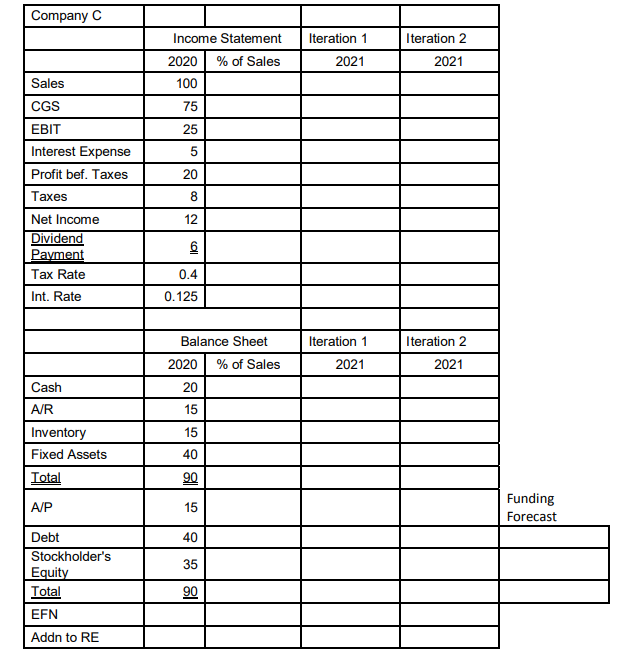

Question: Using the data in the table : 1) forecast the 2018 Pro forma Financial Statements for Company C using the % of Sales Method assuming:

Using the data in the table :

1) forecast the 2018 Pro forma Financial Statements for Company C using the % of Sales Method assuming: a) sales increase by 20%, from 2017 to 2018, as do all other operating accounts on the balance sheet, except the company must increase Fixed Assets to $50,000 to support the higher level of production; b) all external funds needed (EFN) will come from additional debt, c) the $ amount of the dividend payment in 2018 will remain the same as in 2017, and d) the effective tax rate and the rate of interest on debt will remain unchanged from 2017. 2) Based on just 2 iterations, what is your forecast the $ amount of debt and the debt/equity ratio Co. C will require to support this growth.

Company C Iteration 1 2021 Iteration 2 2021 Income Statement 2020 % of Sales 100 75 Sales 25 5 20 8 CGS EBIT Interest Expense Profit bef. Taxes Taxes Net Income Dividend Payment Tax Rate Int. Rate 12 6 0.4 0.125 Iteration 1 Iteration 2 Balance Sheet 2020 % of Sales 2021 2021 20 15 Cash AR Inventory Fixed Assets Total 15 40 90 A/P 15 Funding Forecast 40 35 Debt Stockholder's Equity Total EFN Addn to RE 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts