Question: Using the data from the table below please answer the following questions: Please adjust the 6 questions 1.5 19 21 Home Insert Page Layout Formulas

Using the data from the table below please answer the following questions:

Please adjust the 6 questions

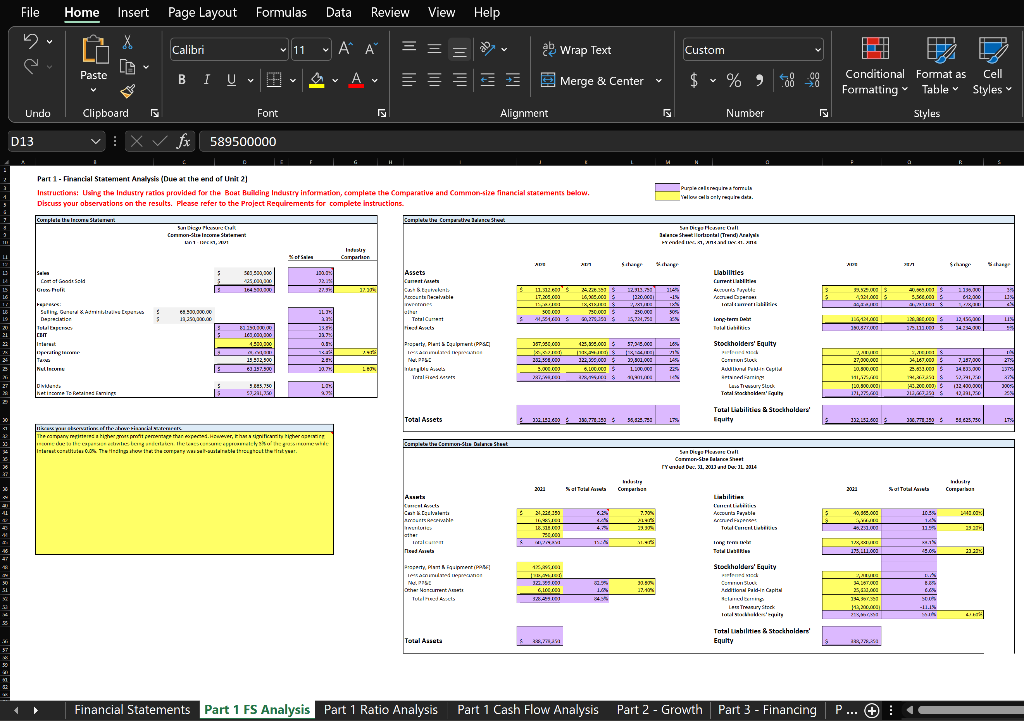

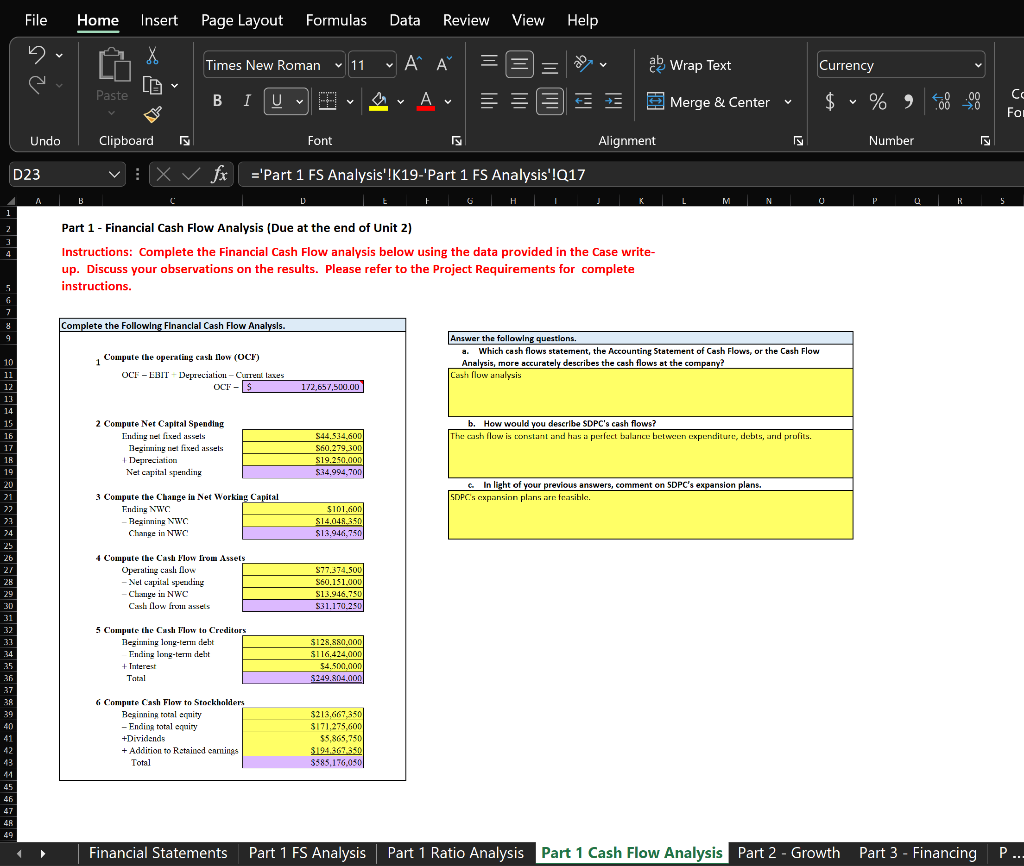

1.5 19 21 Home Insert Page Layout Formulas Data X Calibri 11 A^ A Y Wrap Text Merge & Center Paste BIU U I A = = = = = Undo Clipboard Font Alignment X fx 589500000 fx L Part 1 - Financial Statement Analysis (Due at the end of Unit 2) Purple college fo Instructions: Using the Industry ratios provided for the Boat Building Industry information, complete the Comparative and Common-size financial statements below Discuss your observations on the results. Please refer to the Project Requirements for complete instructions. Vale allantyrequire data Complete the incre Compriate the Comparative Balance Shed, San Diego Hona Call See Du Connect 21-11, 401 espetal (Tr) Analys wreaded ca, ancand we 41.20 Indralay Compartion % of S ADE S 5 130.3% 543,500,000 425,000,000 Assets Canetas Liabilities Comenta Com God Soeld 5 32.1% Gros Prof 164 500.000 22.3 37.37 314 St curtcevable wwwmas 24.20.30 $ 16,000,000 $ P Harrys: 11.312600 $ 17,205.000 15,00 500.000 1221000 S 12.313.790 1140 13500001 -1% IX% MANEL IN 50% 28 AKUJEE alhar Saling Garden Dis S Depreciation 250.000 IX $ 750.000 $ 20,270353 S 68.500,000.00 13,250,000 www Acceder taltamertalles Long-ter Talics $ Total Care 25,324.750 TotalExpr 811912000 33. As CENT 163,000,000 33.7% 4.500,000 0.3% Property, Plant & P COLOR 14 LENOU mod mo 425,300.000 $7,3/18.000 $ [99943RD) $. PAROLE 336X0.000$ 122,300,000 357.000.000 20 335.568.000 5.000.000 287,06101 108 AN 32,501.000 45 Stockholders' Equity Pirtrand Ma Common Stock Aud 15932,500 25% Kalinoves 63157.500 20.7% langes Avass www 6.100.000 $ 1.200.000 MATKA Total Redes cad dram $ IN artyred Gaming Dande 5 2.885,750 LIK Lav Try Totalcity het To Rings 53,241,320 93% Total Liabilities & Stockholders Equity 132.151.600 330,778.253 $ 56,822,750 75 tikcase was observations of the chove-siswciel votements The company registered a higher groet profit pemenage than expeed. However, the significant highe more due to the expenso edentes bong adolates the lastonsureeppomech so the grosirommewide Internationala 0.0%. The finding show that the company was al-audarable throughout the war. 2023 % Total f Comparban 625 7.30% 21,224393 18.318.000 7:50.000 aprav Liabilities Comentalis Accounts Payable pom Tol Cebies JL+F5 23.37 1528 3145 Tatl 12,365,100 IDIOT Stockholders' Equity frondin Co Aladin Capital 30.90% 327.389.000 6.100.000 12:229.001 10% 24.3% La Thry Stock Total Liabilities & Stockholder Equity $ 30,700,350 Part 1 Cash Flow Analysis Part 2 - Growth Part 3 - Financing File D13 23% ww Review View Help LEON | Total Assets Complete the common-dia Dalance Sheet Asants Cancel ods C&C ather walcan Teed Aasta Property, Plant &quipement (PPBE) N775 Other Namen Total Assuta Financial Statements Part 1 FS Analysis Part 1 Ratio Analysis wh 2 Custom $ % 9 Number San Diego Dell Commer-Sealance Sheet Yded Dec 31, 2013 andD:31 2314 58 -980 5 HT ++ Cell Conditional Format as Formatting Table Styles Styles ADE 4,324.000 5 20 SIAJES 1/424.000 381,877380 ZARURG 27,000,000 20,900,000 111,575/40 120,500,000 171,275.00 132,150.000 2023 A 1136,000 000 $ 5,300,000 $ 12,300 aparel 18,403 12,435,000 $ 225.111.409 $ 34.234,000 Sale $ 26.167003 $ 7,387,000 2.822.000 $34.833.000 1,5 $ $2,741,20 13.200.000) (22,400,000 312,203,299 $ 42,291,700 330.77-350 33.77.99 $ 21,625,750 baked Cur Sala 40,00.000 EATIVEC 45.233.00 170,00 175,111.000 34167.000 25,520,000 13599735 1,200,000 2447 P... + 10.5% 11. XE1% 42.0% LAS SOUS -ILIN MIA 2042.00% 23 27 23 2310 20 2 11% 15 2375 KIN 300 2% 17% Page Layout Formulas Data Review View Times New Roman 11 A^ A Currency BI U H A Merge & Center $ % 9 500 000 Font Number T X fx ='Part 1 FS Analysis' !K19-'Part 1 FS Analysis'!Q17 B L M N 0 P Part 1 - Financial Cash Flow Analysis (Due at the end of Unit 2) 3 4 Instructions: Complete the Financial Cash Flow analysis below using the data provided in the Case write- up. Discuss your observations on the results. Please refer to the Project Requirements for complete instructions. 8 Complete the Following Financial Cash Flow Analysis. 9 Answer the following questions. 10 1 Compute the operating cash flow (OCF) a. Which cash flows statement, the Accounting Statement of Cash Flows, or the Cash Flow Analysis, more accurately describes the cash flows at the company? Cash flow analysis 11 OCF - EBIT - Depreciation - Current taxes OCF - $ 12 172,657,500.00 13 14 15 2 Compute Net Capital Spending b. How would you describe SDPC's cash flows? 16 Ending net fixed assets $44.534,600 The cash flow is constant and has a perfect balance between expenditure, debts, and profits. 17 Begirming net fixed assets $60.279,300 18 + Depreciation $19.250,000 $34,994,700 19 Net capital spending 20 c. In light of your previous answers, comment on SDPC's expansion plans. SDPC's expansion plans are feasible. 21 3 Compute the Change in Net Working Capital 77 Ending NWC 73 Beginning NWC Change in NWC $101,600 $14.048,350 $13.946,750 74 25 26 4 Compute the Cash Flow from Assets 27 Operating cash flow $77.374,500 28 -Net capital spending $60.151.000 29 - Change in NWC $13.946,750 30 Cash flow from assets $31.170,250 31 32 5 Compute the Cash Flow to Creditors 33 Begirming long-term debt $128.880,001 34 Ending long-term deht $116.424,000 35 + Interest $4,500,000 36 Total $249.804,000 37 38 6 Compute Cash Flow to Stockholders 39 Beginning total equity $213,667,350 40 - Ending total equiry $171.275.600 41 +Dividends 42 + Addition to Retained earnings $5,865,750 $194.367.350 $585,176,050 43 Total 44 45 46 47 48 49 Financial Statements Part 1 FS Analysis Part 1 Ratio Analysis Part 1 Cash Flow Analysis Part 2 - Growth Part 3 - Financing | P... File 5 e Undo D23 Home Insert X Paste Clipboard V V Help ab Wrap Text Alignment Q R 5 Co For 1.5 19 21 Home Insert Page Layout Formulas Data X Calibri 11 A^ A Y Wrap Text Merge & Center Paste BIU U I A = = = = = Undo Clipboard Font Alignment X fx 589500000 fx L Part 1 - Financial Statement Analysis (Due at the end of Unit 2) Purple college fo Instructions: Using the Industry ratios provided for the Boat Building Industry information, complete the Comparative and Common-size financial statements below Discuss your observations on the results. Please refer to the Project Requirements for complete instructions. Vale allantyrequire data Complete the incre Compriate the Comparative Balance Shed, San Diego Hona Call See Du Connect 21-11, 401 espetal (Tr) Analys wreaded ca, ancand we 41.20 Indralay Compartion % of S ADE S 5 130.3% 543,500,000 425,000,000 Assets Canetas Liabilities Comenta Com God Soeld 5 32.1% Gros Prof 164 500.000 22.3 37.37 314 St curtcevable wwwmas 24.20.30 $ 16,000,000 $ P Harrys: 11.312600 $ 17,205.000 15,00 500.000 1221000 S 12.313.790 1140 13500001 -1% IX% MANEL IN 50% 28 AKUJEE alhar Saling Garden Dis S Depreciation 250.000 IX $ 750.000 $ 20,270353 S 68.500,000.00 13,250,000 www Acceder taltamertalles Long-ter Talics $ Total Care 25,324.750 TotalExpr 811912000 33. As CENT 163,000,000 33.7% 4.500,000 0.3% Property, Plant & P COLOR 14 LENOU mod mo 425,300.000 $7,3/18.000 $ [99943RD) $. PAROLE 336X0.000$ 122,300,000 357.000.000 20 335.568.000 5.000.000 287,06101 108 AN 32,501.000 45 Stockholders' Equity Pirtrand Ma Common Stock Aud 15932,500 25% Kalinoves 63157.500 20.7% langes Avass www 6.100.000 $ 1.200.000 MATKA Total Redes cad dram $ IN artyred Gaming Dande 5 2.885,750 LIK Lav Try Totalcity het To Rings 53,241,320 93% Total Liabilities & Stockholders Equity 132.151.600 330,778.253 $ 56,822,750 75 tikcase was observations of the chove-siswciel votements The company registered a higher groet profit pemenage than expeed. However, the significant highe more due to the expenso edentes bong adolates the lastonsureeppomech so the grosirommewide Internationala 0.0%. The finding show that the company was al-audarable throughout the war. 2023 % Total f Comparban 625 7.30% 21,224393 18.318.000 7:50.000 aprav Liabilities Comentalis Accounts Payable pom Tol Cebies JL+F5 23.37 1528 3145 Tatl 12,365,100 IDIOT Stockholders' Equity frondin Co Aladin Capital 30.90% 327.389.000 6.100.000 12:229.001 10% 24.3% La Thry Stock Total Liabilities & Stockholder Equity $ 30,700,350 Part 1 Cash Flow Analysis Part 2 - Growth Part 3 - Financing File D13 23% ww Review View Help LEON | Total Assets Complete the common-dia Dalance Sheet Asants Cancel ods C&C ather walcan Teed Aasta Property, Plant &quipement (PPBE) N775 Other Namen Total Assuta Financial Statements Part 1 FS Analysis Part 1 Ratio Analysis wh 2 Custom $ % 9 Number San Diego Dell Commer-Sealance Sheet Yded Dec 31, 2013 andD:31 2314 58 -980 5 HT ++ Cell Conditional Format as Formatting Table Styles Styles ADE 4,324.000 5 20 SIAJES 1/424.000 381,877380 ZARURG 27,000,000 20,900,000 111,575/40 120,500,000 171,275.00 132,150.000 2023 A 1136,000 000 $ 5,300,000 $ 12,300 aparel 18,403 12,435,000 $ 225.111.409 $ 34.234,000 Sale $ 26.167003 $ 7,387,000 2.822.000 $34.833.000 1,5 $ $2,741,20 13.200.000) (22,400,000 312,203,299 $ 42,291,700 330.77-350 33.77.99 $ 21,625,750 baked Cur Sala 40,00.000 EATIVEC 45.233.00 170,00 175,111.000 34167.000 25,520,000 13599735 1,200,000 2447 P... + 10.5% 11. XE1% 42.0% LAS SOUS -ILIN MIA 2042.00% 23 27 23 2310 20 2 11% 15 2375 KIN 300 2% 17% Page Layout Formulas Data Review View Times New Roman 11 A^ A Currency BI U H A Merge & Center $ % 9 500 000 Font Number T X fx ='Part 1 FS Analysis' !K19-'Part 1 FS Analysis'!Q17 B L M N 0 P Part 1 - Financial Cash Flow Analysis (Due at the end of Unit 2) 3 4 Instructions: Complete the Financial Cash Flow analysis below using the data provided in the Case write- up. Discuss your observations on the results. Please refer to the Project Requirements for complete instructions. 8 Complete the Following Financial Cash Flow Analysis. 9 Answer the following questions. 10 1 Compute the operating cash flow (OCF) a. Which cash flows statement, the Accounting Statement of Cash Flows, or the Cash Flow Analysis, more accurately describes the cash flows at the company? Cash flow analysis 11 OCF - EBIT - Depreciation - Current taxes OCF - $ 12 172,657,500.00 13 14 15 2 Compute Net Capital Spending b. How would you describe SDPC's cash flows? 16 Ending net fixed assets $44.534,600 The cash flow is constant and has a perfect balance between expenditure, debts, and profits. 17 Begirming net fixed assets $60.279,300 18 + Depreciation $19.250,000 $34,994,700 19 Net capital spending 20 c. In light of your previous answers, comment on SDPC's expansion plans. SDPC's expansion plans are feasible. 21 3 Compute the Change in Net Working Capital 77 Ending NWC 73 Beginning NWC Change in NWC $101,600 $14.048,350 $13.946,750 74 25 26 4 Compute the Cash Flow from Assets 27 Operating cash flow $77.374,500 28 -Net capital spending $60.151.000 29 - Change in NWC $13.946,750 30 Cash flow from assets $31.170,250 31 32 5 Compute the Cash Flow to Creditors 33 Begirming long-term debt $128.880,001 34 Ending long-term deht $116.424,000 35 + Interest $4,500,000 36 Total $249.804,000 37 38 6 Compute Cash Flow to Stockholders 39 Beginning total equity $213,667,350 40 - Ending total equiry $171.275.600 41 +Dividends 42 + Addition to Retained earnings $5,865,750 $194.367.350 $585,176,050 43 Total 44 45 46 47 48 49 Financial Statements Part 1 FS Analysis Part 1 Ratio Analysis Part 1 Cash Flow Analysis Part 2 - Growth Part 3 - Financing | P... File 5 e Undo D23 Home Insert X Paste Clipboard V V Help ab Wrap Text Alignment Q R 5 Co For

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts