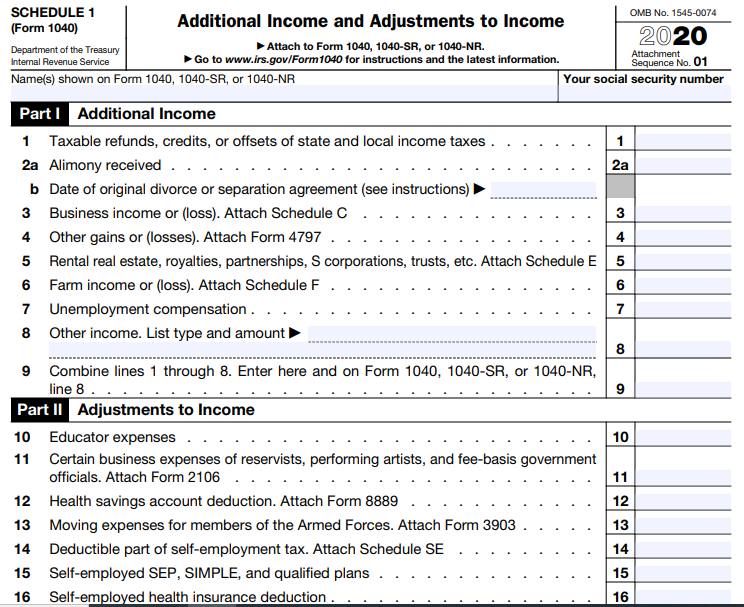

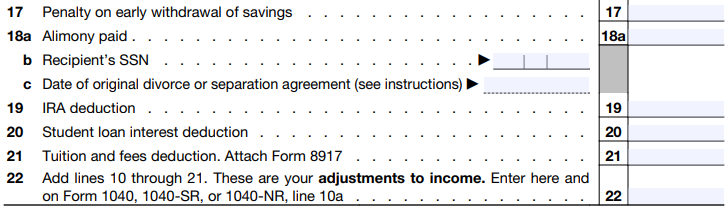

Question: Using the case below, fill out SCHEDULE 1 FORM attached below based on current Tax Year. Denise Lopez, age 40, is single and has no

Using the case below, fill out SCHEDULE 1 FORM attached below based on current Tax Year.

Denise Lopez, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434. Denise is a material participant in the business, she is a cash basis taxpayer, and her Social Security number is 123-45-6781. Denise lives at 2020 Oakcrest Road, Boca Raton, FL 33431. Denise wants to designate $3 to the Presidential Election Campaign Fund. She has never owned or used any virtual currency. Denise received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored. During 2020, Denise had the following income and expense items:

-

$100,000 salary from Legal Services, Inc.

-

$20,000 gross receipts from her typing services business.

-

$700 interest income from Third National Bank.

-

$1,000 Christmas bonus from Legal Services, Inc.

-

$60,000 life insurance proceeds on the death of her sister.

-

$5,000 check given to her by her wealthy aunt.

-

$100 won in a bingo game.

-

Expenses connected with Typing Services:

Office rent $7,000 Supplies 4,400 Utilities and telephone 4,680 Wages to part-time typists 5,000 Payroll taxes 500 Equipment rentals 3,000 -

$9,500 interest expense on a home mortgage (paid to Boca Raton Savings and Loan).

-

$15,000 fair market value of silverware stolen from her home by a burglar on October 12, 2020. Denise had paid $14,000 for the silverware on July 1, 2010. She was reimbursed $10,000 by her insurance company.

-

Denise had loaned $2,100 to a friend, Joan Jensen, on June 3, 2016. Joan declared bankruptcy on August 14, 2020, and was unable to repay the loan. Assume that the loan is a bona fide debt.

-

Legal Services, Inc., withheld Federal income tax of $15,000 and the appropriate amount of FICA tax from her wages.

-

Alimony of $10,000 received from her former husband, Omar Guzman; divorce was finalized on December 2, 2013, and no changes have been made to the divorce decree since that time.

-

Interest income of $800 on City of Boca Raton bonds.

-

Denise made estimated Federal tax payments of $2,000.

-

Sales taxes from the sales tax table of $953.

-

Property taxes on her residence of $3,200.

-

Charitable contribution of $2,500 to her alma mater, Citrus State College.

-

On November 1, 2020, Denise was involved in an automobile accident. At the time of the accident, her automobiles FMV was $45,000. After the accident, the automobiles FMV was $38,000. Denise acquired the car on May 2, 2019, at a cost of $52,000. Denises car was covered by insurance, but because the policy had a $5,000 deduction clause, Denise decided not to file a claim for the damage.

-

-

OMB No. 1545-0074 Attachment Sequence No. 01 2a 3 4 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Part 1 Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes. 1 2a Alimony received .. b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule 4 Other gains or losses). Attach Form 4797 ... 4 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 5 6 Farm income or loss). Attach Schedule F 6 7 Unemployment compensation. 7 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8... 9 Part II Adjustments to Income 10 Educator expenses.. 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans. 15 16 Self-employed health insurance deduction. 16 12 . 17 18a 17 Penalty on early withdrawal of savings 18a Alimony paid . . . b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 19 IRA deduction ... 20 Student loan interest deduction 21 Tuition and fees deduction. Attach Form 8917 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 19 20 21 22 OMB No. 1545-0074 Attachment Sequence No. 01 2a 3 4 SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2020 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Part 1 Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes. 1 2a Alimony received .. b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule 4 Other gains or losses). Attach Form 4797 ... 4 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 5 6 Farm income or loss). Attach Schedule F 6 7 Unemployment compensation. 7 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8... 9 Part II Adjustments to Income 10 Educator expenses.. 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans. 15 16 Self-employed health insurance deduction. 16 12 . 17 18a 17 Penalty on early withdrawal of savings 18a Alimony paid . . . b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 19 IRA deduction ... 20 Student loan interest deduction 21 Tuition and fees deduction. Attach Form 8917 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 10a 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts