Question: Using the beginning balance sheet provided please complete step 2b Step 2b. - Assume the following actual values for the year 1 Income Statement and

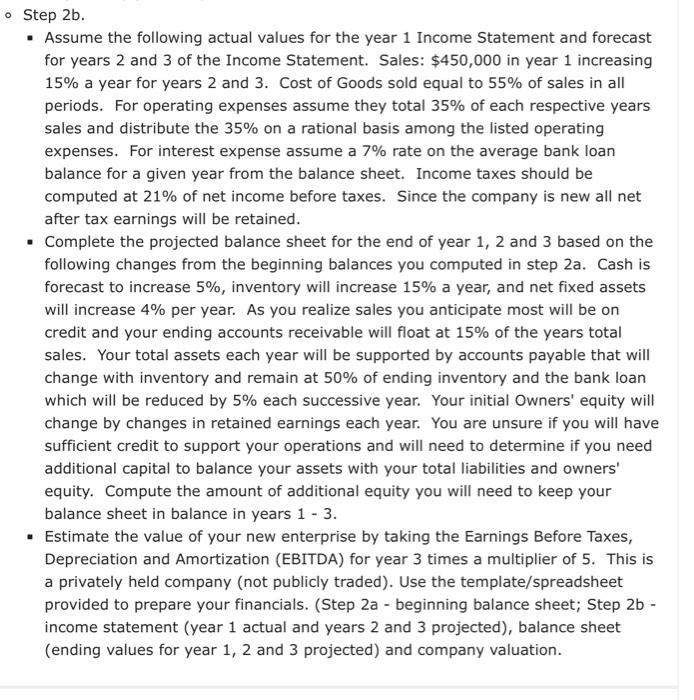

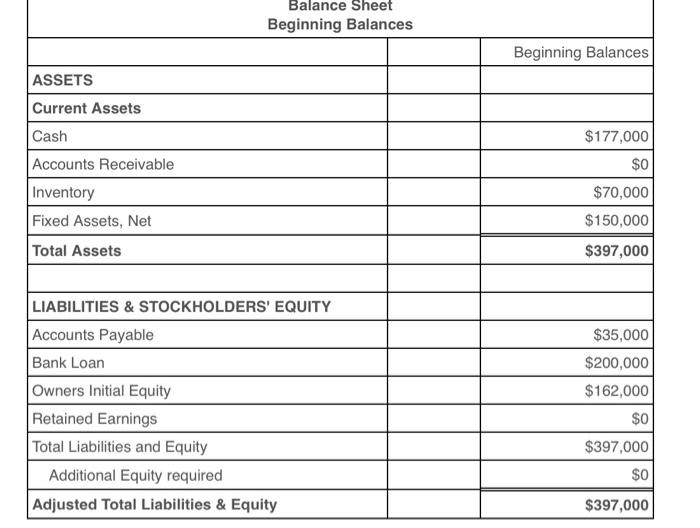

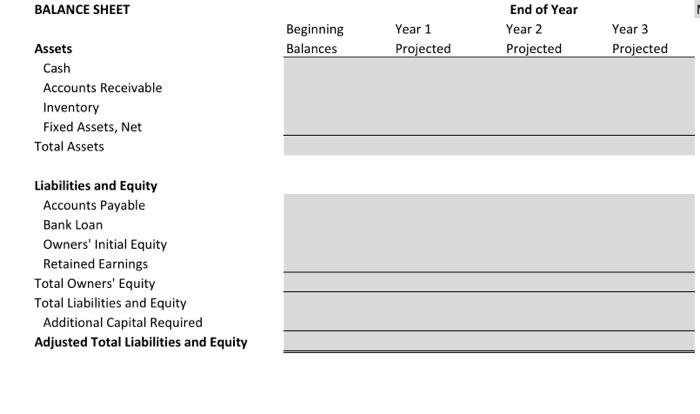

Step 2b. - Assume the following actual values for the year 1 Income Statement and forecast for years 2 and 3 of the Income Statement. Sales: $450,000 in year 1 increasing 15% a year for years 2 and 3. Cost of Goods sold equal to 55% of sales in all periods. For operating expenses assume they total 35% of each respective years sales and distribute the 35% on a rational basis among the listed operating expenses. For interest expense assume a 7% rate on the average bank loan balance for a given year from the balance sheet. Income taxes should be computed at 21% of net income before taxes. Since the company is new all net after tax earnings will be retained. - Complete the projected balance sheet for the end of year 1, 2 and 3 based on the following changes from the beginning balances you computed in step 2a. Cash is forecast to increase 5%, inventory will increase 15% a year, and net fixed assets will increase 4% per year. As you realize sales you anticipate most will be on credit and your ending accounts receivable will float at 15% of the years total sales. Your total assets each year will be supported by accounts payable that will change with inventory and remain at 50% of ending inventory and the bank loan which will be reduced by 5% each successive year. Your initial Owners' equity will change by changes in retained earnings each year. You are unsure if you will have sufficient credit to support your operations and will need to determine if you need additional capital to balance your assets with your total liabilities and owners' equity. Compute the amount of additional equity you will need to keep your balance sheet in balance in years 13. - Estimate the value of your new enterprise by taking the Earnings Before Taxes, Depreciation and Amortization (EBITDA) for year 3 times a multiplier of 5 . This is a privately held company (not publicly traded). Use the template/spreadsheet provided to prepare your financials. (Step 2a - beginning balance sheet; Step 2b income statement (year 1 actual and years 2 and 3 projected), balance sheet (ending values for year 1,2 and 3 projected) and company valuation. \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Beginning Balances } \\ \hline & & Beginning Balances \\ \hline ASSETS & & \\ \hline Current Assets & & $177,000 \\ \hline Cash & & $0 \\ \hline Accounts Receivable & & $70,000 \\ \hline Inventory & & $150,000 \\ \hline Fixed Assets, Net & & $397,000 \\ \hline Total Assets & & $35,000 \\ \hline & & $200,000 \\ \hline LIABILITIES \& STOCKHOLDERS' EQUITY & & $162,000 \\ \hline Accounts Payable & & $0 \\ \hline Bank Loan & & $397,000 \\ \hline Owners Initial Equity & & $0 \\ \hline Retained Earnings & & \\ \hline Total Liabilities and Equity & & \\ \hline Additional Equity required & & \\ \hline Adjusted Total Liabilities \& Equity & & \\ \hline \end{tabular} BALANCE SHEET \begin{tabular}{llll} Beginning & Year 1 & \multicolumn{1}{c}{ End of Year } \\ Balances & Projected & Year 2 & Year 3 \\ & & Projected & Projected \\ \hline & & \\ & & & \\ & & & \\ & & & \\ & & & \\ & & & \\ & \end{tabular} Inventory Fixed Assets, Net Total Assets Liabilities and Equity Accounts Payable Bank Loan Owners' Initial Equity Retained Earnings Total Owners' Equity Total Liabilities and Equity Additional Capital Required Adjusted Total Liabilities and Equity Step 2b. - Assume the following actual values for the year 1 Income Statement and forecast for years 2 and 3 of the Income Statement. Sales: $450,000 in year 1 increasing 15% a year for years 2 and 3. Cost of Goods sold equal to 55% of sales in all periods. For operating expenses assume they total 35% of each respective years sales and distribute the 35% on a rational basis among the listed operating expenses. For interest expense assume a 7% rate on the average bank loan balance for a given year from the balance sheet. Income taxes should be computed at 21% of net income before taxes. Since the company is new all net after tax earnings will be retained. - Complete the projected balance sheet for the end of year 1, 2 and 3 based on the following changes from the beginning balances you computed in step 2a. Cash is forecast to increase 5%, inventory will increase 15% a year, and net fixed assets will increase 4% per year. As you realize sales you anticipate most will be on credit and your ending accounts receivable will float at 15% of the years total sales. Your total assets each year will be supported by accounts payable that will change with inventory and remain at 50% of ending inventory and the bank loan which will be reduced by 5% each successive year. Your initial Owners' equity will change by changes in retained earnings each year. You are unsure if you will have sufficient credit to support your operations and will need to determine if you need additional capital to balance your assets with your total liabilities and owners' equity. Compute the amount of additional equity you will need to keep your balance sheet in balance in years 13. - Estimate the value of your new enterprise by taking the Earnings Before Taxes, Depreciation and Amortization (EBITDA) for year 3 times a multiplier of 5 . This is a privately held company (not publicly traded). Use the template/spreadsheet provided to prepare your financials. (Step 2a - beginning balance sheet; Step 2b income statement (year 1 actual and years 2 and 3 projected), balance sheet (ending values for year 1,2 and 3 projected) and company valuation. \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Beginning Balances } \\ \hline & & Beginning Balances \\ \hline ASSETS & & \\ \hline Current Assets & & $177,000 \\ \hline Cash & & $0 \\ \hline Accounts Receivable & & $70,000 \\ \hline Inventory & & $150,000 \\ \hline Fixed Assets, Net & & $397,000 \\ \hline Total Assets & & $35,000 \\ \hline & & $200,000 \\ \hline LIABILITIES \& STOCKHOLDERS' EQUITY & & $162,000 \\ \hline Accounts Payable & & $0 \\ \hline Bank Loan & & $397,000 \\ \hline Owners Initial Equity & & $0 \\ \hline Retained Earnings & & \\ \hline Total Liabilities and Equity & & \\ \hline Additional Equity required & & \\ \hline Adjusted Total Liabilities \& Equity & & \\ \hline \end{tabular} BALANCE SHEET \begin{tabular}{llll} Beginning & Year 1 & \multicolumn{1}{c}{ End of Year } \\ Balances & Projected & Year 2 & Year 3 \\ & & Projected & Projected \\ \hline & & \\ & & & \\ & & & \\ & & & \\ & & & \\ & & & \\ & \end{tabular} Inventory Fixed Assets, Net Total Assets Liabilities and Equity Accounts Payable Bank Loan Owners' Initial Equity Retained Earnings Total Owners' Equity Total Liabilities and Equity Additional Capital Required Adjusted Total Liabilities and Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts