Question: Using the Capital Asset Pricing Model, calculate the required rate of return on equity of Aussie Growers Company (AGC). Justify your data choices. Proxy Company:

Using the Capital Asset Pricing Model, calculate the required rate of return on equity of Aussie Growers Company (AGC). Justify your data choices.

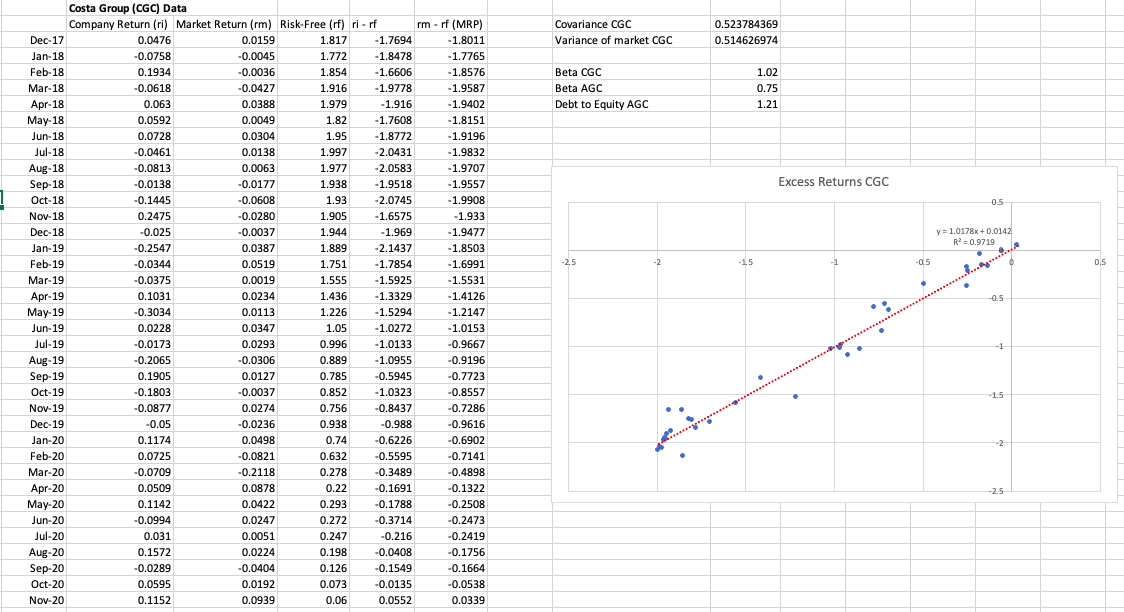

Proxy Company: Costa Group (CGC)

Covariance CGC Variance of market CGC 0.523784369 0.514626974 1.772 Beta CGC Beta AGC Debt to Equity AGC 1.02 0.75 1.21 Excess Returns CGC 0.5 y = 1.0178x+0.0142 R = 0.9719 -2.5 - 2 -1.5 -OS 0.5 . -0.5 Costa Group (CGC) Data Company Return (ri) Market Return (rm) Risk-Free (rf) ri - rf Dec-17 0.0476 0.0159 1.817 -1.7694 Jan-18 -0.0758 -0.0045 -1.8478 Feb-18 - 0.1934 -0.0036 1.854 1.854 -0.0036 -1.6606 Mar-18 Mar 10 -0.0618 -0.0427 1.916 *0.0427 -1.9778 Apr-18 Apr 18 0.063 0.0388 0.0388 1.979 -1.916 1.979 0.0592 2.310 May-18 W.234 0.0049 1.82 0.0049 Jun-18 -1.7608 4.02 0.0728 0.0304 1.95 -1.8772 Jul-18 Viva -0.0461 Juleo wome 0.00 0.0138 Vives 1.997 Aug-18 -2.0431 2.045" - -0.0813 0.0063 1.977 -2.0583 Sep-18 Sepoto 2.0505 -0.0138 -0.0177 1.938 Voir Oct-18 -1.9518 1950 DC10 -0.1445 0.143 -0.0608 1.93 -2.0745 Nov-18 novo 0.2475 -0.0280 1.905 -1.6575 -0.0280 1.905 2.0573 Dec-18 -0.025 2.02 -0.0037 1.944 "0.0057 -1.969 Jan-19 war 12 " -0.2547 0.0387 1.889 1.00 -2.1437 Feb-19 2.1457 -0.0344 V. 0.0519 1.751 . -1.7854 Mar-19 -0.0375 0.0019 1.555 -1.5925 Apr-19 www 0.1031 Apr 19 1922 0.1051 1.436 0.0234 -1.3329 May-19 23323 -0.3034 ".3054 0.0113 Vivas 1.226 -1.5294 Jun-19 229 surt 19 0.0228 W.UZZO 0.0347 0.0541 1.05 . -1.0272 0 Jul-19 Jules -0.0173 0.0293 W.UZ 0.990 0.996 - 1.0133 Aug-19 -0.2065 -0.0306 0.0300 0.009 0.889 -1.0955 Sep-19 1.0955 0.1905 0.0127 Viva! 0.785 -0.5945 Oct-19 -0.1803 -0.0037 0.852 -1.0323 Nov-19 2.0323 -0.0877 0.0274 0.756 -0.8437 Dec-19 0.0457 -0.05 . -0.0236 0.938 -0.988 Jan-20 0.1174 0.0498 0.1 0.74 -0.6226 Feb-20 0.0725 -0.0821 -0.5595 Mar-20 -0.0709 -0.2118 0.278 -0.3489 Apr-20 0.0509 como 0.0878 0.22 -0.1691 May-20 0.1142 0.0422 0.293 -0.1788 Jun-20 -0.0994 0.0247 0.272 -0.3714 Jul-20 0.031 2015 0.0051 0.247 w -0.216 Aug-20 0.1572 0.0224 0.198 -0.0408 Sep-20 -0.0289 -0.0404 0.126 -0.1549 Oct-20 0.0595 0.0192 0.073 -0.0135 Nov-20 0.1152 0.0939 0.06 0.0552 rm -rf (MRP) -1.8011 -1.7765 -1.8576 -1.9587 -1.9402 -1.8151 -1.9196 1.9834 -1.9832 1.9707 -1.9707 -1.9557 -1.9908 -1.933 1.955 -1.9477 -1.8503 -1.6991 -1.5531 2.333 -1.4126 -1.2147 -1.0153 -0.9667 V.2007 -0.9196 -0.7723 "0.0557 -0.8557 -0.7286 -0.9616 -0.6902 -0.7141 -0.4898 -0.1322 -0.2508 -0.2473 -0.2419 -0.1756 -0.1664 -0.0538 0.0339 -1 -1.5 0.632 -2.5 Covariance CGC Variance of market CGC 0.523784369 0.514626974 1.772 Beta CGC Beta AGC Debt to Equity AGC 1.02 0.75 1.21 Excess Returns CGC 0.5 y = 1.0178x+0.0142 R = 0.9719 -2.5 - 2 -1.5 -OS 0.5 . -0.5 Costa Group (CGC) Data Company Return (ri) Market Return (rm) Risk-Free (rf) ri - rf Dec-17 0.0476 0.0159 1.817 -1.7694 Jan-18 -0.0758 -0.0045 -1.8478 Feb-18 - 0.1934 -0.0036 1.854 1.854 -0.0036 -1.6606 Mar-18 Mar 10 -0.0618 -0.0427 1.916 *0.0427 -1.9778 Apr-18 Apr 18 0.063 0.0388 0.0388 1.979 -1.916 1.979 0.0592 2.310 May-18 W.234 0.0049 1.82 0.0049 Jun-18 -1.7608 4.02 0.0728 0.0304 1.95 -1.8772 Jul-18 Viva -0.0461 Juleo wome 0.00 0.0138 Vives 1.997 Aug-18 -2.0431 2.045" - -0.0813 0.0063 1.977 -2.0583 Sep-18 Sepoto 2.0505 -0.0138 -0.0177 1.938 Voir Oct-18 -1.9518 1950 DC10 -0.1445 0.143 -0.0608 1.93 -2.0745 Nov-18 novo 0.2475 -0.0280 1.905 -1.6575 -0.0280 1.905 2.0573 Dec-18 -0.025 2.02 -0.0037 1.944 "0.0057 -1.969 Jan-19 war 12 " -0.2547 0.0387 1.889 1.00 -2.1437 Feb-19 2.1457 -0.0344 V. 0.0519 1.751 . -1.7854 Mar-19 -0.0375 0.0019 1.555 -1.5925 Apr-19 www 0.1031 Apr 19 1922 0.1051 1.436 0.0234 -1.3329 May-19 23323 -0.3034 ".3054 0.0113 Vivas 1.226 -1.5294 Jun-19 229 surt 19 0.0228 W.UZZO 0.0347 0.0541 1.05 . -1.0272 0 Jul-19 Jules -0.0173 0.0293 W.UZ 0.990 0.996 - 1.0133 Aug-19 -0.2065 -0.0306 0.0300 0.009 0.889 -1.0955 Sep-19 1.0955 0.1905 0.0127 Viva! 0.785 -0.5945 Oct-19 -0.1803 -0.0037 0.852 -1.0323 Nov-19 2.0323 -0.0877 0.0274 0.756 -0.8437 Dec-19 0.0457 -0.05 . -0.0236 0.938 -0.988 Jan-20 0.1174 0.0498 0.1 0.74 -0.6226 Feb-20 0.0725 -0.0821 -0.5595 Mar-20 -0.0709 -0.2118 0.278 -0.3489 Apr-20 0.0509 como 0.0878 0.22 -0.1691 May-20 0.1142 0.0422 0.293 -0.1788 Jun-20 -0.0994 0.0247 0.272 -0.3714 Jul-20 0.031 2015 0.0051 0.247 w -0.216 Aug-20 0.1572 0.0224 0.198 -0.0408 Sep-20 -0.0289 -0.0404 0.126 -0.1549 Oct-20 0.0595 0.0192 0.073 -0.0135 Nov-20 0.1152 0.0939 0.06 0.0552 rm -rf (MRP) -1.8011 -1.7765 -1.8576 -1.9587 -1.9402 -1.8151 -1.9196 1.9834 -1.9832 1.9707 -1.9707 -1.9557 -1.9908 -1.933 1.955 -1.9477 -1.8503 -1.6991 -1.5531 2.333 -1.4126 -1.2147 -1.0153 -0.9667 V.2007 -0.9196 -0.7723 "0.0557 -0.8557 -0.7286 -0.9616 -0.6902 -0.7141 -0.4898 -0.1322 -0.2508 -0.2473 -0.2419 -0.1756 -0.1664 -0.0538 0.0339 -1 -1.5 0.632 -2.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts