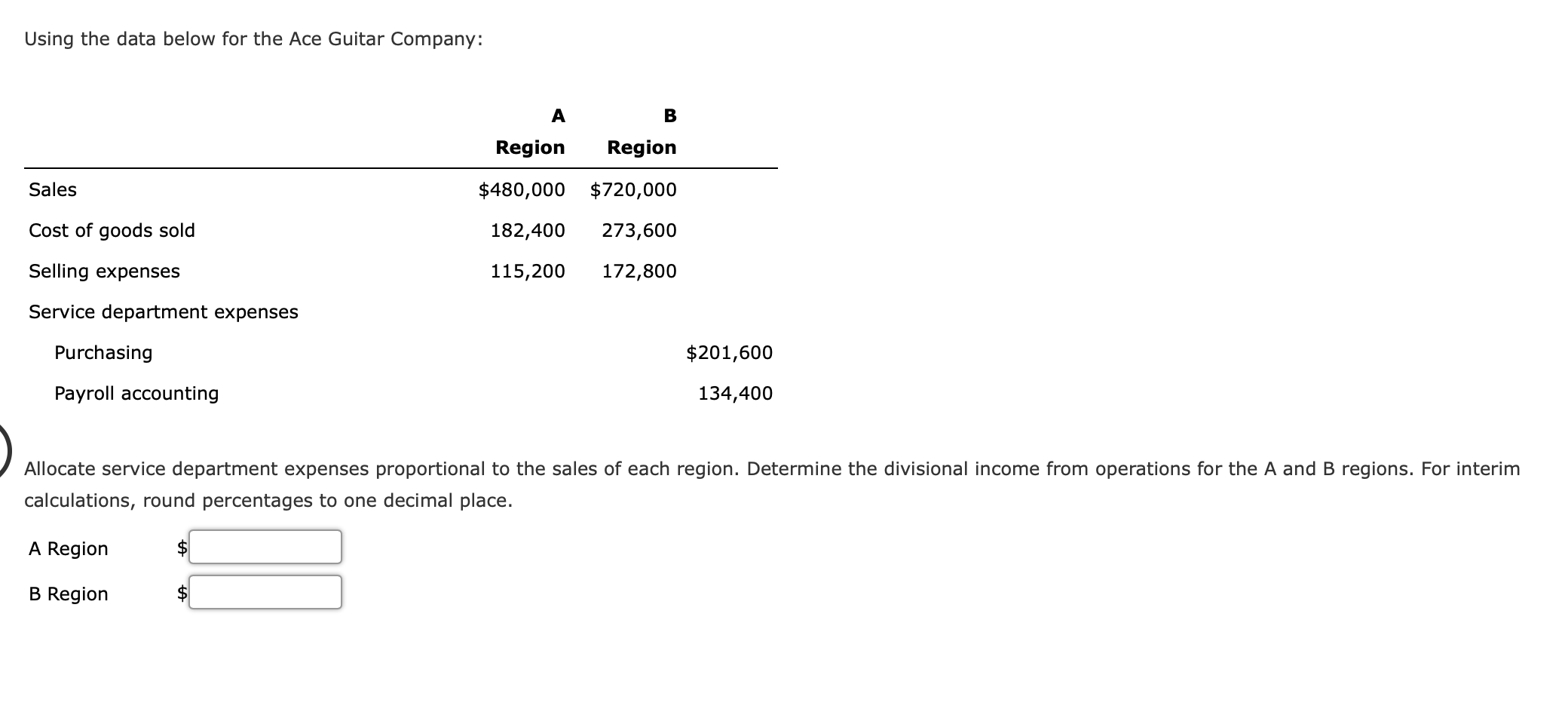

Question: Using the data below for the Ace Guitar Company: A B Region Region Sales $480,000 $720,000 Cost of goods sold 182,400 273,600 Selling expenses 115,200

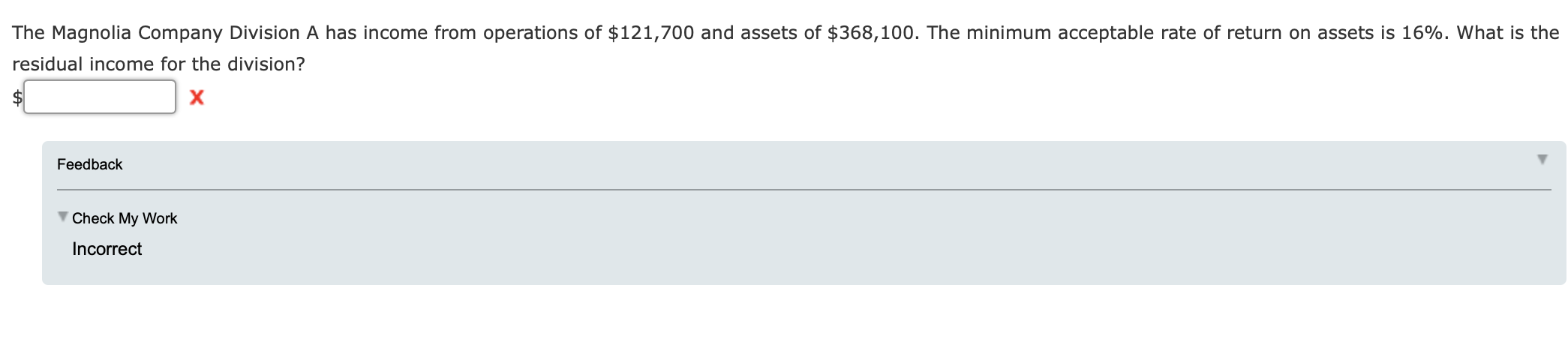

Using the data below for the Ace Guitar Company: A B Region Region Sales $480,000 $720,000 Cost of goods sold 182,400 273,600 Selling expenses 115,200 172,800 Service department expenses Purchasing $201,600 Payroll accounting 134,400 Allocate service department expenses proportional to the sales of each region. Determine the divisional income from operations for the A and B regions. For interim calculations, round percentages to one decimal place. A Region B Region The Magnolia Company Division A has income from operations of $121,700 and assets of $368,100. The minimum acceptable rate of return on assets is 16%. What is the residual income for the division? Feedback Check My Work Incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts