Question: using the data find the following :a. expected return in percent b. highest expected return in percent c. lowest expected return in percent d. would

using the data find the following :a. expected return in percent b. highest expected return in percent c. lowest expected return in percent d. would U.S Steel offer a higher or lower expected return?e. Would Coca-Cola offer a higher or lower expected return?

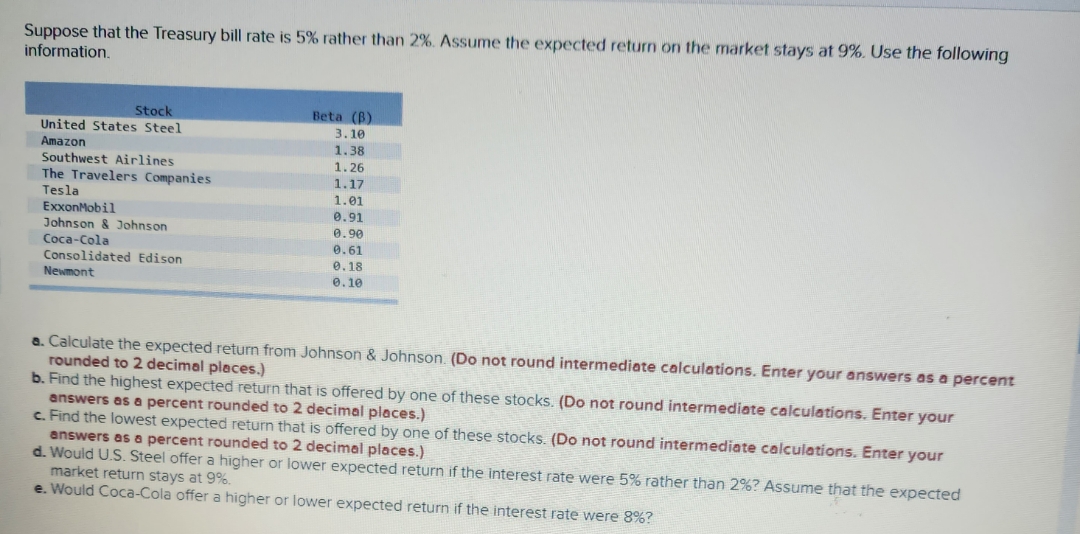

Suppose that the Treasury bill rate is 5% rather than 2%. Assume the expected return on the market stays at 9%. Use the following information. Stock Beta (B) United States Steel 3. 10 Amazon 1.38 Southwest Airlines 1. 26 The Travelers Companies 1. 17 Tesla 1.01 ExxonMobil 0. 91 Johnson & Johnson 0.90 Coca-cola 0. 61 Consolidated Edison 0. 18 Newmont 0. 10 a. Calculate the expected return from Johnson & Johnson. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) b. Find the highest expected return that is offered by one of these stocks. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) c. Find the lowest expected return that is offered by one of these stocks. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) d. Would U.S. Steel offer a higher or lower expected return if the interest rate were 5% rather than 2%? Assume that the expected market return stays at 9%. e. Would Coca-cola offer a higher or lower expected return if the interest rate were 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts