Question: (using the data provided, the adjusted trial balance, income statement, and final table need to be filled out) 4 2 Holister Electric Inc. 3 Balance

(using the data provided, the adjusted trial balance, income statement, and final table need to be filled out)

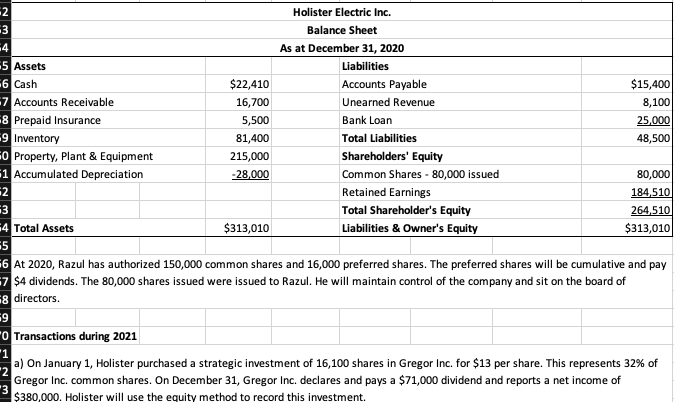

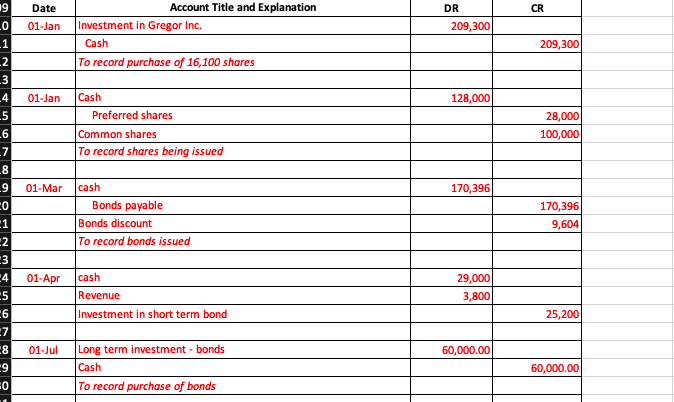

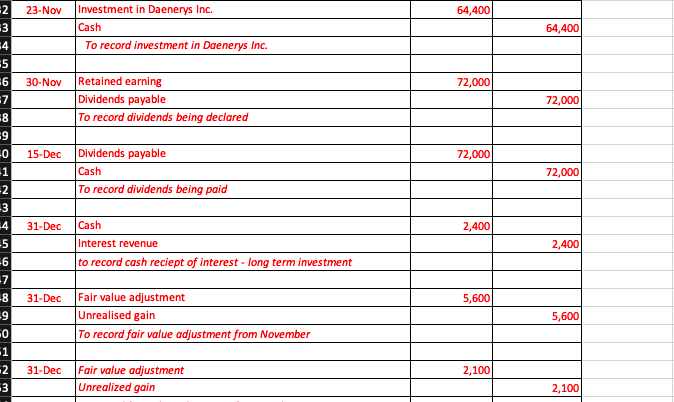

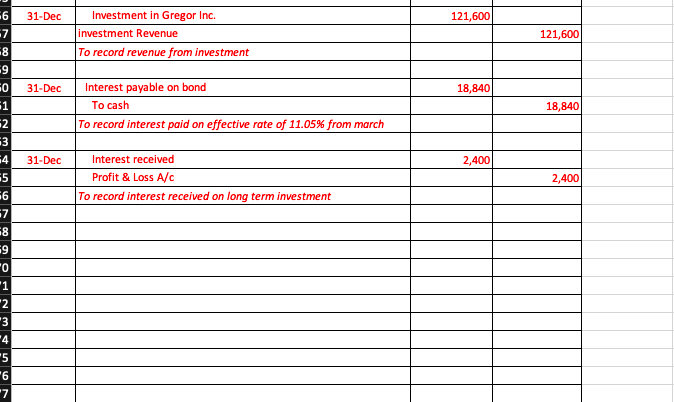

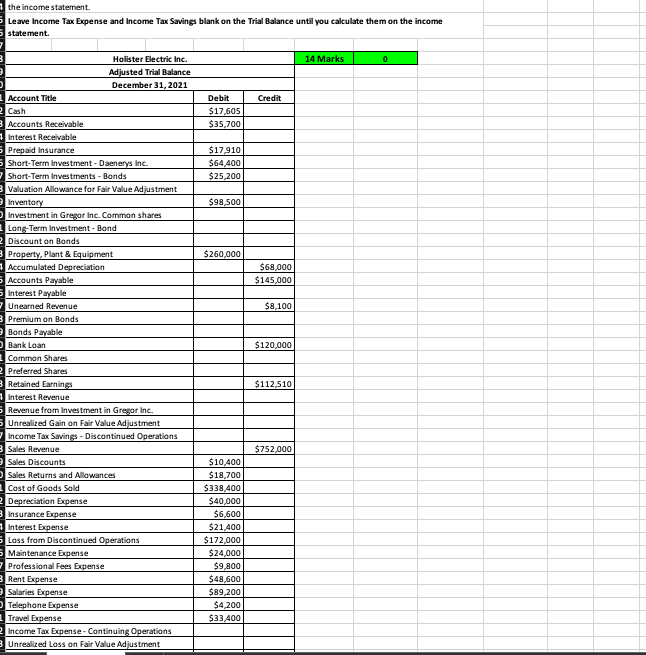

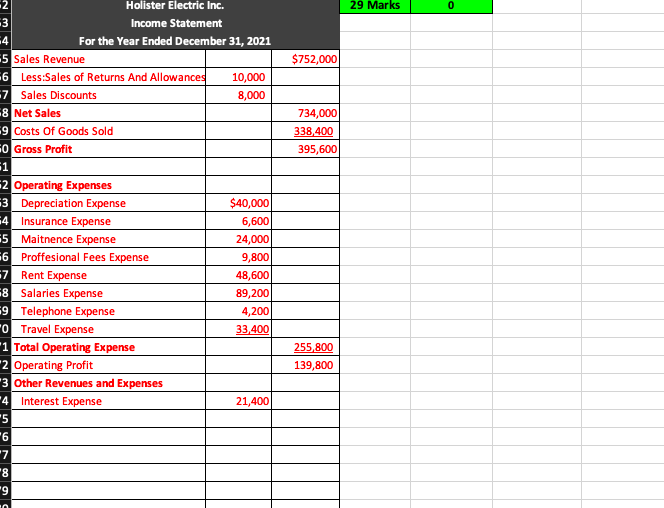

4 2 Holister Electric Inc. 3 Balance Sheet As at December 31, 2020 5 Assets Liabilities 6 Cash $22,410 Accounts Payable $15,400 7 Accounts Receivable 16,700 Unearned Revenue 8,100 8 Prepaid Insurance 5,500 Bank Loan 25,000 9 Inventory 81,400 Total Liabilities 48,500 0 Property, Plant & Equipment 215,000 Shareholders' Equity 1 Accumulated Depreciation -28,000 Common Shares - 80,000 issued 80,000 2 Retained Earnings 184,510 3 Total Shareholder's Equity 264,510 4 Total Assets $313,010 Liabilities & Owner's Equity $313,010 5 6 At 2020, Razul has authorized 150,000 common shares and 16,000 preferred shares. The preferred shares will be cumulative and pay 7 $4 dividends. The 80,000 shares issued were issued to Razul. He will maintain control of the company and sit on the board of 8 directors. 9 0 Transactions during 2021 -1 a) On January 1, Holister purchased a strategic investment of 16,100 shares in Gregor Inc. for $13 per share. This represents 32% of 2 Gregor Inc. common shares. On December 31, Gregor Inc. declares and pays a $71,000 dividend and reports a net income of 3 $380,000. Holister will use the equity method to record this investment. CR Date 01-Jan DR 209,300 Account Title and Explanation Investment in Gregor Inc. Cash To record purchase of 16,100 shares 209,300 01-Jan 128,000 2 2 Cash Preferred shares 28,000 100,000 Common shares To record shares being issued 01-Mar 170,396 cash Bonds payable Bonds discount To record bonds issued 170,396 9,604 1 2 01-Apr cash Revenue 29,000 3,800 Investment in short term bond 25,200 01-Jul 60,000.00 Long term investment - bonds Cash To record purchase of bonds 9 0 60,000.00 23-Nov 64,400 Investment in Daenerys Inc. Cash To record investment in Daenerys Inc. 64,400 5 6 7 30-Nov 72,000 Retained earning Dividends payable To record dividends being declared 72,000 15-Dec 72,000 9 -0 1 -2 -3 -4 -5 Dividends payable Cash To record dividends being paid 72,000 31-Dec 2,400 Cash Interest revenue 2,400 -6 to record cash reciept of interest - long term investment -7 8 -9 31-Dec 5,600 Fair value adjustment Unrealised gain To record fair value adjustment from November 5,600 31-Dec Fair value adjustment Unrealized gain 2,100 2,100 6 31-Dec 121,600 Investment in Gregor Inc. investment Revenue To record revenue from investment 121,600 31-Dec 18,840 Interest payable on bond To cash To record interest paid on effective rate of 11.05% from march 18,840 2 13 14 31-Dec 2,400 Interest received Profit & Loss A/C To record interest received on long term investment 2,400 17 o 00 ou -9 1 *2 3 4 5 6 7 the income statement. Leave Income Tax Expense and Income Tax Savings blank on the Trial Balance until you calculate them on the income statement 14 Marks 0 Credit Debit $17,605 $35,700 $17.910 $64,400 $25,200 $98,500 $260,000 $68,000 $145,000 $8,100 $120,000 Holister Electric Inc. Adjusted Trial Balance December 31, 2021 Account Title Cash Accounts Receivable Interest Receivable Prepaid Insurance Short-Term Investment - Daenerys Inc. Short-Term Investments - Bonds Valuation Allowance for Fair Value Adjustment Inventory Investment in Gregor Inc. Common shares Long-Term Investment - Bond Discount on Bonds Property, Plant & Equipment Accumulated Depreciation Accounts Payable Interest Payable Unearned Revenue Premium on Bonds Bonds Payable Bank Loan Common Shares Preferred Shares Retained Earnings Interest Revenue Revenue from Investment in Gregor Inc. Unrealized Gain on Fair Value Adjustment Income Tax Savings - Discontinued Operations 3 Sales Revenue Sales Discounts Sales Returns and Allowances Cost of Goods Sold Depreciation Expense Insurance Expense Interest Expense Loss from Discontinued Operations Maintenance Expense Professional Fees Expense Rent Expense Salaries Expense Telephone Expense Travel Expense Income Tax Expense - Continuing Operations Unrealized Loss on Fair Value Adjustment $112,510 $752,000 $10,400 $18,700 $338,400 $40,000 $6,600 $21,400 $172,000 $24,000 $9,800 $48,600 $89,200 $4,200 $33,400 29 Marks 0 $752,000 734,000 338.400 395,600 Holister Electric Inc. 3 Income Statement 14 For the Year Ended December 31, 2021 5 Sales Revenue 6 Less:Sales of Returns And Allowances 10,000 7 Sales Discounts 8,000 8 Net Sales 9 Costs of Goods Sold O Gross Profit 1 2 Operating Expenses 3 Depreciation Expense $40,000 -4 Insurance Expense 6,600 5 Maltnence Expense 24,000 6 Proffesional Fees Expense 9,800 7 Rent Expense 48,600 8 Salaries Expense 89,200 -9 Telephone Expense 4,200 "O Travel Expense 33,400 *1 Total Operating Expense 2 Operating Profit 3 Other Revenues and Expenses -4 Interest Expense 21,400 *5 255,800 139,800 7 *8 9 4 2 Holister Electric Inc. 3 Balance Sheet As at December 31, 2020 5 Assets Liabilities 6 Cash $22,410 Accounts Payable $15,400 7 Accounts Receivable 16,700 Unearned Revenue 8,100 8 Prepaid Insurance 5,500 Bank Loan 25,000 9 Inventory 81,400 Total Liabilities 48,500 0 Property, Plant & Equipment 215,000 Shareholders' Equity 1 Accumulated Depreciation -28,000 Common Shares - 80,000 issued 80,000 2 Retained Earnings 184,510 3 Total Shareholder's Equity 264,510 4 Total Assets $313,010 Liabilities & Owner's Equity $313,010 5 6 At 2020, Razul has authorized 150,000 common shares and 16,000 preferred shares. The preferred shares will be cumulative and pay 7 $4 dividends. The 80,000 shares issued were issued to Razul. He will maintain control of the company and sit on the board of 8 directors. 9 0 Transactions during 2021 -1 a) On January 1, Holister purchased a strategic investment of 16,100 shares in Gregor Inc. for $13 per share. This represents 32% of 2 Gregor Inc. common shares. On December 31, Gregor Inc. declares and pays a $71,000 dividend and reports a net income of 3 $380,000. Holister will use the equity method to record this investment. CR Date 01-Jan DR 209,300 Account Title and Explanation Investment in Gregor Inc. Cash To record purchase of 16,100 shares 209,300 01-Jan 128,000 2 2 Cash Preferred shares 28,000 100,000 Common shares To record shares being issued 01-Mar 170,396 cash Bonds payable Bonds discount To record bonds issued 170,396 9,604 1 2 01-Apr cash Revenue 29,000 3,800 Investment in short term bond 25,200 01-Jul 60,000.00 Long term investment - bonds Cash To record purchase of bonds 9 0 60,000.00 23-Nov 64,400 Investment in Daenerys Inc. Cash To record investment in Daenerys Inc. 64,400 5 6 7 30-Nov 72,000 Retained earning Dividends payable To record dividends being declared 72,000 15-Dec 72,000 9 -0 1 -2 -3 -4 -5 Dividends payable Cash To record dividends being paid 72,000 31-Dec 2,400 Cash Interest revenue 2,400 -6 to record cash reciept of interest - long term investment -7 8 -9 31-Dec 5,600 Fair value adjustment Unrealised gain To record fair value adjustment from November 5,600 31-Dec Fair value adjustment Unrealized gain 2,100 2,100 6 31-Dec 121,600 Investment in Gregor Inc. investment Revenue To record revenue from investment 121,600 31-Dec 18,840 Interest payable on bond To cash To record interest paid on effective rate of 11.05% from march 18,840 2 13 14 31-Dec 2,400 Interest received Profit & Loss A/C To record interest received on long term investment 2,400 17 o 00 ou -9 1 *2 3 4 5 6 7 the income statement. Leave Income Tax Expense and Income Tax Savings blank on the Trial Balance until you calculate them on the income statement 14 Marks 0 Credit Debit $17,605 $35,700 $17.910 $64,400 $25,200 $98,500 $260,000 $68,000 $145,000 $8,100 $120,000 Holister Electric Inc. Adjusted Trial Balance December 31, 2021 Account Title Cash Accounts Receivable Interest Receivable Prepaid Insurance Short-Term Investment - Daenerys Inc. Short-Term Investments - Bonds Valuation Allowance for Fair Value Adjustment Inventory Investment in Gregor Inc. Common shares Long-Term Investment - Bond Discount on Bonds Property, Plant & Equipment Accumulated Depreciation Accounts Payable Interest Payable Unearned Revenue Premium on Bonds Bonds Payable Bank Loan Common Shares Preferred Shares Retained Earnings Interest Revenue Revenue from Investment in Gregor Inc. Unrealized Gain on Fair Value Adjustment Income Tax Savings - Discontinued Operations 3 Sales Revenue Sales Discounts Sales Returns and Allowances Cost of Goods Sold Depreciation Expense Insurance Expense Interest Expense Loss from Discontinued Operations Maintenance Expense Professional Fees Expense Rent Expense Salaries Expense Telephone Expense Travel Expense Income Tax Expense - Continuing Operations Unrealized Loss on Fair Value Adjustment $112,510 $752,000 $10,400 $18,700 $338,400 $40,000 $6,600 $21,400 $172,000 $24,000 $9,800 $48,600 $89,200 $4,200 $33,400 29 Marks 0 $752,000 734,000 338.400 395,600 Holister Electric Inc. 3 Income Statement 14 For the Year Ended December 31, 2021 5 Sales Revenue 6 Less:Sales of Returns And Allowances 10,000 7 Sales Discounts 8,000 8 Net Sales 9 Costs of Goods Sold O Gross Profit 1 2 Operating Expenses 3 Depreciation Expense $40,000 -4 Insurance Expense 6,600 5 Maltnence Expense 24,000 6 Proffesional Fees Expense 9,800 7 Rent Expense 48,600 8 Salaries Expense 89,200 -9 Telephone Expense 4,200 "O Travel Expense 33,400 *1 Total Operating Expense 2 Operating Profit 3 Other Revenues and Expenses -4 Interest Expense 21,400 *5 255,800 139,800 7 *8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts