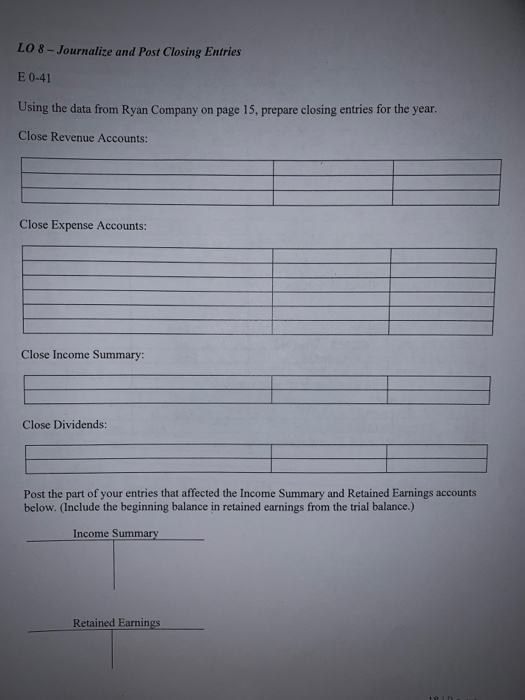

Question: Using the data from Ryan company, prepare closing entries for the year. Post the part of your entries that affected the income summary and retained

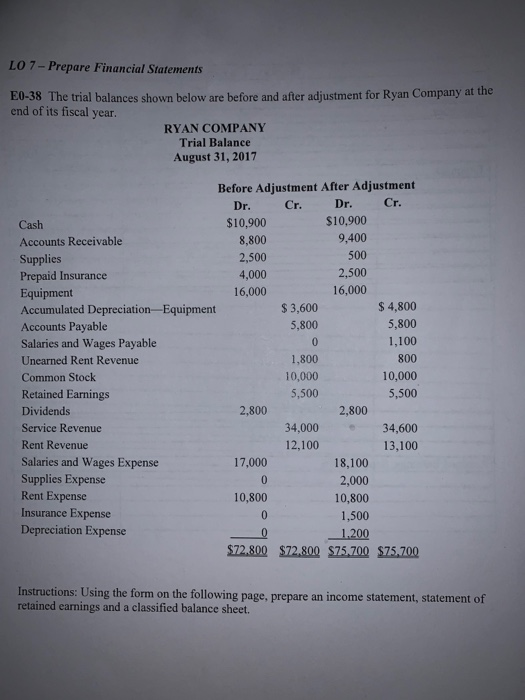

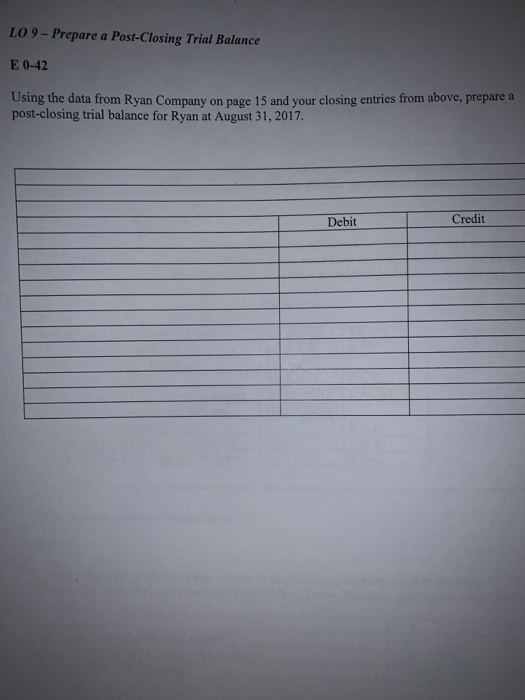

LO 7-Prepare Financial Statements E0-38 The trial balances shown below are before and after adjustment for Ryan Company at the end of its fiscal year. RYAN COMPANY Trial Balance August 31, 2017 Before Adjustment After Adjustment Dr. Cr. Dr. Cr. $10,900 9,400 500 2,500 16,000 $10,900 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Common Stock Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense Supplies Expense Rent Expense Insurance Expense Depreciation Expense 8,800 2,500 4,000 16,000 $ 3,600 5,800 0 1,800 10,000 5,500 $ 4,800 5,800 1,100 800 10,000 5,500 2,800 2,800 34,000 34,600 12,100 13,100 17,000 18,100 2,000 10,800 1,500 10,800 $72,800 $72,800 $75.700 $75,700 Instructions: Using the form on the following page, prepare an income statement, statement of retained earnings and a classified balance sheet. LO 8-Journalize and Post Closing Entries E 0-41 Using the data from Ryan Company on page 15, prepare closing entries for the year. Close Revenue Accounts: Close Expense Accounts: Close Income Summary Close Dividends: Post the part of your entries that affected the Income Summary and Retained Earnings accounts below. (Include the beginning balance in retained earnings from the trial balance.) Income Summary Retained Earnings LO 9-Prepare a Post-Closing Trial Balance E 0-42 Using the data from Ryan Company on page 15 and your closing entries from above, prepare a post-closing trial balance for Ryan at August 31, 2017. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts