Question: Using the DuPont method, evaluate the effects on the folowing relationships for Lava Corp. Formatting requirements: Do not round intermediate calculations. Round the fin answer

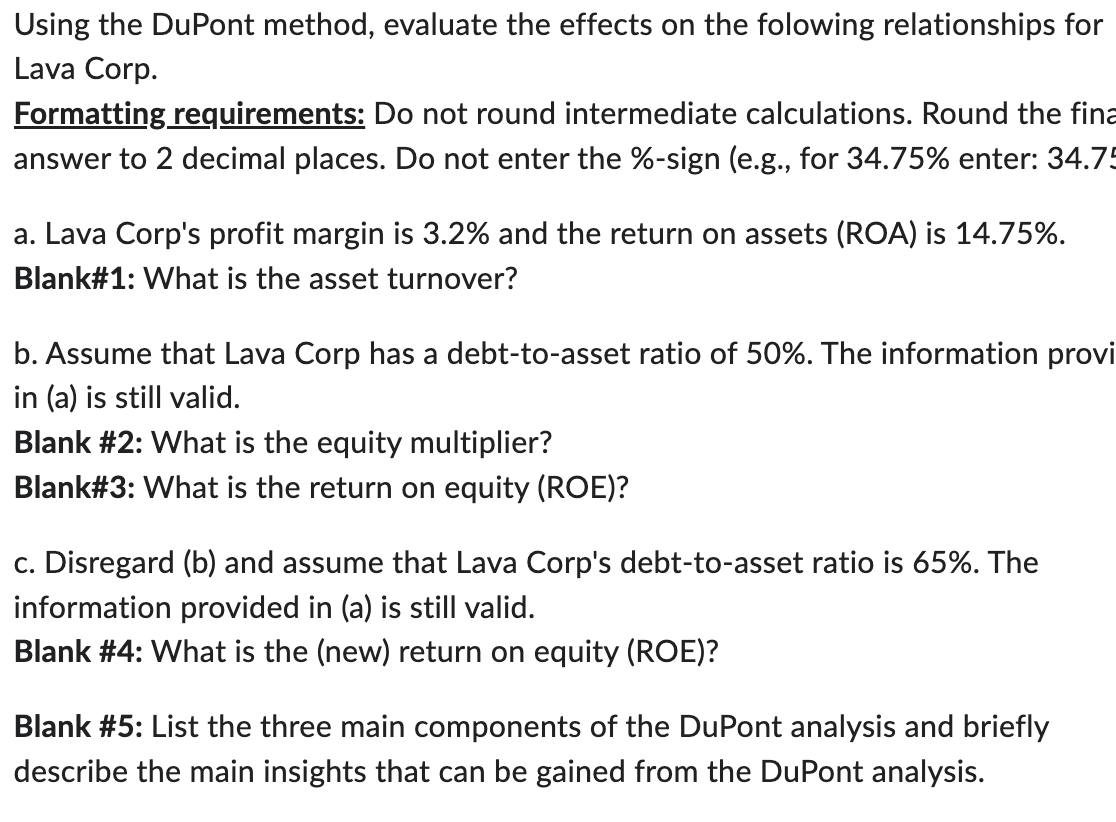

Using the DuPont method, evaluate the effects on the folowing relationships for Lava Corp. Formatting requirements: Do not round intermediate calculations. Round the fin answer to 2 decimal places. Do not enter the \%-sign (e.g., for 34.75% enter: 34.7 a. Lava Corp's profit margin is 3.2% and the return on assets (ROA) is 14.75%. Blank\#1: What is the asset turnover? b. Assume that Lava Corp has a debt-to-asset ratio of 50%. The information prov in (a) is still valid. Blank \#2: What is the equity multiplier? Blank\#3: What is the return on equity (ROE)? c. Disregard (b) and assume that Lava Corp's debt-to-asset ratio is 65%. The information provided in (a) is still valid. Blank \#4: What is the (new) return on equity (ROE)? Blank \#5: List the three main components of the DuPont analysis and briefly describe the main insights that can be gained from the DuPont analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts