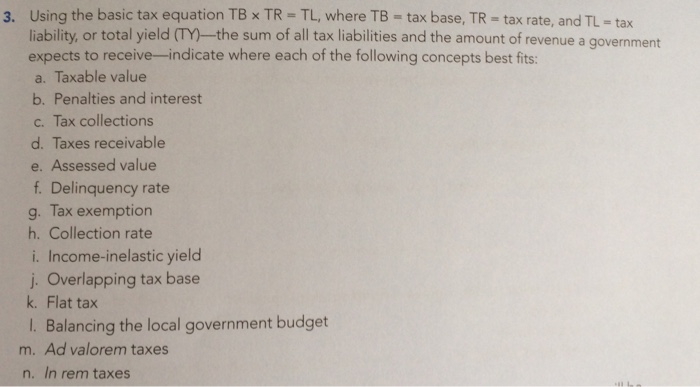

Question: Using the basic tax equation TB times TR - TL, where TB = tax e, TR = tax rate, and TL = tax liability, or

Using the basic tax equation TB times TR - TL, where TB = tax e, TR = tax rate, and TL = tax liability, or total yield (TY)-the sum of all tax liabilities and the amount of revenue a government expects to receive-indicate where each of the following concepts best fits: a. Taxable value b. Penalties and interest c. Tax collections d. Taxes receivable e. Assessed value f. Delinquency rate g. Tax exemption h. Collection rate i. Income-inelastic yield j. Overlapping tax base k. Flat tax l. Balancing the local government budget m. Ad valorem taxes n. In rem taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts