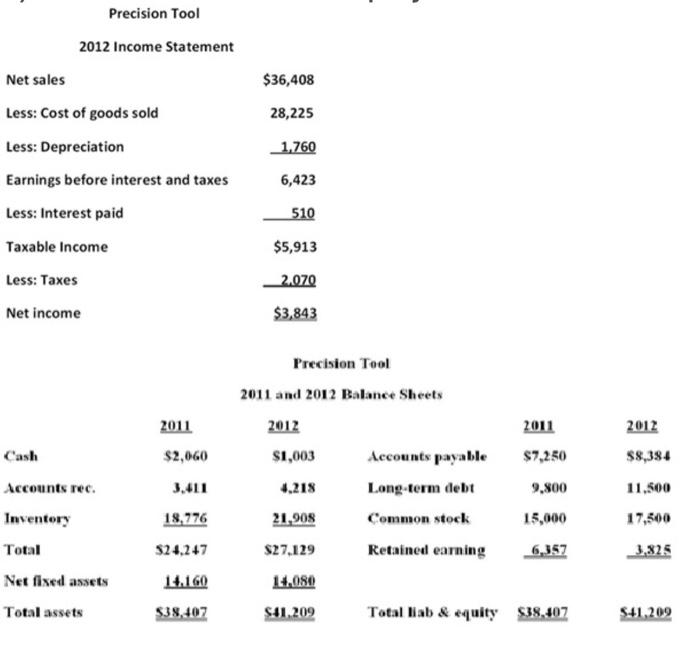

Question: Using the below financial information for Precision Tool calculate the ratios and match them with the correct answer. $36,408 28,225 Precision Tool 2012 Income Statement

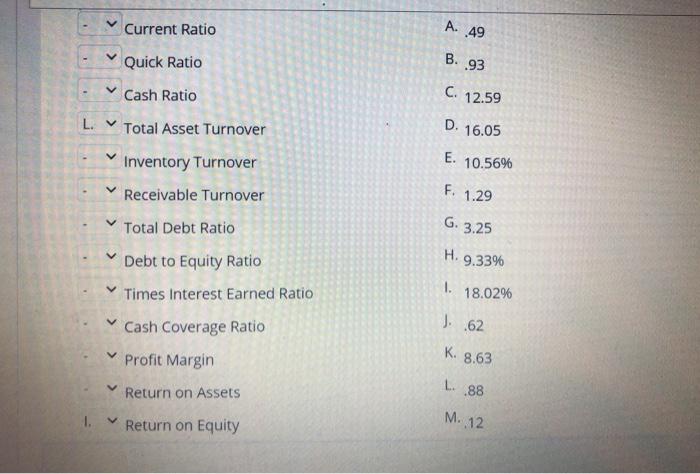

$36,408 28,225 Precision Tool 2012 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable income 1.760 6,423 510 $5,913 Less: Taxes 2,070 Net income $3,843 2011 Cash $2,060 Precision Tool 2011 and 2012 Balance Sheets 2012 2011 $1,003 Accounts payable $7,250 4.218 Long term debt 9.800 21,908 Common stock 15,000 $27.129 Retained earning 6,357 14.080 S41.209 Total lab & equity $38.407 Accounts rec. Inventory Total Net fixed assets Total assets 2012 $8,384 11.500 17,500 3.325 18,776 $24,247 14.160 $38,407 S41,209 Current Ratio A. 49 Quick Ratio B. 93 C. 12.59 D. 16.05 E. 10.5696 V F. 1.29 Cash Ratio L. Total Asset Turnover Inventory Turnover Receivable Turnover Total Debt Ratio Debt to Equity Ratio Times Interest Earned Ratio Cash Coverage Ratio Profit Margin G. 3.25 V H. 9.33% V 1. 18.0296 1. .62 K 8.63 L. 88 Return on Assets 1. Return on Equity M. 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts