Question: Using the data set on the Excel regression tool provided, create a predictive model capable of forecasting 5-year average return of a mutual fund with

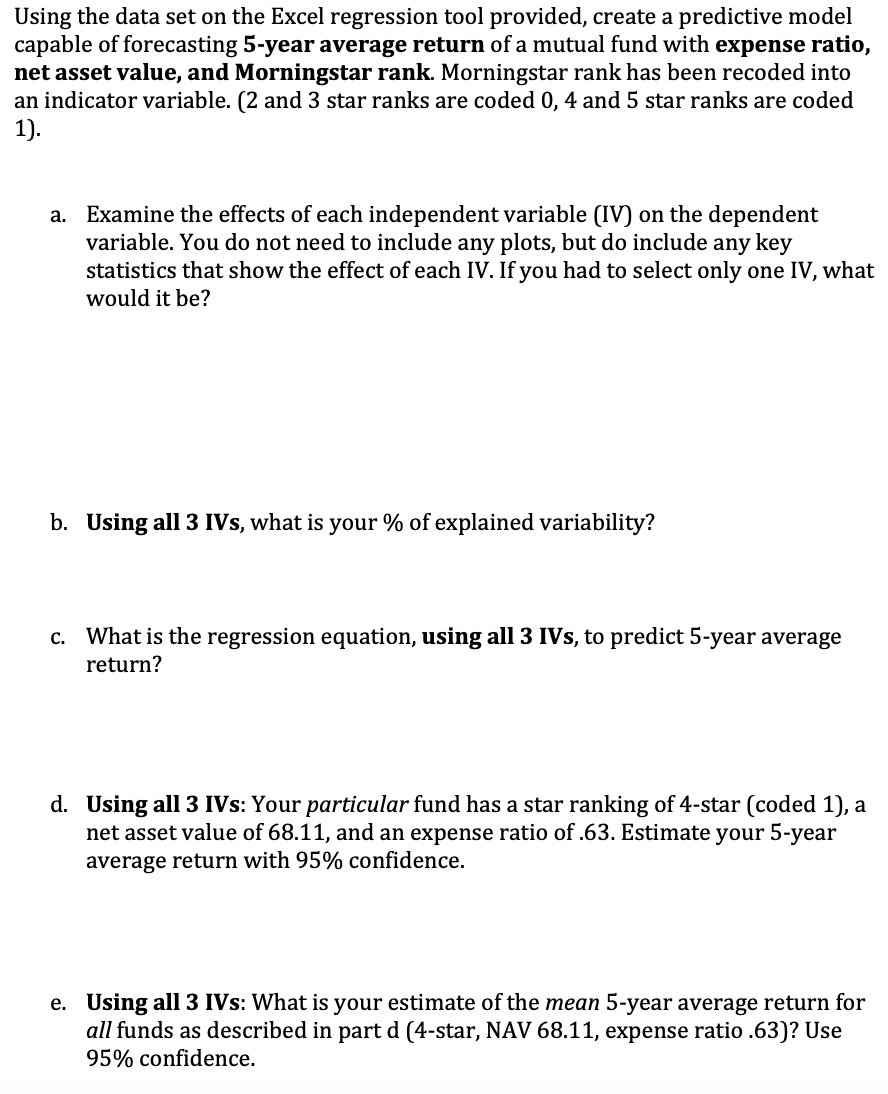

Using the data set on the Excel regression tool provided, create a predictive model capable of forecasting 5-year average return of a mutual fund with expense ratio, net asset value, and Morningstar rank. Morningstar rank has been recoded into an indicator variable. (2 and 3 star ranks are coded 0, 4 and 5 star ranks are coded 1). a. Examine the effects of each independent variable (IV) on the dependent variable. You do not need to include any plots, but do include any key statistics that show the effect of each IV. If you had to select only one IV, what would it be? b. Using all 3 IVs, what is your % of explained variability? C. What is the regression equation, using all 3 IVs, to predict 5-year average return? d. Using all 3 IVs: Your particular fund has a star ranking of 4-star (coded 1), a net asset value of 68.11, and an expense ratio of .63. Estimate your 5-year average return with 95% confidence. e. Using all 3 IVs: What is your estimate of the mean 5-year average return for all funds as described in part d (4-star, NAV 68.11, expense ratio.63)? Use 95% confidence. f. Using all 3 IVs: Is this model significant overall? Be sure to support your answer with specific results. g. Remove any insignificant variables, stepwise, and fully correct the model. What are your IV(s) on the corrected model? h. On the corrected model (after stepwise), do you suspect any problems due to co-linearity? Be sure to support your answer with specific results. Using the data set on the Excel regression tool provided, create a predictive model capable of forecasting 5-year average return of a mutual fund with expense ratio, net asset value, and Morningstar rank. Morningstar rank has been recoded into an indicator variable. (2 and 3 star ranks are coded 0, 4 and 5 star ranks are coded 1). a. Examine the effects of each independent variable (IV) on the dependent variable. You do not need to include any plots, but do include any key statistics that show the effect of each IV. If you had to select only one IV, what would it be? b. Using all 3 IVs, what is your % of explained variability? C. What is the regression equation, using all 3 IVs, to predict 5-year average return? d. Using all 3 IVs: Your particular fund has a star ranking of 4-star (coded 1), a net asset value of 68.11, and an expense ratio of .63. Estimate your 5-year average return with 95% confidence. e. Using all 3 IVs: What is your estimate of the mean 5-year average return for all funds as described in part d (4-star, NAV 68.11, expense ratio.63)? Use 95% confidence. f. Using all 3 IVs: Is this model significant overall? Be sure to support your answer with specific results. g. Remove any insignificant variables, stepwise, and fully correct the model. What are your IV(s) on the corrected model? h. On the corrected model (after stepwise), do you suspect any problems due to co-linearity? Be sure to support your answer with specific results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts