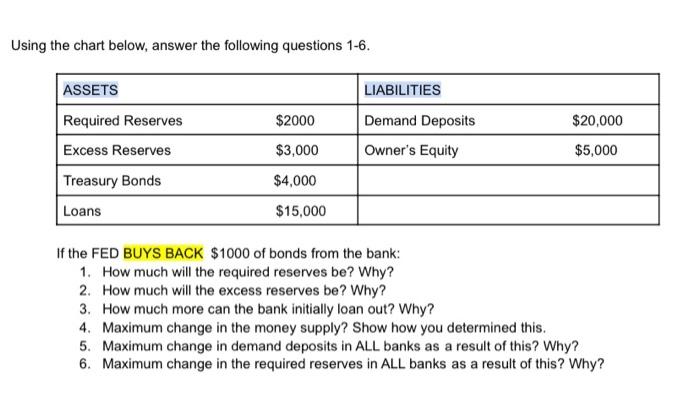

Question: Using the chart below, answer the following questions 1-6. ASSETS Required Reserves Excess Reserves Treasury Bonds Loans LIABILITIES Demand Deposits Owner's Equity 520.000 $5,000 52000

Using the chart below, answer the following questions 1-6. ASSETS Required Reserves Excess Reserves Treasury Bonds Loans LIABILITIES Demand Deposits Owner's Equity 520.000 $5,000 52000 $3.000 $4,000 $15.000 If the FED BUYS BACK $1000 of bonds from the bank. 1. How much will the required reserves be? Why? 2. How much will the excess reserves be? Why? 3. How much more can the bank initially loan out? Why? 4. Maximum change in the money supply? Show how you determined this 5. Maimum change in demand deposits in ALL banks as a result of this? Why? 6. Macmun change in the required reserves in ALL banks as a result of ?? Using the chart below, answer the following questions 1-6. LIABILITIES ASSETS Required Reserves $2000 Demand Deposits $20,000 Excess Reserves $3,000 Owner's Equity $5,000 Treasury Bonds $4,000 Loans $15,000 If the FED BUYS BACK $1000 of bonds from the bank: 1. How much will the required reserves be? Why? 2. How much will the excess reserves be? Why? 3. How much more can the bank initially loan out? Why? 4. Maximum change in the money supply? Show how you determined this. 5. Maximum change in demand deposits in ALL banks as a result of this? Why? 6. Maximum change in the required reserves in ALL banks as a result of this? Why? Using the chart below, answer the following questions 1-6. ASSETS Required Reserves Excess Reserves Treasury Bonds Loans LIABILITIES Demand Deposits Owner's Equity 520.000 $5,000 52000 $3.000 $4,000 $15.000 If the FED BUYS BACK $1000 of bonds from the bank. 1. How much will the required reserves be? Why? 2. How much will the excess reserves be? Why? 3. How much more can the bank initially loan out? Why? 4. Maximum change in the money supply? Show how you determined this 5. Maimum change in demand deposits in ALL banks as a result of this? Why? 6. Macmun change in the required reserves in ALL banks as a result of ?? Using the chart below, answer the following questions 1-6. LIABILITIES ASSETS Required Reserves $2000 Demand Deposits $20,000 Excess Reserves $3,000 Owner's Equity $5,000 Treasury Bonds $4,000 Loans $15,000 If the FED BUYS BACK $1000 of bonds from the bank: 1. How much will the required reserves be? Why? 2. How much will the excess reserves be? Why? 3. How much more can the bank initially loan out? Why? 4. Maximum change in the money supply? Show how you determined this. 5. Maximum change in demand deposits in ALL banks as a result of this? Why? 6. Maximum change in the required reserves in ALL banks as a result of this? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts