Question: Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 7.5

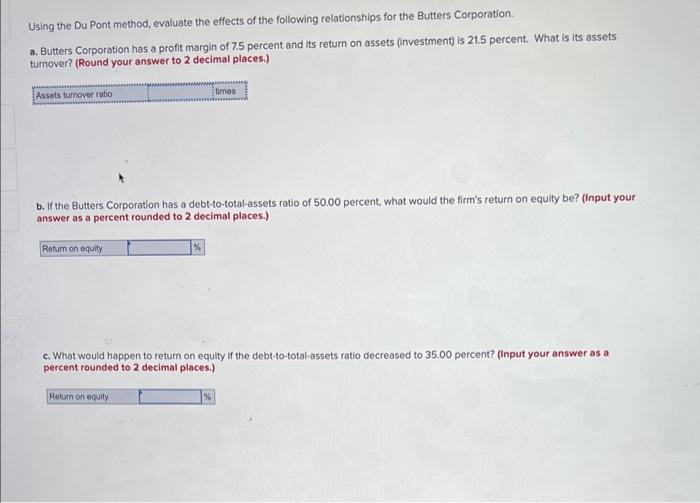

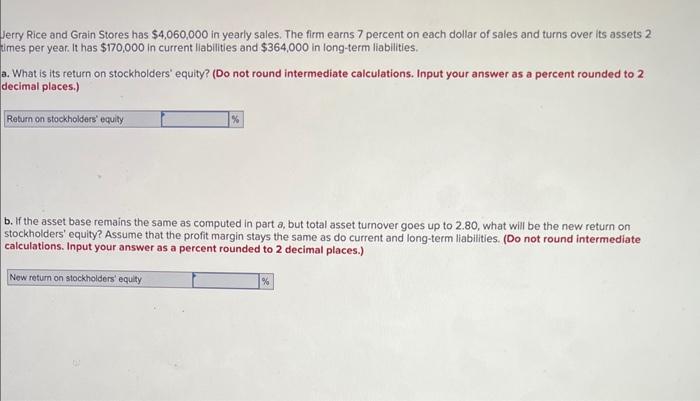

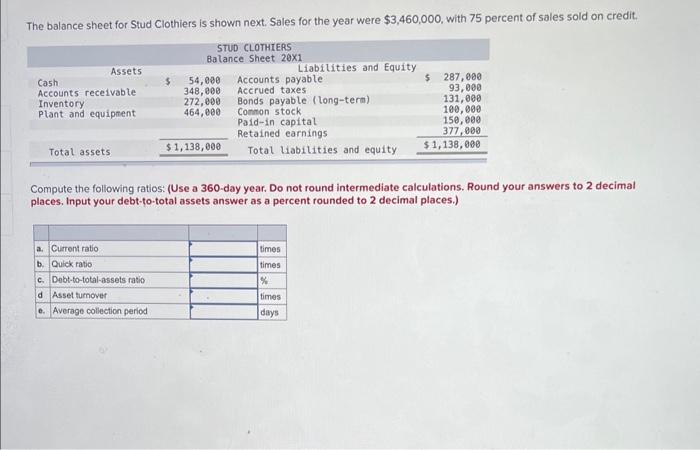

Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 7.5 percent and its return on assets (investment) is 21.5 percent. What is its assets turnover? (Round your answer to 2 decimal places.) b. If the Butters Corporation has a debt-to-total-assets ratio of 50.00 percent, what would the firm's return on equity be? (input your answer as a percent rounded to 2 decimal places.) c. What would happen to return on equity If the debt-to-total-assets ratio decreased to 35.00 percent? (Input your answer as a percent rounded to 2 decimal places.) erry Rice and Grain Stores has $4,060,000 in yearly sales. The firm earns 7 percent on each dollar of sales and turns over its assets 2 mes per year. It has $170,000 in current llabilities and $364,000 in long-term liabilities. What is its return on stockholders' equity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 lecimal places.) b. If the asset base remains the same as computed in part a, but total asset turnover goes up to 2.80, what will be the new return on stockholders' equity? Assume that the profit margin stays the same as do current and long-term liabilities. (Do not round intermediate. calculations. Input your answer as a percent rounded to 2 decimal places.) The balance sheet for Stud Clothiers is shown next. Sales for the year were $3,460,000, with 75 percent of sales sold on credit. Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.) Using the Du Pont method, evaluate the effects of the following relationships for the Butters Corporation. a. Butters Corporation has a profit margin of 7.5 percent and its return on assets (investment) is 21.5 percent. What is its assets turnover? (Round your answer to 2 decimal places.) b. If the Butters Corporation has a debt-to-total-assets ratio of 50.00 percent, what would the firm's return on equity be? (input your answer as a percent rounded to 2 decimal places.) c. What would happen to return on equity If the debt-to-total-assets ratio decreased to 35.00 percent? (Input your answer as a percent rounded to 2 decimal places.) erry Rice and Grain Stores has $4,060,000 in yearly sales. The firm earns 7 percent on each dollar of sales and turns over its assets 2 mes per year. It has $170,000 in current llabilities and $364,000 in long-term liabilities. What is its return on stockholders' equity? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 lecimal places.) b. If the asset base remains the same as computed in part a, but total asset turnover goes up to 2.80, what will be the new return on stockholders' equity? Assume that the profit margin stays the same as do current and long-term liabilities. (Do not round intermediate. calculations. Input your answer as a percent rounded to 2 decimal places.) The balance sheet for Stud Clothiers is shown next. Sales for the year were $3,460,000, with 75 percent of sales sold on credit. Compute the following ratios: (Use a 360-day year. Do not round intermediate calculations. Round your answers to 2 decimal places. Input your debt-to-total assets answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts