Question: Using the data in the tables below, compute Net Cash Flow from Investing Activities for Eureka Ruby, Inc. for Year 2 : Additional Data from

Using the data in the tables below, compute Net Cash Flow from Investing Activities for Eureka Ruby, Inc. for Year 2:

Additional Data from Company Income Statement(s):

- Sales in Year 2 = 4,215,000

- Net income in Year 2 = 10,370

- Depreciation expense in Year 1 = 256,900

- Depreciation expense in Year 2 = 303,400

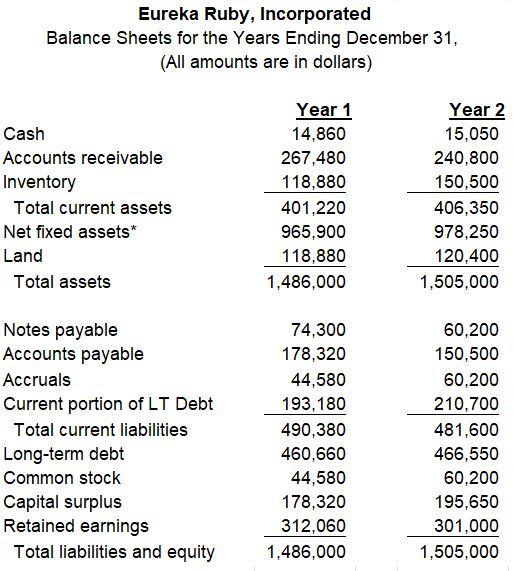

Eureka Ruby, Incorporated Balance Sheets for the Years Ending December 31, (All amounts are in dollars) Cash Accounts receivable Inventory Total current assets Net fixed assets* Land Total assets Year 1 14,860 267,480 118,880 401,220 965,900 118,880 1,486,000 Year 2 15,050 240,800 150,500 406,350 978,250 120,400 1,505,000 Notes payable Accounts payable Accruals Current portion of LT Debt Total current liabilities Long-term debt Common stock Capital surplus Retained earnings Total liabilities and equity 74,300 178,320 44,580 193,180 490,380 460,660 44,580 178,320 312,060 1,486,000 60,200 150,500 60,200 210,700 481,600 466,550 60,200 195,650 301,000 1,505,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts