Question: Using the downloaded Excel data, retrieve the file labeled 20X9 Cutoff. (Link) Study WP 6.4, Inventory Cutoff, and compare it with the voucher register and

Using the downloaded Excel data, retrieve the file labeled "20X9 Cutoff." (Link) Study WP 6.4, "Inventory Cutoff," and compare it with the voucher register and sales summary portions reproduced in Exhibits BB.13 and BB.14. Comment on any cutoff misstatements that you detect and determine their effect on net income. Do the misstatements appear to be intentional or unintentional? Explain

Draft any audit adjustments suggested by the analysis performed in requirement (1). (Remember that Brony's Bikes maintains perpetual inventory records and adjusts its perpetual inventory to the physical inventory through the appropriate "Cost of Goods Sold" accounts.)

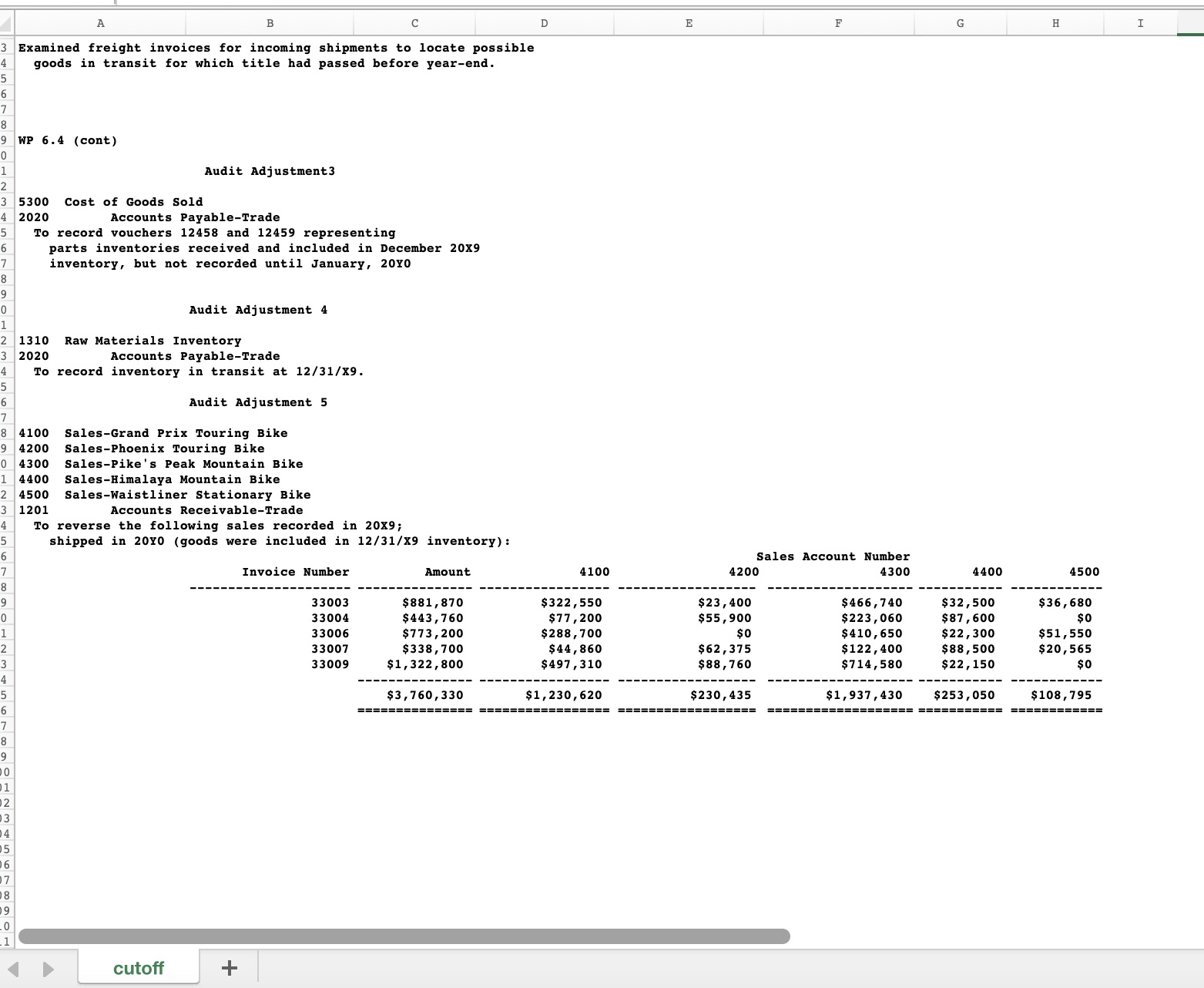

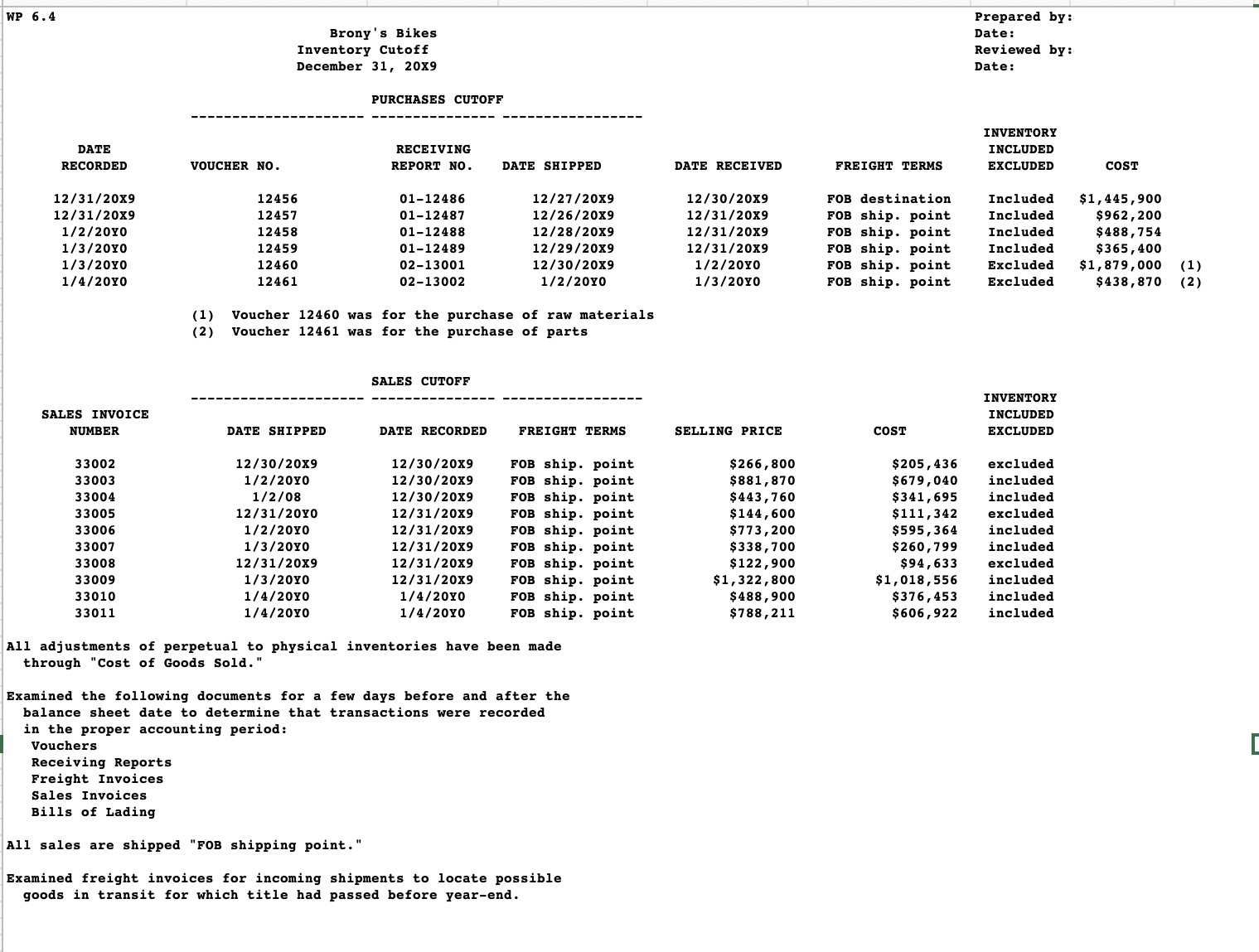

A B C D E F G H I Examined freight invoices for incoming shipments to locate possible goods in transit for which title had passed before year-end. WP 6.4 (cont) Audit Adjustment3 5300 Cost of Goods Sold 2020 Accounts Payable-Trade To record vouchers 12458 and 12459 representing parts inventories received and included in December 20x9 inventory, but not recorded until January, 2010 Audit Adjustment 4 1310 Raw Materials Inventory 2020 Accounts Payable-Trade To record inventory in transit at 12/31/x9. Audit Adjustment 5 4100 Sales-Grand Prix Touring Bike 4200 Sales-Phoenix Touring Bike 4300 Sales-Pike's Peak Mountain Bike 4400 Sales-Himalaya Mountain Bike 4500 Sales-Waistliner Stationary Bike 1201 Accounts Receivable-Trade To reverse the following sales recorded in 20X9; shipped in 2010 (goods were included in 12/31/x9 inventory) : Sales Account Number Invoice Number Amount 4100 4200 4300 4400 4500 ----- 3300 $881, 870 $322 , 550 $23 , 400 $466 , 740 $32 , 500 $36, 68 33004 $443 , 760 $77 , 200 $55 , 900 $223 , 060 $87 , 600 $0 33006 $773, 200 $288 , 700 $0 $410, 650 $22, 300 $51 , 550 3300' $338 , 700 $44, 860 $62, 375 $122 , 400 $88 , 500 $20, 565 33009 $1, 322, 800 $497 , 310 $88 , 760 $714 , 580 $22 , 150 SO $3 , 760, 330 $1, 230, 620 $230, 435 $1,937 , 430 $253 , 050 $108,795 cutoff +WP 6.4 DATE RECORDED 12/31/2019 1213112019 11212020 11312020 11312020 11412020 SALES INVOICE NUMBER 33002 33003 33004 33005 33006 33007 33008 33009 33010 33011 Brony's Bikes Inventory Cutoff December 31, 2019 VOUCHER NO. (1) (2) 12456 12457 12453 12459 12460 12461 Voucher 12460 was for the purchase of raw materials PURCHASES CUTOFF RECEIVING REPORT NO. 0112436 0112487 01-12433 0112489 0213001 0213002 DATE SHIPPED 1212712019 1212612019 1212312019 1212912019 1213012019 112/2020 Voucher 12461 was for the purchase of parts DATE SHIPPED 12130/2019 112/2020 112/08 1213112020 112/2020 113/2020 12131/2019 113/2020 114/2020 114/2020 SALES CUTOFF DATE RECORDED 1213012019 1213012019 1213012019 1213112019 1213112019 1213112019 1213112019 1213112019 114/2020 114/2020 FREIGHT TERMS FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point FOB ship. point All adjustments of perpetual to physical inventories have been made through \"Cost of Goods Sold." Examined the following documents for a few days before and after the balance sheet date to determine that transactions were recorded in the proper accounting period: Vouchers Receiving Reports Freight Invoices sales Invoices Bills of Lading All sales are shipped "FOB shipping point." Examined freight invoices for incoming shipments to locate possible goods in transit for which title had passed before yearend. DATE RECEIVED 1213012019 12/3112019 1213112019 12/3112019 11212020 1/312020 SELLING PRICE $266,300 $331,370 $443,760 $144,600 $773,200 $333,700 $122,900 $1,322,300 $433,900 $733,211 FREIGHT TERMS FOR FOB FOB FOB FOB FOB destination ship. point ship. point ship. point ship. point ship. point COST $205,436 $679,040 $341,695 $111,342 $595,364 $260,799 $94,633 $1,013,556 $376,453 $606,922 Prepared by: Date: Reviewed by: Date: INVENTOR2 INCLUDED EXCLUDED Included Included Included Included Excluded Excluded INVENTORY INCLUDED EXCLUDED excluded included included excluded included included excluded included included included COST $1,445,900 $962,200 $433,754 $365,400 $1,379,000 $433,370 (1) (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts