Question: Using the data provided, prepare the 2016 statement of cash flow using both the direct and indirect formats for operating cash flows. Timeless Company Statements

Using the data provided, prepare the 2016 statement of cash flow using both the direct and indirect formats for operating cash flows.

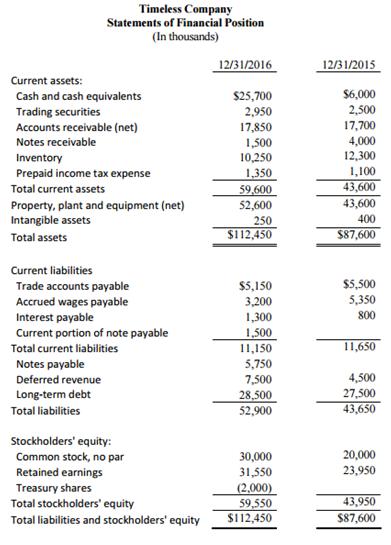

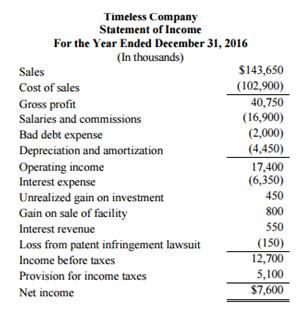

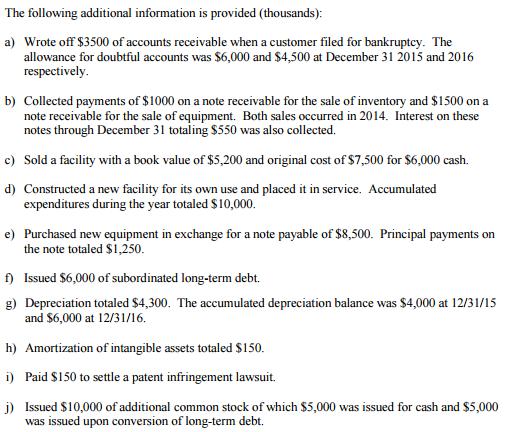

Timeless Company Statements of Financial Position (In thousands) Current assets: Cash and cash equivalents Trading securities Accounts receivable (net) Notes receivable Inventory Prepaid income tax expense Total current assets Property, plant and equipment (net) Intangible assets Total assets Current liabilities Trade accounts payable Accrued wages payable Interest payable Current portion of note payable Total current liabilities Notes payable Deferred revenue Long-term debt Total liabilities Stockholders' equity: Common stock, no par Retained earnings Treasury shares Total stockholders' equity Total liabilities and stockholders' equity 12/31/2016 $25,700 2,950 17,850 1,500 10,250 1,350 59,600 52,600 250 $112,450 $5,150 3,200 1,300 1,500 11,150 5,750 7,500 28,500 52,900 30,000 31,550 (2,000) 59,550 $112,450 12/31/2015 $6,000 2,500 17,700 4,000 12,300 1,100 43,600 43,600 400 $87,600 $5,500 5,350 800 11,650 4,500 27,500 43,650 20,000 23,950 43,950 $87,600

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

To prepare the statement of cash flows for Timeless Company for the year ended December 31 2016 in both direct and indirect formats we need to analyze the provided information and make the necessary a... View full answer

Get step-by-step solutions from verified subject matter experts