Question: Using the discounted cash flow method, what is the property value of a building with the following information? NOI for next five years $600,000 NOI

Using the discounted cash flow method, what is the property value of a building with the following information? NOI for next five years $600,000 NOI in Year 6 $700,000 Holding period 5 years Discount rate 10% Terminal growth rate 2%

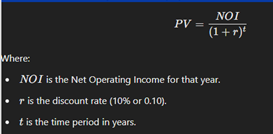

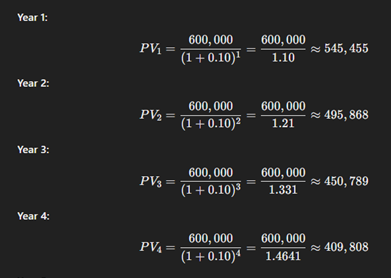

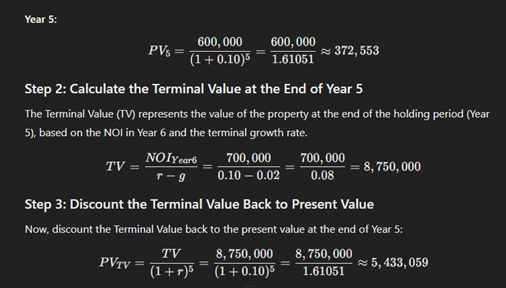

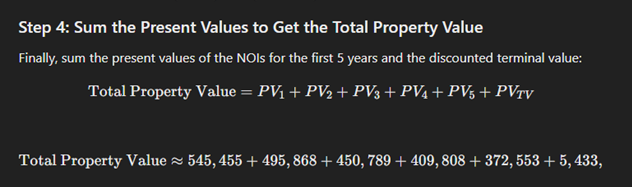

NOT PV (1 +r) Where: NOI is the Net Operating Income for that year. is the discount rate (10% or 0.10). * # is the time period in years.Year 1: 600, 000 600, 000 PV1 545, 455 (1 + 0.10)1 1.10 Year 2: 600, 000 600, 000 PV-= 495, 868 (1 + 0.10)2 1.21 Year 3: 600, 000 600, 000 PVS = (1 + 0.10)3 450, 789 1.331 Year 4: 600, 000 600, 000 PVA 409, 808 (1 + 0.10)4 1.4641TR TR (1+0.10) 1.61051 f 24 '_I.':_I - == 372, 5563 Step 2: Calculate the Terminal Value at the End of Year 5 The Terminal Value (TV) represents the value of the property at the end of the holding period (Year 5), based on the NOI in Year & and the terminal growth rate. R rL N e il . 2 g8, 750,000 rg IR N L Step 3: Discount the Terminal Value Back to Present Value Mow, discount the Terminal Value back to the present value at the end of Year 5: 8 750,000 8,750,000 et Al b L e e (L+7) (1+0.10)5 WG] : Step 4: Sum the Present Values to Get the Total Property Value Finally, sum the present values of the NOls for the first 5 years and the discounted terminal value: Total Property Value = PV1 + PV2 + PV3 + PV4 + PVs + PVTV Total Property Value 545, 455 + 495, 868 + 450, 789 + 409, 808 + 372, 553 + 5, 433

NOT PV (1 +r) Where: NOI is the Net Operating Income for that year. is the discount rate (10% or 0.10). * # is the time period in years.Year 1: 600, 000 600, 000 PV1 545, 455 (1 + 0.10)1 1.10 Year 2: 600, 000 600, 000 PV-= 495, 868 (1 + 0.10)2 1.21 Year 3: 600, 000 600, 000 PVS = (1 + 0.10)3 450, 789 1.331 Year 4: 600, 000 600, 000 PVA 409, 808 (1 + 0.10)4 1.4641TR TR (1+0.10) 1.61051 f 24 '_I.':_I - == 372, 5563 Step 2: Calculate the Terminal Value at the End of Year 5 The Terminal Value (TV) represents the value of the property at the end of the holding period (Year 5), based on the NOI in Year & and the terminal growth rate. R rL N e il . 2 g8, 750,000 rg IR N L Step 3: Discount the Terminal Value Back to Present Value Mow, discount the Terminal Value back to the present value at the end of Year 5: 8 750,000 8,750,000 et Al b L e e (L+7) (1+0.10)5 WG] : Step 4: Sum the Present Values to Get the Total Property Value Finally, sum the present values of the NOls for the first 5 years and the discounted terminal value: Total Property Value = PV1 + PV2 + PV3 + PV4 + PVs + PVTV Total Property Value 545, 455 + 495, 868 + 450, 789 + 409, 808 + 372, 553 + 5, 433

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts