Question: Using the beta from the previous problem, and Rf = 6 % , a Rmkt = 1 8 % compute Ks . Given D 0

Using the beta from the previous problem, and Rf a Rmkt compute Ks Given D $; D; D; D; D; D and then g Find P

PAGE

points

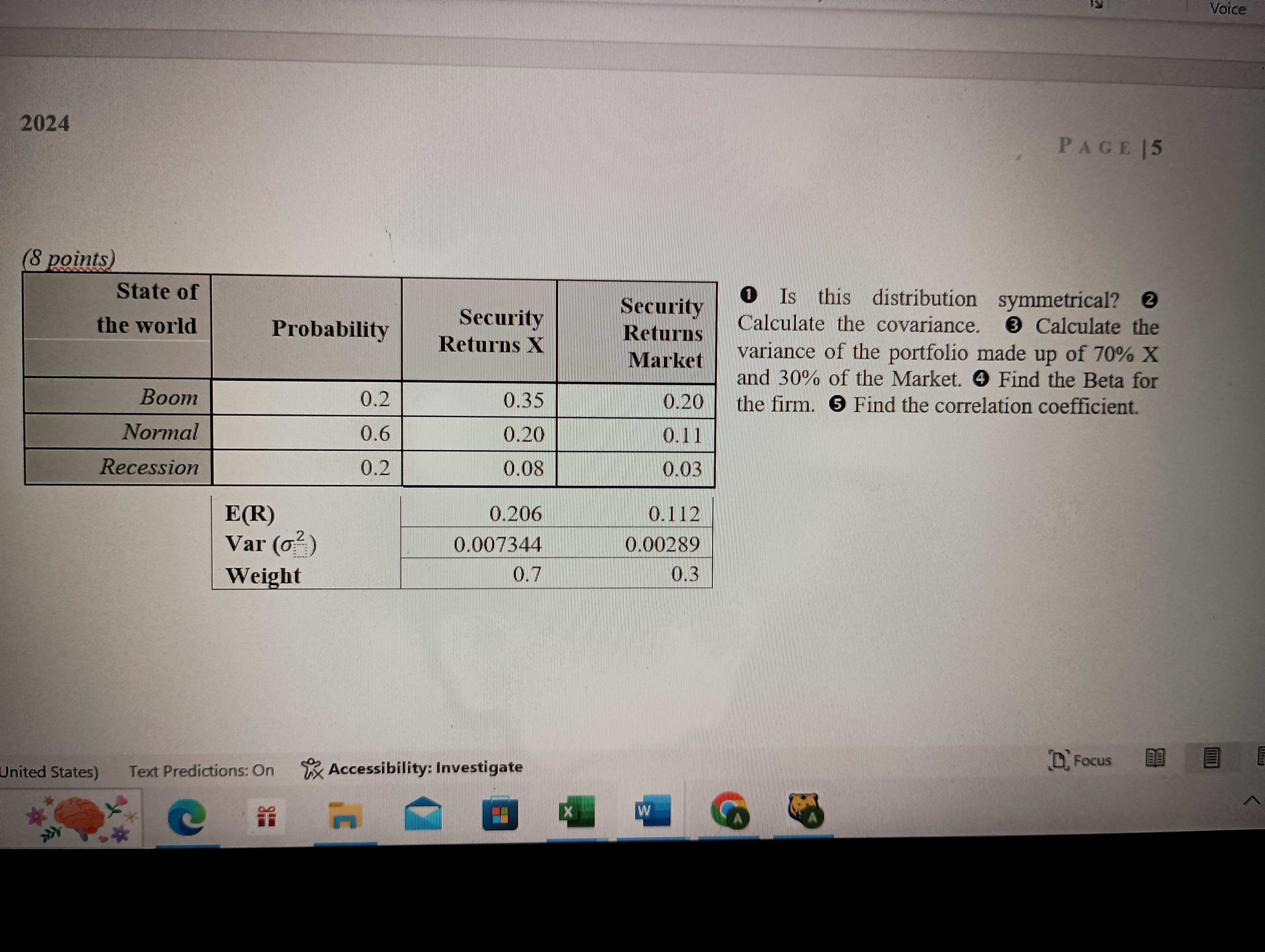

tabletableState ofthe worldProbability,tableSecurityReturns XtableSecurityReturnsMarketBoomNormalRecession

Is this distribution symmetrical? Calculate the covariance. Calculate the variance of the portfolio made up of and of the Market. Find the Beta for the firm. Find the correlation coefficient.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock