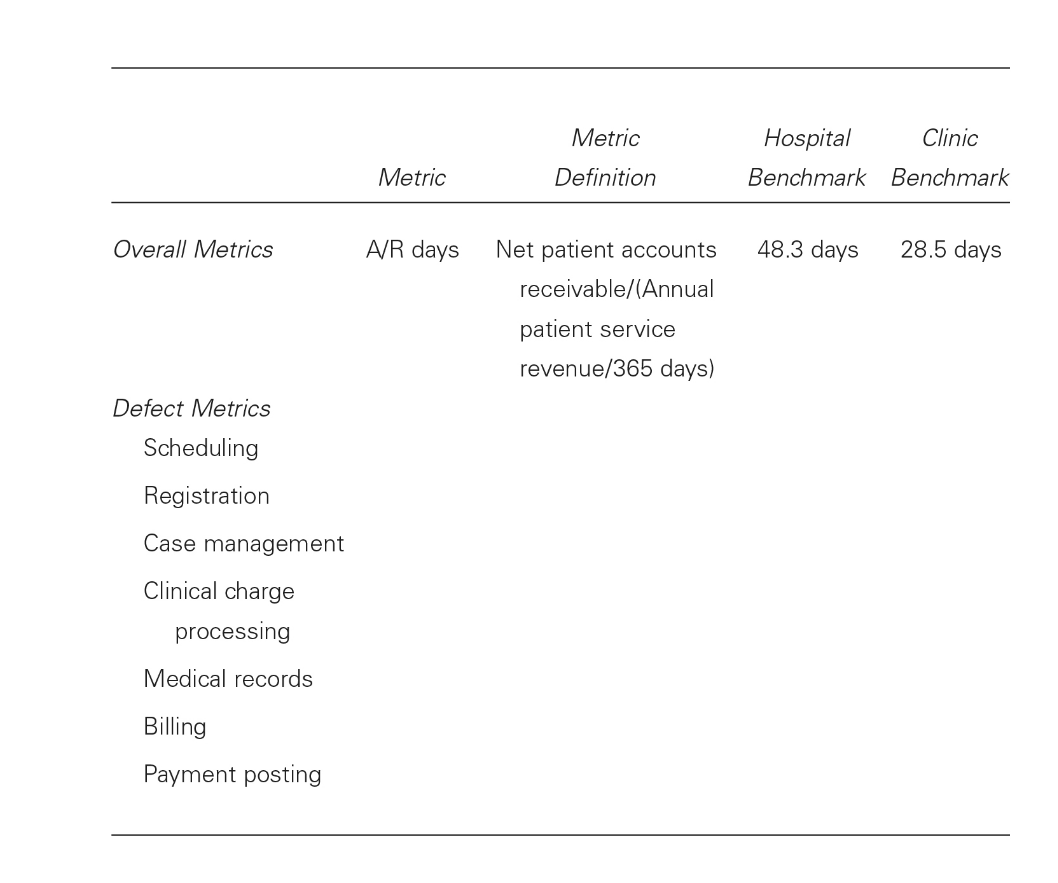

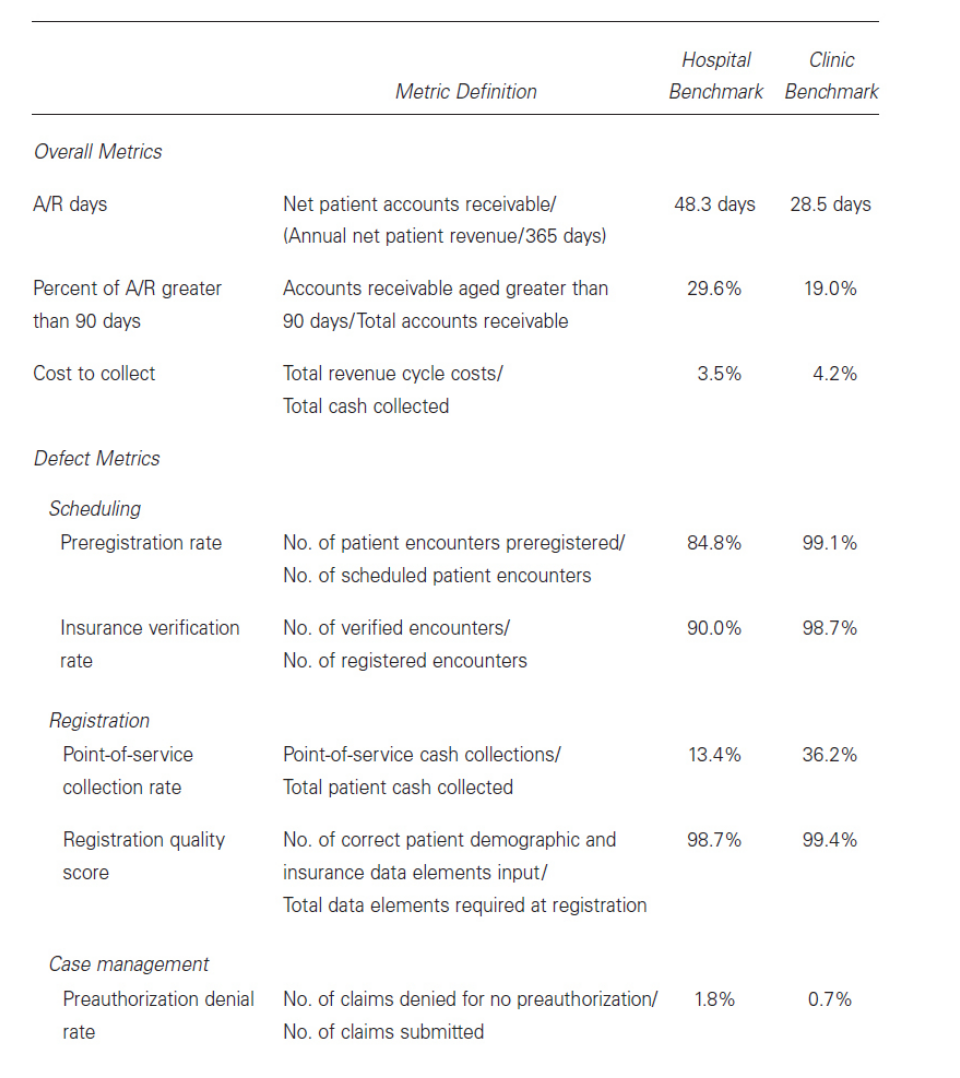

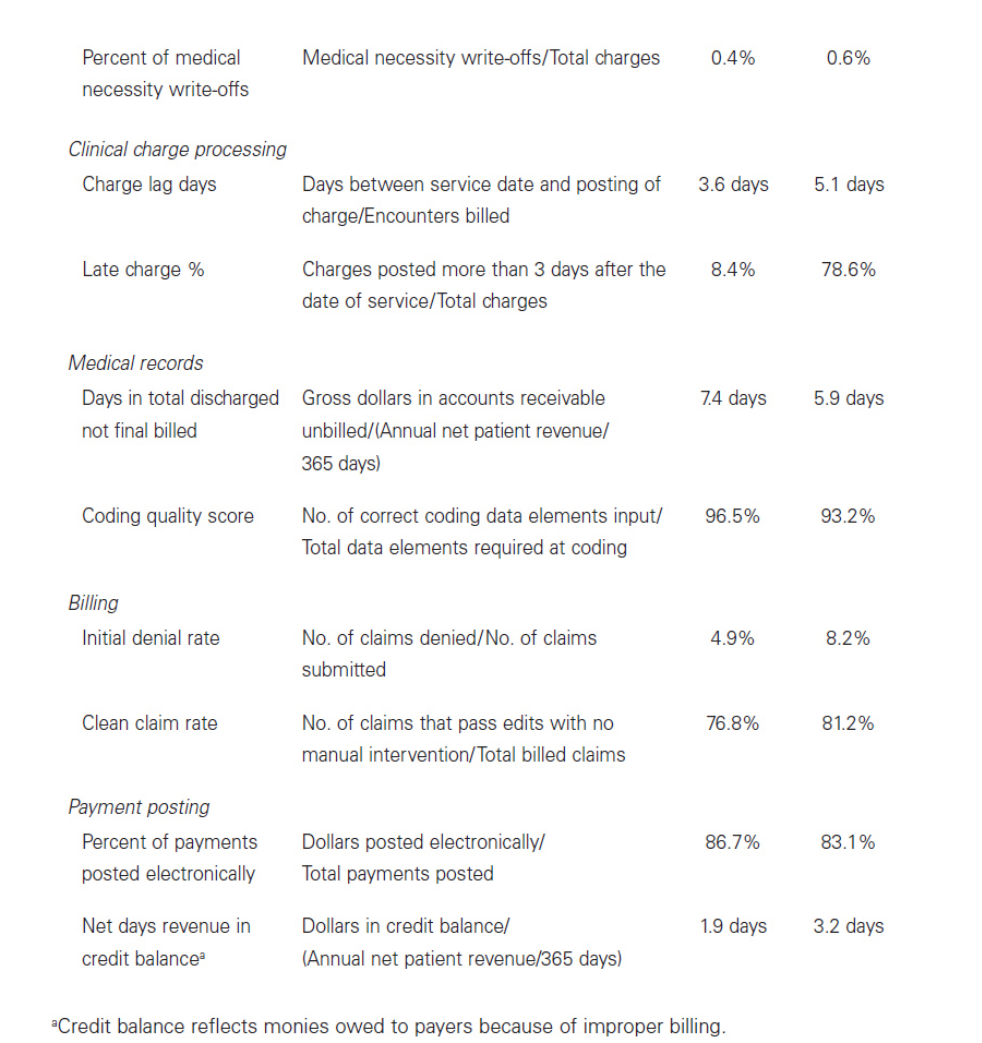

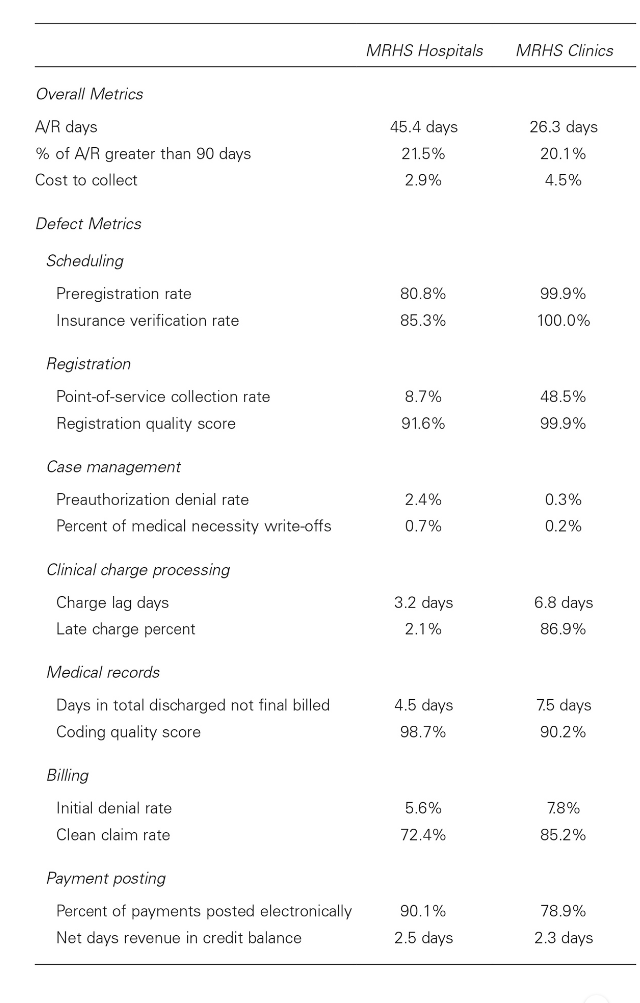

Question: *Using the below template add one additional overall benchmark and one defect benchmark for each of the revenue cycle functions listed. ( Gapenski CASE #30

*Using the below template add one additional overall benchmark and one defect benchmark for each of the revenue cycle functions listed. ( Gapenski CASE #30 MILWAUKEE REGIONAL HEALTH SYSTEM 7th edition )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts