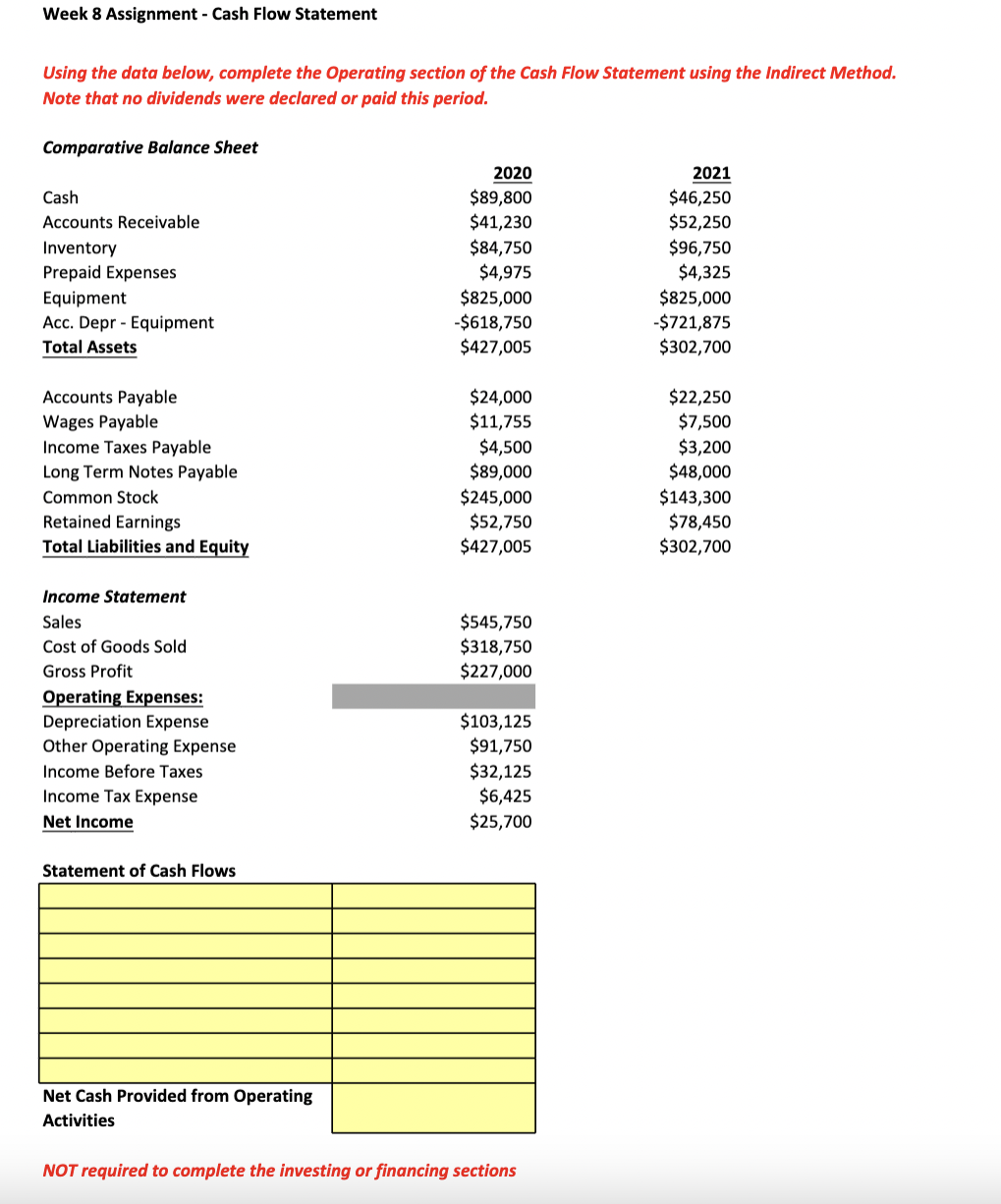

Question: Using the data below, complete the Operating section of the Cash Flow Statement using the Indirect Method. Note that no dividends were declared or paid

Using the data below, complete the Operating section of the Cash Flow Statement using the Indirect Method. Note that no dividends were declared or paid this period. Comparative Balance Sheet 2020 2021 Cash $89,800 $46,250 Accounts Receivable $41,230 $52,250 Inventory $84,750 $96,750 Prepaid Expenses $4,975 $4,325 Equipment $825,000 $825,000 Acc. Depr - Equipment -$618,750 -$721,875 Total Assets $427,005 $302,700 Accounts Payable $24,000 $22,250 Wages Payable $11,755 $7,500 Income Taxes Payable $4,500 $3,200 Long Term Notes Payable $89,000 $48,000 Common Stock $245,000 $143,300 Retained Earnings $52,750 $78,450 Total Liabilities and Equity $427,005 $302,700 Income Statement Sales $545,750 Cost of Goods Sold $318,750 Gross Profit $227,000 Operating Expenses: Depreciation Expense $103,125 Other Operating Expense $91,750 Income Before Taxes $32,125 Income Tax Expense $6,425 Net Income $25,700 Statement of Cash Flows Net Cash Provided from Operating Activities NOT required to complete the investing or financing sections

Week 8 Assignment - Cash Flow Statement Using the data below, complete the Operating section of the Cash Flow Statement using the Indirect Method. Note that no dividends were declared or paid this period. Comparative Balance Sheet 2021 $46,250 Cash Accounts Receivable Inventory Prepaid Expenses Equipment Acc. Depr - Equipment Total Assets 2020 $89,800 $41,230 $84,750 $4,975 $825,000 -$618,750 $427,005 $52,250 $96,750 $4,325 $825,000 -$721,875 $302,700 Accounts Payable Wages Payable Income Taxes Payable Long Term Notes Payable Common Stock Retained Earnings Total Liabilities and Equity $24,000 $11,755 $4,500 $89,000 $245,000 $52,750 $427,005 $22,250 $7,500 $3,200 $48,000 $143,300 $78,450 $302,700 $545,750 $318,750 $227,000 Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses: Depreciation Expense Other Operating Expense Income Before Taxes Income Tax Expense Net Income $103,125 $91,750 $32,125 $6,425 $25,700 Statement of Cash Flows Net Cash Provided from Operating Activities NOT required to complete the investing or financing sections

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts