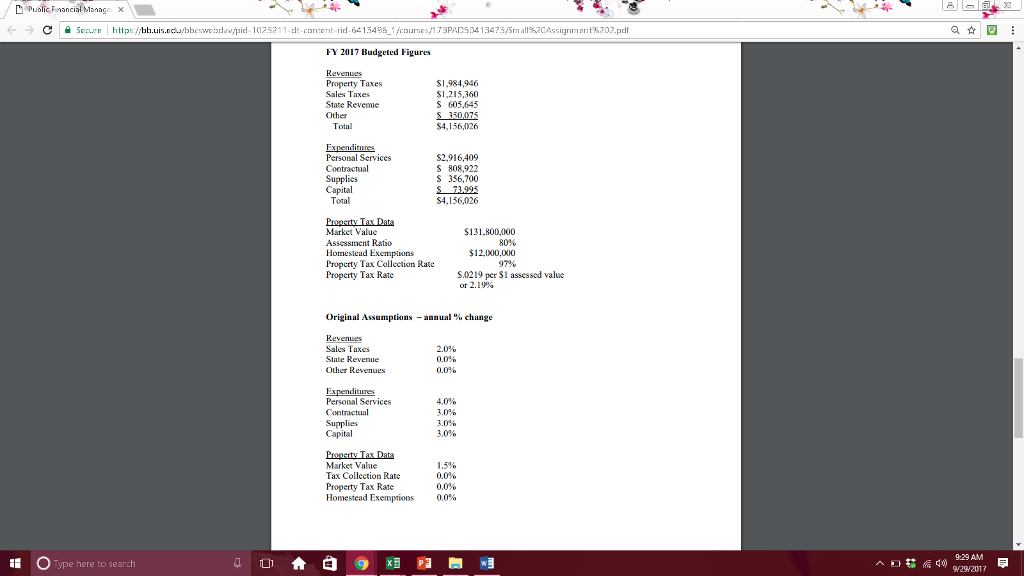

Question: Using the data and assumptions shown in Figure 1, prepare a table that shows the components of the FY 2017 budgeted revenues and expenditures, along

Using the data and assumptions shown in Figure 1, prepare a table that shows the components of the FY 2017 budgeted revenues and expenditures, along with the projected revenues and expenditures for the fiscal years 2018-2022. Calculate the projected total revenues, total expenditures, and surplus or deficit for each of the future years. You should also show the following property tax figures for each year: the market value of property, the assessment ratio, the assessed value of property, the property tax rate, and the property tax collection rate. (Note: Even though some assumption value equal to zero, those assumptions could change in the future. Therefore, you should still use cells for these assumptions and formulas that refer to the assumption cells. However, you do not need to include formulas for the assessment ratio which is set by state law and therefore will not change.)

* I am having a hard time trying to figure out how to calculate the homestead exemptions, property tax rate, and proerty tax collection rates for the next following years. I was able to calculate market values, assessment ratios, and assessed values. However, I need all these elements before I can find revenues, expenditures, suprlus (deficit). Can someone pease help me to get started? I am stuck.

s are

s are

D Pualic Financial Manae x C seure | https://b /pid 102321 1. dt-content-rid6413496-1/course:/173PAD504 13473/small%20Assignmen1%202.pdf FY 2017 Budgeted Figures S1,984,946 S1,215,360 S 605,645 S2,916,409 S 808,922 S 356,700 131.800,000 Homestead Exemptions Property Tax Collection Rate Property Tax Rate $12,000,00O S.0219 per $1 assessed value or 2.19% Original Assumptions-annual % change Personal Services Tax Collection Rate 9:29 AM Type here to search W3 929V2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts