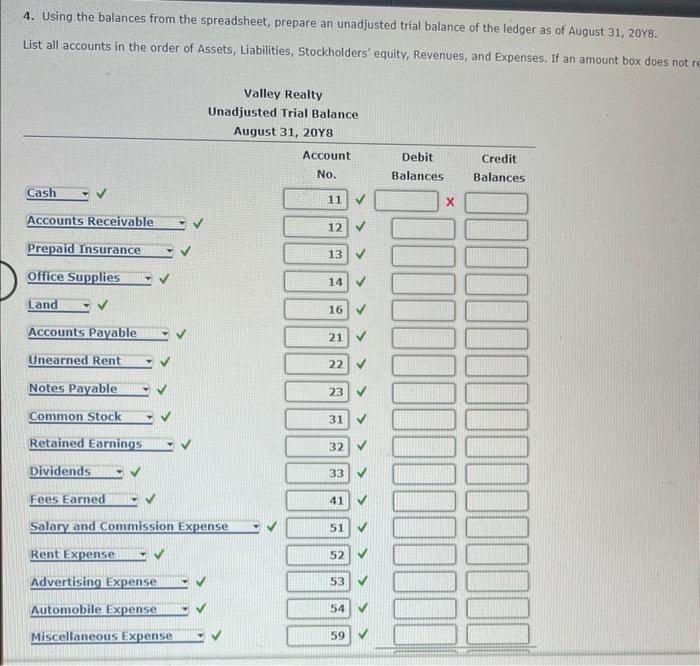

Question: Using the balances from the spreadsheet, prepare an unadjusted trial balance of the ledger as of August 31, 20Y8. ... Valley Realty Unadjusted Trial Balance

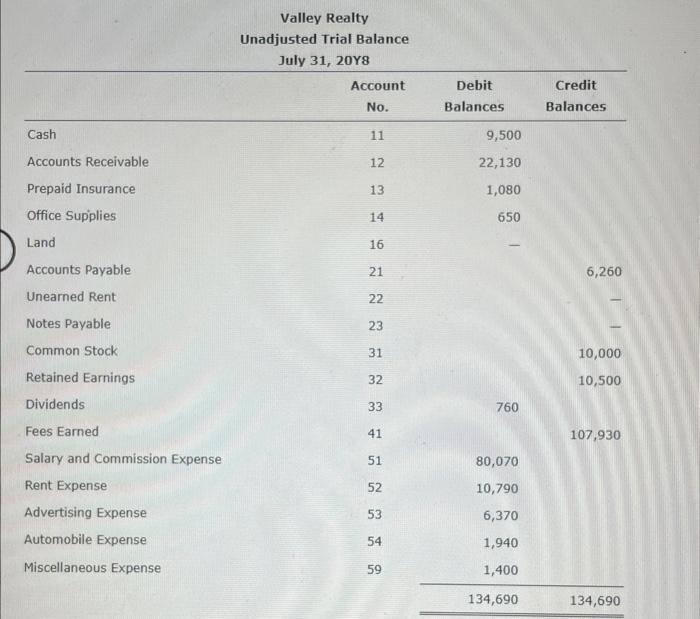

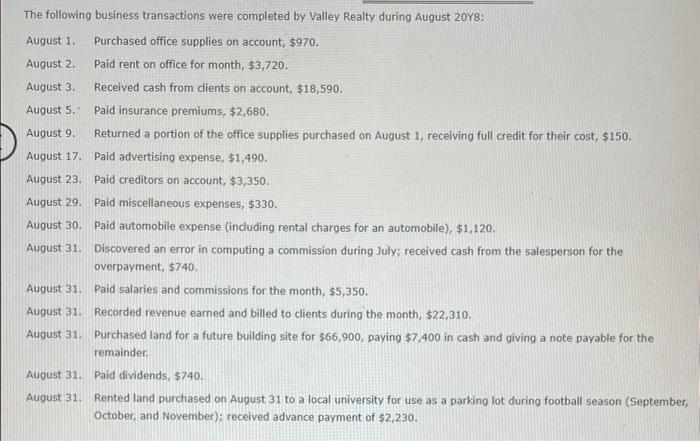

Valley Realty Unadjusted Trial Balance July 31,20Y8 The following business transactions were completed by Valley Realty during August 20 r 8 : August 1. Purchased office supplies on account, $970. August 2. Paid rent on office for month, $3,720. August 3. Received cash from clients on account, $18,590. August 5.* Paid insurance premiums, $2,680. August 9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, $150. August 17. Paid advertising expense, $1,490. August 23. Paid creditors on account, $3,350. August 29. Paid miscellaneous expenses, $330. August 30. Paid automobile expense (including rental charoes for an automobile), $1,120. August 31. Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, $740. August 31. Paid salaries and commissions for the month, $5,350. August 31. Recorded revenue earned and billed to clients during the month, $22,310. August 31. Purchased land for a future building site for $66,900, paying $7,400 in cash and giving a note payable for the remainder. August 31. Paid dividends, $740. August 31. Rented land purchased on August 31 to a local university for use as a parking lot during football season (Septemb October, and November); received advance payment of $2,230. 4. Using the balances from the spreadsheet, prepare an unadjusted trial balance of the ledger as of August 31,20Y8. List all accounts in the order of Assets, Liabilities, Stockholders' equity, Revenues, and Expenses. If an amount box does not i Valley Realty Unadjusted Trial Balance July 31,20Y8 The following business transactions were completed by Valley Realty during August 20 r 8 : August 1. Purchased office supplies on account, $970. August 2. Paid rent on office for month, $3,720. August 3. Received cash from clients on account, $18,590. August 5.* Paid insurance premiums, $2,680. August 9. Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, $150. August 17. Paid advertising expense, $1,490. August 23. Paid creditors on account, $3,350. August 29. Paid miscellaneous expenses, $330. August 30. Paid automobile expense (including rental charoes for an automobile), $1,120. August 31. Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, $740. August 31. Paid salaries and commissions for the month, $5,350. August 31. Recorded revenue earned and billed to clients during the month, $22,310. August 31. Purchased land for a future building site for $66,900, paying $7,400 in cash and giving a note payable for the remainder. August 31. Paid dividends, $740. August 31. Rented land purchased on August 31 to a local university for use as a parking lot during football season (Septemb October, and November); received advance payment of $2,230. 4. Using the balances from the spreadsheet, prepare an unadjusted trial balance of the ledger as of August 31,20Y8. List all accounts in the order of Assets, Liabilities, Stockholders' equity, Revenues, and Expenses. If an amount box does not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts