Question: Using the data in the table a. What was the average annual return of Microsoft stock from 2005-2017? The average annual return is ________%. b.

Using the data in the table

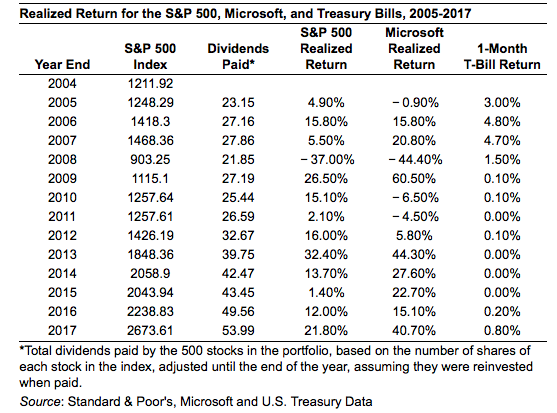

a. What was the average annual return of Microsoft stock from 2005-2017?

The average annual return is ________%.

b. What was the annual volatility for Microsoft stock from 2005-2017?

The average annual volatility is ________%.

(Round to two decimal places.)

Realized Return for the S&P 500, Microsoft, and Treasury Bills, 2005-2017 S&P 500 Microsoft S&P 500 Dividends Realized Realized 1-Month Year End Index Paid* Return Return T-Bill Return 2004 1211.92 2005 1248.29 23.15 4.90% -0.90% 3.00% 2006 1418.3 27.16 15.80% 15.80% 4.80% 2007 1468.36 27.86 5.50% 20.80% 4.70% 2008 903.25 21.85 - 37.00% - 44.40% 1.50% 2009 1115.1 27.19 26.50% 60.50% 0.10% 2010 1257.64 25.44 15.10% - 6.50% 0.10% 2011 1257.61 26.59 2.10% - 4.50% 0.00% 2012 1426.19 32.67 16.00% 5.80% 0.10% 2013 1848.36 39.75 32.40% 44.30% 0.00% 2014 2058.9 42.47 13.70% 27.60% 0.00% 2015 2043.94 43.45 1.40% 22.70% 0.00% 2016 2238.83 49.56 12.00% 15.10% 0.20% 2017 2673.61 53.99 21.80% 40.70% 0.80% *Total dividends paid by the 500 stocks in the portfolio, based on the number of shares of each stock in the index, adjusted until the end of the year, assuming they were reinvested when paid. Source: Standard & Poor's, Microsoft and U.S. Treasury Data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts