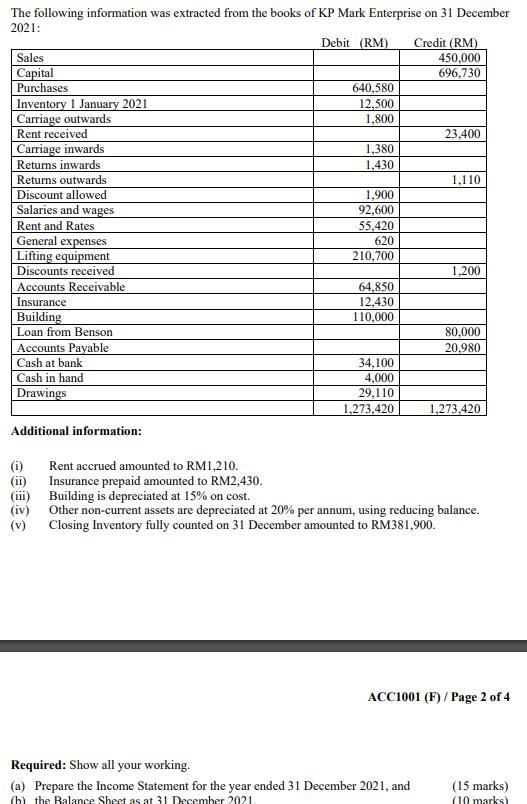

Question: The following information was extracted from the books of KP Mark Enterprise on 31 December 2021: Debit (RM) Sales Capital Purchases Inventory 1 January

The following information was extracted from the books of KP Mark Enterprise on 31 December 2021: Debit (RM) Sales Capital Purchases Inventory 1 January 2021 Carriage outwards Rent received Carriage inwards Returns inwards Returns outwards Discount allowed Salaries and wages Rent and Rates General expenses Lifting equipment Discounts received Accounts Receivable Insurance Building Loan from Benson Accounts Payable Cash at bank Cash in hand Drawings Additional information: (i) (ii) (iii) (iv) (v) 640,580 12,500 1,800 1,380 1,430 1,900 92,600 55,420 620 210,700 64,850 12,430 110,000 34,100 4,000 29,110 1,273,420 Credit (RM) 450,000 696,730 23,400 Required: Show all your working. (a) Prepare the Income Statement for the year ended 31 December 2021, and (b) the Balance Sheet as at 31 December 2021. 1,110 1,200 80,000 20,980 1,273,420 Rent accrued amounted to RM1,210. Insurance prepaid amounted to RM2,430. Building is depreciated at 15% on cost. Other non-current assets are depreciated at 20% per annum, using reducing balance. Closing Inventory fully counted on 31 December amounted to RM381,900. ACC1001 (F)/ Page 2 of 4 (15 marks) (10 marks)

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Required financial statements are Particulars Sales Less Return Inwards Less Discount allowed Less C... View full answer

Get step-by-step solutions from verified subject matter experts