Question: Using the data below, answer the questions about the Direct Materials Cost (DMC) variances and the Direct Labor Cost (DLC) variances. 1. Who is responsible

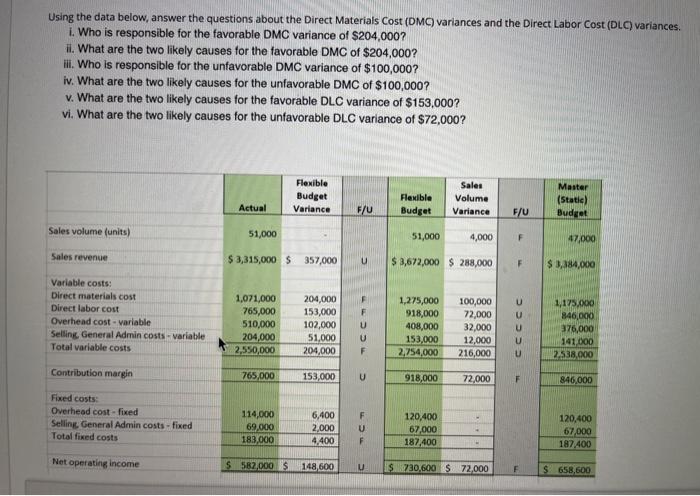

Using the data below, answer the questions about the Direct Materials Cost (DMC) variances and the Direct Labor Cost (DLC) variances. 1. Who is responsible for the favorable DMC variance of $204,000? it. What are the two likely causes for the favorable DMC of $204,000? HII. Who is responsible for the unfavorable DMC variance of $100,000? iv. What are the two likely causes for the unfavorable DMC of $100,000? v. What are the two likely causes for the favorable DLC variance of $153,000? vi. What are the two likely causes for the unfavorable DLC variance of $72,000? Flexible Budget Variance Sales Volume Variance Master (Statle) Budet Flexible Budget Actual F/U F/U Sales volume (units) 51,000 51,000 4,000 F 47,000 Sales revenue $ 3,315,000 $ 357.000 $ 3,672,000 $ 288,000 F $ 3,184.000 Variable costs: Direct materials cost Direct labor cost Overhead cost-variable Selling General Admin costs - variable Total variable costs 1,071,000 765,000 510,000 204,000 2,550,000 204,000 153,000 102,000 51,000 204,000 F U U F 1,275,000 918,000 408,000 153,000 2,254,000 100,000 72,000 32,000 12,000 216,000 1,175.00 846,000 376,000 141.000 2.538.000 Contribution margin 765,000 153,000 U 918,000 72,000 F 846,000 Fixed costs Overhead cost-fixed Selling General Admin costs - fixed Total fixed costs 114,000 69.000 183,000 6,400 2,000 4,400 F U F 120,400 67,000 187,400 120,400 67,000 187 400 Net operating income $ 582,000 $ 148,600 U $ 230.600 $ 72,000 F S 658,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts