Question: Using the choices provided below, show the justification for each provision of the tax law listed. A tax credit for amounts spent to furnish care

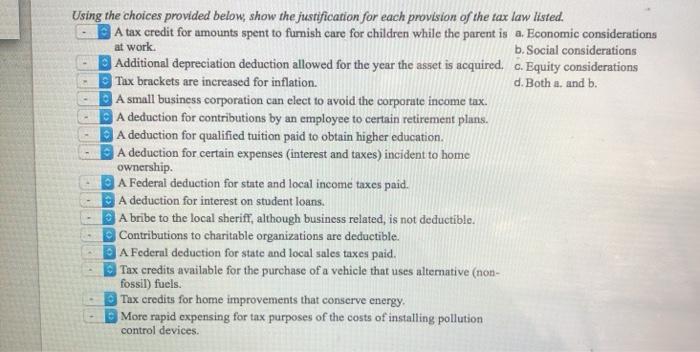

Using the choices provided below, show the justification for each provision of the tax law listed. A tax credit for amounts spent to furnish care for children while the parent is a. Economic considerations at work. b. Social considerations Additional depreciation deduction allowed for the year the asset is acquired. c. Equity considerations Tax brackets are increased for inflation. d. Both a. and b. A small business corporation can elect to avoid the corporate income tax. A deduction for contributions by an employee to certain retirement plans. A deduction for qualified tuition paid to obtain higher education. A deduction for certain expenses (interest and taxes) incident to home ownership. A Federal deduction for state and local income taxes paid. DA deduction for interest on student loans. A bribe to the local sheriff, although business related, is not deductible. Contributions to charitable organizations are deductible. A Federal deduction for state and local sales taxes paid. Tax credits available for the purchase of a vehicle that uses alternative (non- fossil) fuels. Tax credits for home improvements that conserve energy More rapid expensing for tax purposes of the costs of installing pollution control devices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts