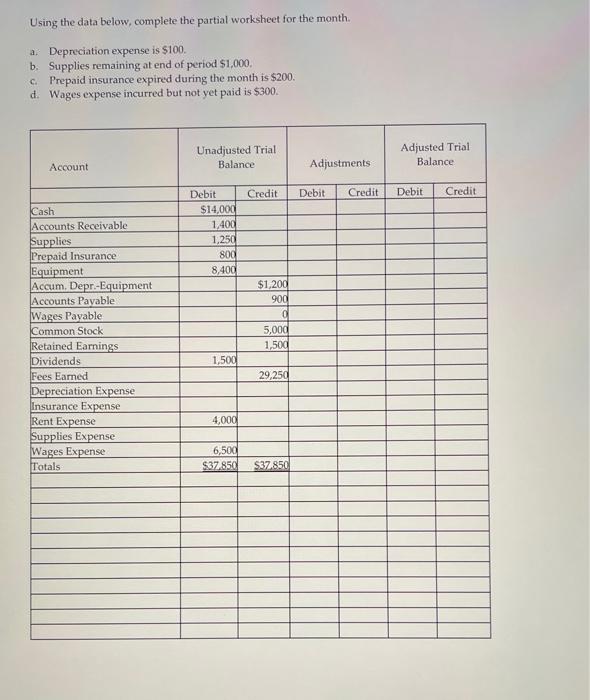

Question: Using the data below, complete the partial worksheet for the month. a. Depreciation expense is $100. b. Supplies remaining at end of period $1,000. c.

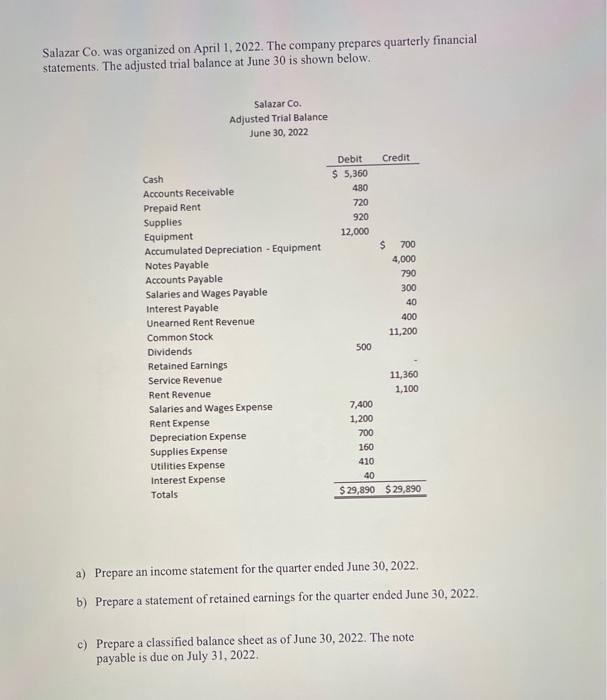

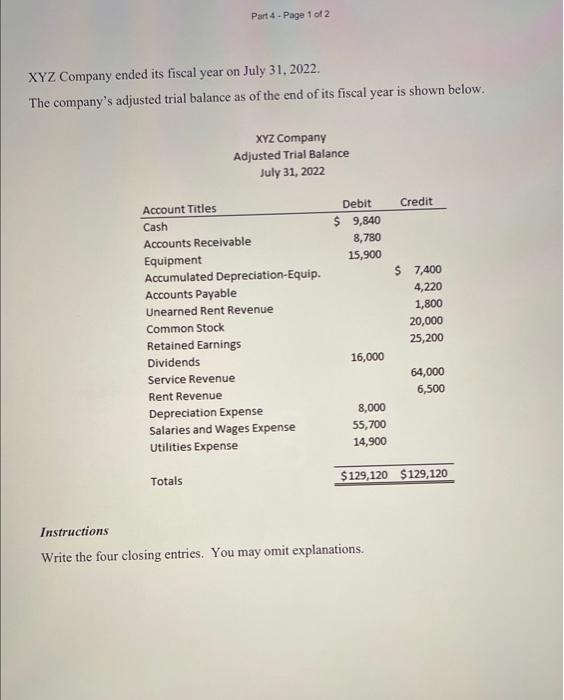

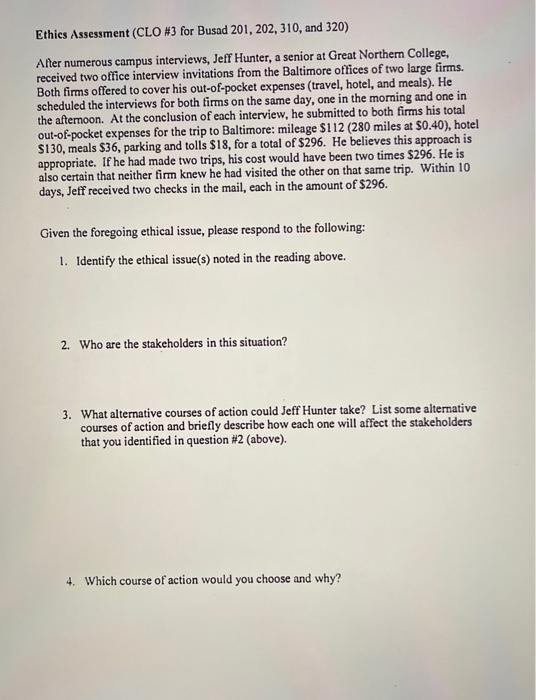

Using the data below, complete the partial worksheet for the month. a. Depreciation expense is $100. b. Supplies remaining at end of period $1,000. c. Prepaid insurance expired during the month is $200. d. Wages expense incurred but not yet paid is $300. Salazar Co. was organized on April 1, 2022. The company prepares quarterly financial statements. The adjusted trial balance at June 30 is shown below. Salazar Co. Adjusted Trial Balance June 30,2022 a) Prepare an income statement for the quarter ended June 30,2022 . b) Prepare a statement of retained earnings for the quarter ended June 30,2022. c) Prepare a classified balance sheet as of June 30, 2022. The note payable is due on July 31,2022. Name Problem XYZ Company ended its fiscal year on July 31, 2022. The company's adjusted trial balance as of the end of its fiscal year is shown below. XYZ Company Adjusted Trial Balance July 31,2022 Instructions Write the four closing entries. You may omit explanations. \begin{tabular}{|l|l|} \hline & \\ \hlinex+1 \\ \hline \end{tabular} Ethics Assessment (CLO \#3 for Busad 201, 202, 310, and 320) After numerous campus interviews, Jeff Hunter, a senior at Great Northern College, received two office interview invitations from the Baltimore offices of two large firms. Both firms offered to cover his out-of-pocket expenses (travel, hotel, and meals). He scheduled the interviews for both firms on the same day, one in the morning and one in the afternoon. At the conclusion of each interview, he submitted to both firms his total out-of-pocket expenses for the trip to Baltimore: mileage $112 (280 miles at $0.40), hotel $130, meals $36, parking and tolls $18, for a total of $296. He believes this approach is appropriate. If he had made two trips, his cost would have been two times $296. He is also certain that neither firm knew he had visited the other on that same trip. Within 10 days, Jeff received two checks in the mail, each in the amount of $296. Given the foregoing ethical issue, please respond to the following: 1. Identify the ethical issue(s) noted in the reading above. 2. Who are the stakeholders in this situation? 3. What alternative courses of action could Jeff Hunter take? List some alternative courses of action and briefly describe how each one will affect the stakeholders that you identified in question #2 (above). 4. Which course of action would you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts