Question: Using the data given for Clorox, what is the full year after tax cost of debt? A. 1.59% B. 3.66& C. 2.45% D. 3.18% Using

Using the data given for Clorox, what is the full year after tax cost of debt?

A. 1.59%

B. 3.66&

C. 2.45%

D. 3.18%

Using the Clorox information provided, what is the cost of their preferred stock?

| A. | 12.16% | |

| B. | 11.8% | |

| C. | 10.67% | |

| D. | 9.60%

|

Using the Clorox information provided, what is their cost of common equity using the CAPM method?

A. 1.05%

B. 5.02%

C. 3.39%

D. 4.08%

Using the Clorox information provided, what is their cost of common equity using the DCF method?

A. 1.70%

B. 3.90%

C. 3.94%

D. 4.17%

Using the Clorox information provided, what is their cost of common equity using the bond-yield - plus- risk premium method?

A. 5.66%

B. 6.18%

C. 7.51%

D. 8.64%

Using the information provided about Clorox, what is Clorox's weighted average cost of capital?

A. 4.39%

B. 4.44%

C. 5.32%

D. 7.11%

If Clorox has a cost of capital of 10% and they have a project that earns them 7%, they should do the project.

A. TRUE

B. FALSE

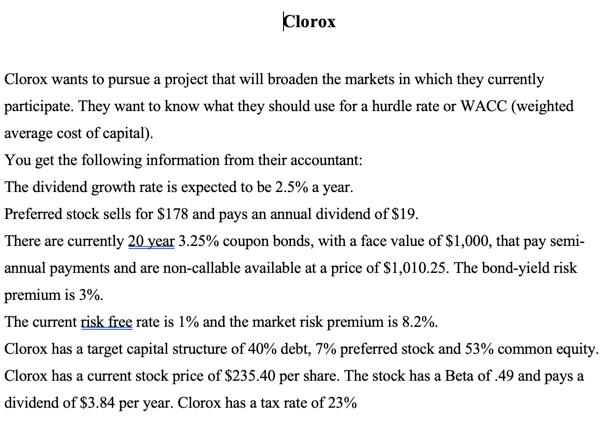

Clorox Clorox wants to pursue a project that will broaden the markets in which they currently participate. They want to know what they should use for a hurdle rate or WACC (weighted average cost of capital). You get the following information from their accountant: The dividend growth rate is expected to be 2.5% a year. Preferred stock sells for $178 and pays an annual dividend of $19. There are currently 20 year 3.25% coupon bonds, with a face value of $1,000, that pay semi- annual payments and are non-callable available at a price of $1,010.25. The bond-yield risk premium is 3% The current risk free rate is 1% and the market risk premium is 8.2%. Clorox has a target capital structure of 40% debt, 7% preferred stock and 53% common equity. Clorox has a current stock price of $235.40 per share. The stock has a Beta of .49 and pays a dividend of $3.84 per year. Clorox has a tax rate of 23%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts