Question: Using the data in the student spreadsheet file Ethan Allen Financials forecast the June 30, 2017 income statement and balance sheet for Ethan Allen. Use

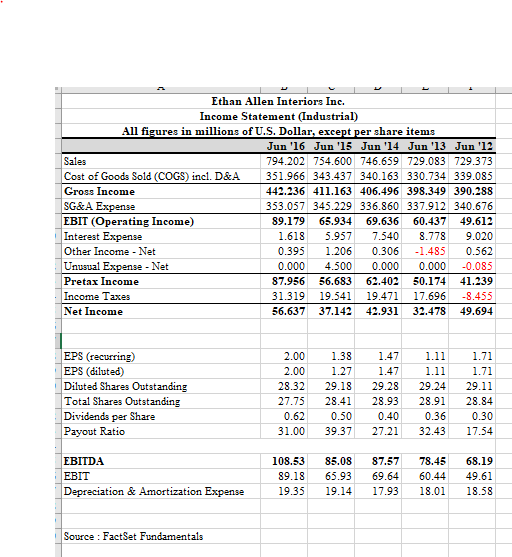

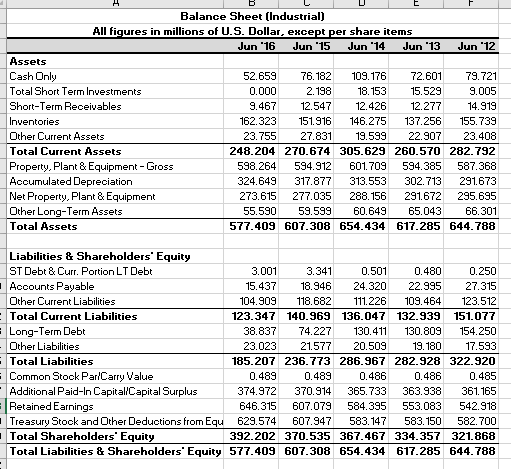

Using the data in the student spreadsheet file Ethan Allen Financials forecast the June 30, 2017 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) sales in FY 2017 will be $797.3359; (2) the tax rate will be 35%; (3) each item that changes with sales will be the five-year average percentage of sales; (4) net fixed assets will increase to $300; and (5) the common dividend will be $0.75 per share.

You will need the following assumptions (please do NOT use your judgement):

- Assume that all expenses (not calculations) on the Income Statement vary with sales, except interest expense

- For interest expense, assume a rate of 6%

- Assume no issue/repurchase of common stock, so that shares outstanding, common stock at par, additional paid in capital and Treasury stock remain the same as the prior year

- Assume depreciation expense will be the same as the prior year, plus an additional $5,000,000 resulting from the purchase of a new asset

- Assume all current assets/liabilities will vary with sales

- Assume Other Long Term Assets and Other Liabilities remain the same as the prior year

a. What is the discretionary financing needed in 2017? Is this a surplus or deficit? Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it.

b. Create a chart of cash versus sales and add a trend line. Is cash a consistent percentage of sales? Does this fit your expectations? Use the regression tool to verify your results from part c. Is the trend statistically significant? Use at least 3 methods frorm the regression output to show why or why not.

c. turn off iteration and use the scenario manager to set up three senarios:

- Best case - sales are 5% higher than expected

- base case- sales are exactly as expected

- worst case- sales at 55 less than expected

What is the DFN under each senario?

Ethan Allen Interiors Inc. Income Statement (Industrial) All figures in millions of U.S. Dollar, except per share items Jun '16 Jun '15 Jun '14 Jun '13 Jun '12 Sales 794.202 754.600 746.659 729.083 729.373 Cost of Goods Sold (COGS) incl. D&A 351.966 343.437 340.163 330.734 339.085 Gross Income 442.236 411.163 406.496 398.349 390.288 SG&A Expense 353.057 345.229 336.860 337.912 340.676 EBIT (Operating Income) 89.179 65.934 69.636 60.437 49.612 Interest Expense 1.618 5.957 7.540 8.778 9.020 Other Income - Net 0.395 1.206 0.306 -1.485 0.562 Unusual Expense - Net 0.000 4.500 0.000 0.000 -0.085 Pretax Income 87.956 56.683 62.402 50.174 41.239 Income Taxes 31.319 19.541 19.471 17.696 -8.455 Net Income 56.637 37.142 42.931 32.478 49.694 EPS (recurring) EPS (diluted) Diluted Shares Outstanding Total Shares Outstanding Dividends per Share Payout Ratio 2.00 2.00 28.32 27.75 0.62 31.00 1.38 1.27 29.18 28.41 0.50 39.37 1.47 1.47 29.28 28.93 0.40 27.21 1.11 1.11 29.24 28.91 0.36 32.43 1.71 1.71 29.11 28.84 0.30 17.54 EBITDA EBIT Depreciation & Amortization Expense 108.53 89.18 19.35 85.08 65.93 19.14 87.57 69.64 17.93 78.45 60.44 18.01 68.19 49.61 18.58 Source : FactSet Fundamentals BLUE Balance Sheet (Industrial) All figures in millions of U.S. Dollar, encept per share items Jun 16 Jun 15 Jun 14 Jun 13 Jun 12 Assets Cash Only 52.659 76.182 109.176 72.601 79.721 Total Short Term Investments 0.000 2.198 18.153 15.529 9.005 Short-Term Receivables 9.467 12.547 12.426 12.277 14.919 Inventories 162.323 151.916 146.275 137.256 155.739 Other Current Assets 23.755 27.831 19.599 22.907 23.408 Total Current Assets 248.204 270.674 305.629 260.570 282.792 Property, Plant & Equipment - Gross 598.264 594.912 601.709 594.385 587.368 Accumulated Depreciation 324.649 317.877 313.553 302.713 291673 Net Property, Plant & Equipment 273.615 277.035 288.156 291.672 295.695 Other Long-Term Assets 55.590 59.599 60.649 65.043 66.301 Total Assets 577.409 607.308 654.434 617.285 644.788 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt 3.001 3.341 0.501 0.480 0.250 Accounts Payable 15.437 18.946 24.320 22.995 27.315 Other Current Liabilities 104.909 118.682 111.226 109.464 123.512 Total Current Liabilities 123.347 140.969 136.047 132.939 151.077 Long-Term Debt 38.837 74.227 130 411 130.809 154.250 Other Liabilities 23.023 21.577 20.509 19. 180 17.593 Total Liabilities 185.207 236.773 286.967 282.928 322.920 Common Stock Par/Carry Value 0.489 0.489 0.486 0.486 0.485 Additional Paid-In Capital/Capital Surplus 374.972 370.914 365.733 363.938 361.165 Retained Earnings 646.315 607.079 584.395 553.083 542.918 Treasury Stock and Other Deductions from Equ 629.574 607.947 583.147 583.150 582.700 Total Shareholders' Equity 392.202 370.535 367.467 334.357 321.868 Total Liabilities & Shareholders' Equity 577.409 607.308 654.434 617.285 644.788 Ethan Allen Interiors Inc. Income Statement (Industrial) All figures in millions of U.S. Dollar, except per share items Jun '16 Jun '15 Jun '14 Jun '13 Jun '12 Sales 794.202 754.600 746.659 729.083 729.373 Cost of Goods Sold (COGS) incl. D&A 351.966 343.437 340.163 330.734 339.085 Gross Income 442.236 411.163 406.496 398.349 390.288 SG&A Expense 353.057 345.229 336.860 337.912 340.676 EBIT (Operating Income) 89.179 65.934 69.636 60.437 49.612 Interest Expense 1.618 5.957 7.540 8.778 9.020 Other Income - Net 0.395 1.206 0.306 -1.485 0.562 Unusual Expense - Net 0.000 4.500 0.000 0.000 -0.085 Pretax Income 87.956 56.683 62.402 50.174 41.239 Income Taxes 31.319 19.541 19.471 17.696 -8.455 Net Income 56.637 37.142 42.931 32.478 49.694 EPS (recurring) EPS (diluted) Diluted Shares Outstanding Total Shares Outstanding Dividends per Share Payout Ratio 2.00 2.00 28.32 27.75 0.62 31.00 1.38 1.27 29.18 28.41 0.50 39.37 1.47 1.47 29.28 28.93 0.40 27.21 1.11 1.11 29.24 28.91 0.36 32.43 1.71 1.71 29.11 28.84 0.30 17.54 EBITDA EBIT Depreciation & Amortization Expense 108.53 89.18 19.35 85.08 65.93 19.14 87.57 69.64 17.93 78.45 60.44 18.01 68.19 49.61 18.58 Source : FactSet Fundamentals BLUE Balance Sheet (Industrial) All figures in millions of U.S. Dollar, encept per share items Jun 16 Jun 15 Jun 14 Jun 13 Jun 12 Assets Cash Only 52.659 76.182 109.176 72.601 79.721 Total Short Term Investments 0.000 2.198 18.153 15.529 9.005 Short-Term Receivables 9.467 12.547 12.426 12.277 14.919 Inventories 162.323 151.916 146.275 137.256 155.739 Other Current Assets 23.755 27.831 19.599 22.907 23.408 Total Current Assets 248.204 270.674 305.629 260.570 282.792 Property, Plant & Equipment - Gross 598.264 594.912 601.709 594.385 587.368 Accumulated Depreciation 324.649 317.877 313.553 302.713 291673 Net Property, Plant & Equipment 273.615 277.035 288.156 291.672 295.695 Other Long-Term Assets 55.590 59.599 60.649 65.043 66.301 Total Assets 577.409 607.308 654.434 617.285 644.788 Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt 3.001 3.341 0.501 0.480 0.250 Accounts Payable 15.437 18.946 24.320 22.995 27.315 Other Current Liabilities 104.909 118.682 111.226 109.464 123.512 Total Current Liabilities 123.347 140.969 136.047 132.939 151.077 Long-Term Debt 38.837 74.227 130 411 130.809 154.250 Other Liabilities 23.023 21.577 20.509 19. 180 17.593 Total Liabilities 185.207 236.773 286.967 282.928 322.920 Common Stock Par/Carry Value 0.489 0.489 0.486 0.486 0.485 Additional Paid-In Capital/Capital Surplus 374.972 370.914 365.733 363.938 361.165 Retained Earnings 646.315 607.079 584.395 553.083 542.918 Treasury Stock and Other Deductions from Equ 629.574 607.947 583.147 583.150 582.700 Total Shareholders' Equity 392.202 370.535 367.467 334.357 321.868 Total Liabilities & Shareholders' Equity 577.409 607.308 654.434 617.285 644.788

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts