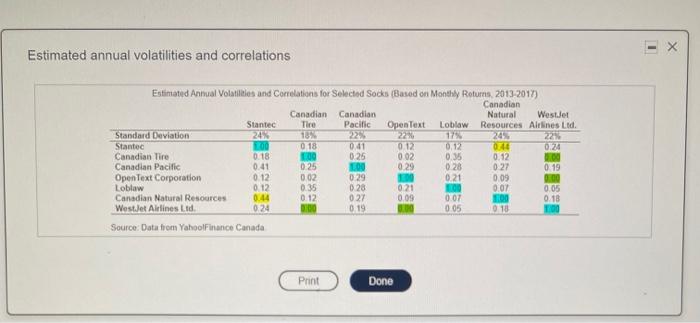

Question: Using the data from the accompanying table, what is the volatility of an equally weighted portfolio of Canadian Tire and Open Text stock? (Click the

Using the data from the accompanying table, what is the volatility of an equally weighted portfolio of Canadian Tire and Open Text stock? (Click the icon to view the table of estimated annual volatilities and correlations.) The volatility of the portfolio is SD (R.) -0% (Round to one decimal place) X Estimated annual volatilities and correlations Estimated Annual Volatilities and Correlations for Selected Socks (Based on Monthly Returns 2013-2017) Canadian Canadian Canadian Natural WestJet Stantec Tire Pacific Open Text Loblaw Resources Alrlines Lid. Standard Deviation 24% 10% 22 22 175 20 22 Stanto 100 0 18 001 0-12 0.22 076 0.24 Canadian Tire 0.18 0.24 002 0.35 0.12 0.00 Canadian Pacific 0.41 0.25 TO 0.29 0.28 0.27 0.19 Open Text Corporation 0.12 0.02 0.29 10 021 0.09 0.00 Loblaw 012 0.35 0.28 0.21 og 007 0.05 Canadian Natural Resources 0.44 0.12 027 0.09 0.07 TOD 0.18 WestJet Airlines Ltd 0.24 000 0.19 0.05 1.00 Source: Data from YahoolFinance Canada 010 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts