Question: Using the contribution margin approach for a special order decision Mayer Company produces and sells a food processor that it price at a 32 percent

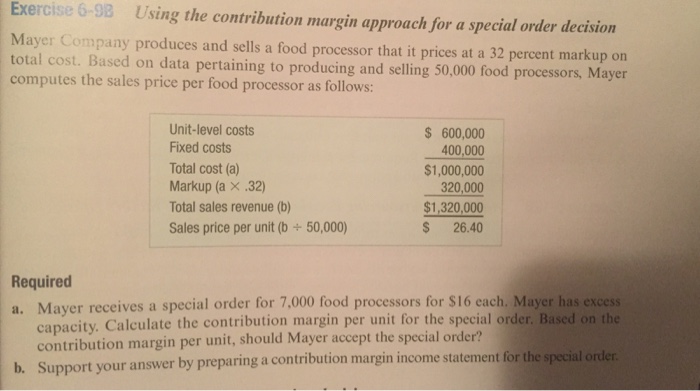

Using the contribution margin approach for a special order decision Mayer Company produces and sells a food processor that it price at a 32 percent markup on total cost. Based on date pertaining to producing and selling 50,000 food processors, Mayer computes the sales price per food processor as follows: Unit-level costs dollar 600,000 Fixes cost 400,000 Total cost(a) dollar1,000,000 Markup (a *.32) 320,000 Total sales revenue (b) dollar 1,320,000 Sales price per unit(b/50,000) dollar 26.40 Required a. Mayer receives a special order for 7.000 food processors for SI6 each. Mayer has excess. capacity Calculate the contribution margin per unit for the special order Based on the contribution margin per unit, should Mayer accept the special order? Support your answer by preparing a contribution margin income statement for the special order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts