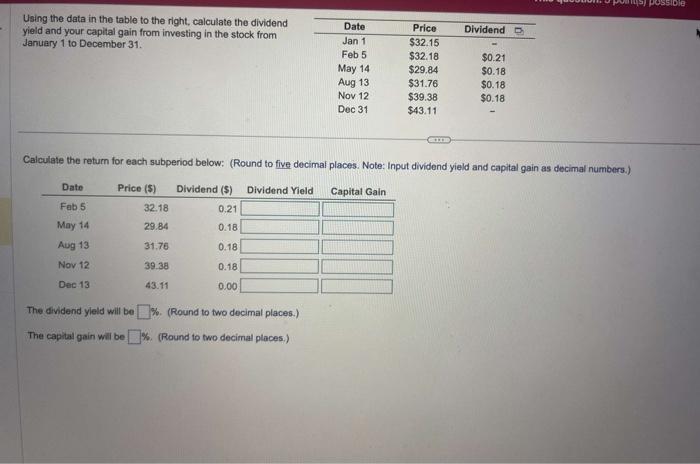

Question: Using the data in the table to the right, calculate the dividend yield and your capital gain from investing in the stock from January 1

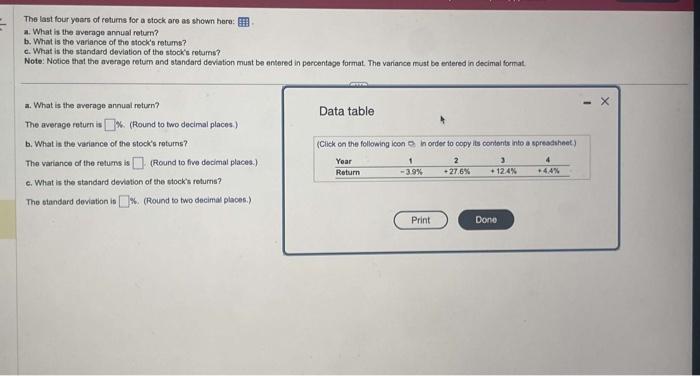

Using the data in the table to the right, calculate the dividend yield and your capital gain from investing in the stock from January 1 to December 31 . Calculate the return for each subperiod below: (Round to five decimal places. Note: Input dividend yield and capital gain as decimal numbers.) The dividend yield will be \%. (Round to two decimal places.) The capital gain wil be W. (Round to two decimal places.) The last four yoars of returns for a stock are as shown here: 3. What is the average annual return? b. What is the variance of the tockcs returs? c. What is the standard devlation of the stock's rotums? Note: Notice that the average retum and atandard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the overage annual return? The average return is W. (Round to two decimal places.) b. What is the variance of the stock's rotums? The variance of the tetums is (Round to five decimal places.) c. What is the standard dediation of the stock's roturns? The otandard deviation is \%. (Round to two docimal places.) Data table (Cick on the following leon = in order to oopy its contorits inte a spresduheet) Using the data in the table to the right, calculate the dividend yield and your capital gain from investing in the stock from January 1 to December 31 . Calculate the return for each subperiod below: (Round to five decimal places. Note: Input dividend yield and capital gain as decimal numbers.) The dividend yield will be \%. (Round to two decimal places.) The capital gain wil be W. (Round to two decimal places.) The last four yoars of returns for a stock are as shown here: 3. What is the average annual return? b. What is the variance of the tockcs returs? c. What is the standard devlation of the stock's rotums? Note: Notice that the average retum and atandard deviation must be entered in percentage format. The variance must be entered in decimal format. a. What is the overage annual return? The average return is W. (Round to two decimal places.) b. What is the variance of the stock's rotums? The variance of the tetums is (Round to five decimal places.) c. What is the standard dediation of the stock's roturns? The otandard deviation is \%. (Round to two docimal places.) Data table (Cick on the following leon = in order to oopy its contorits inte a spresduheet)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts