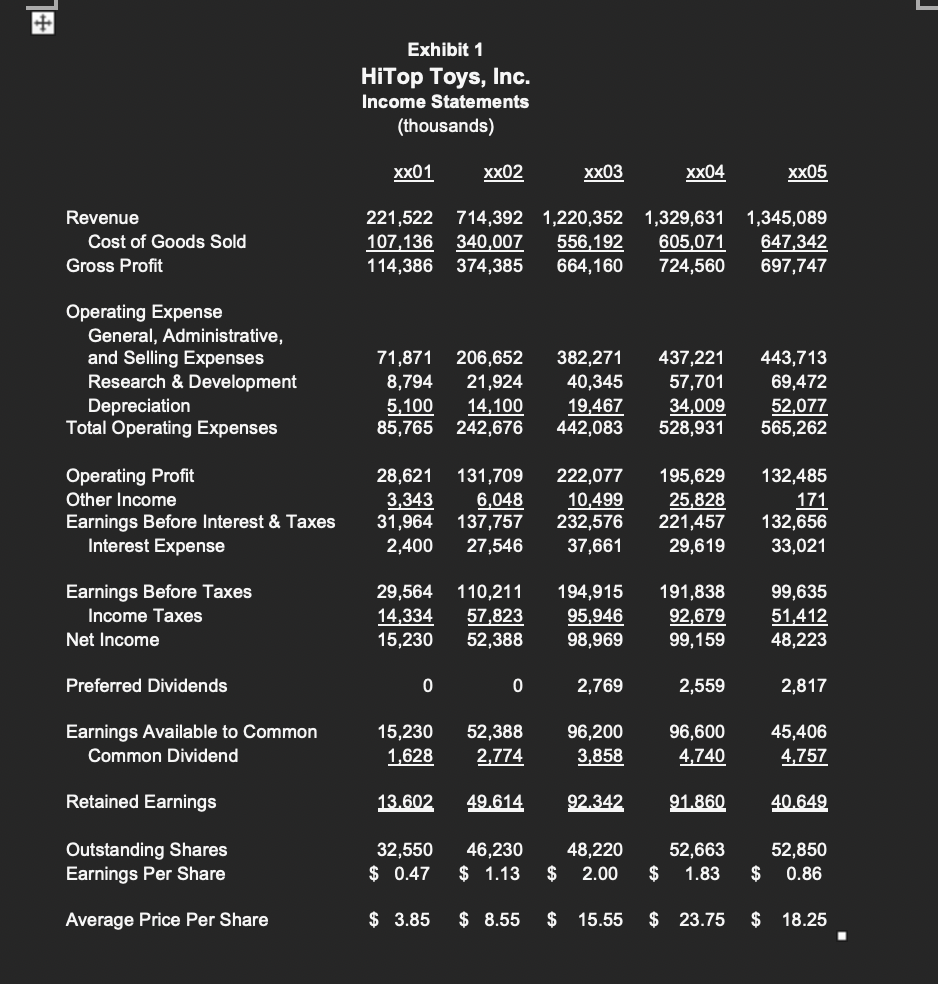

Question: Using the DuPont model analyze the return on equity for the past five years. Exhibit 1 HiTop Toys, Inc. Income Statements (thousands) RevenueCostofGoodsSoldGrossProfitx01221,522107,136114,386xx02714,392340,007374,385xx031,220,352556,192664,160xx041,329,631605,071724,560xx051,345,089647,342697,747 Operating Expense

Using the DuPont model analyze the return on equity for the past five years.

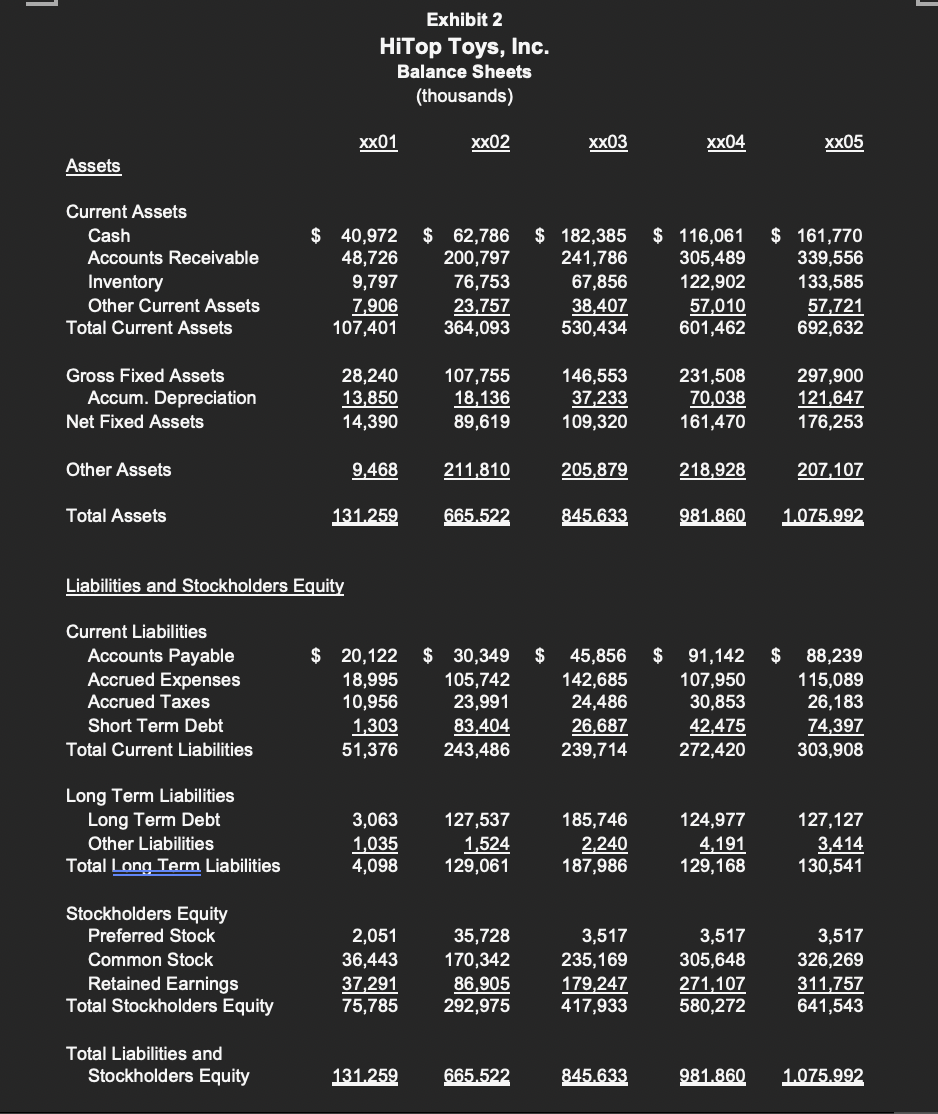

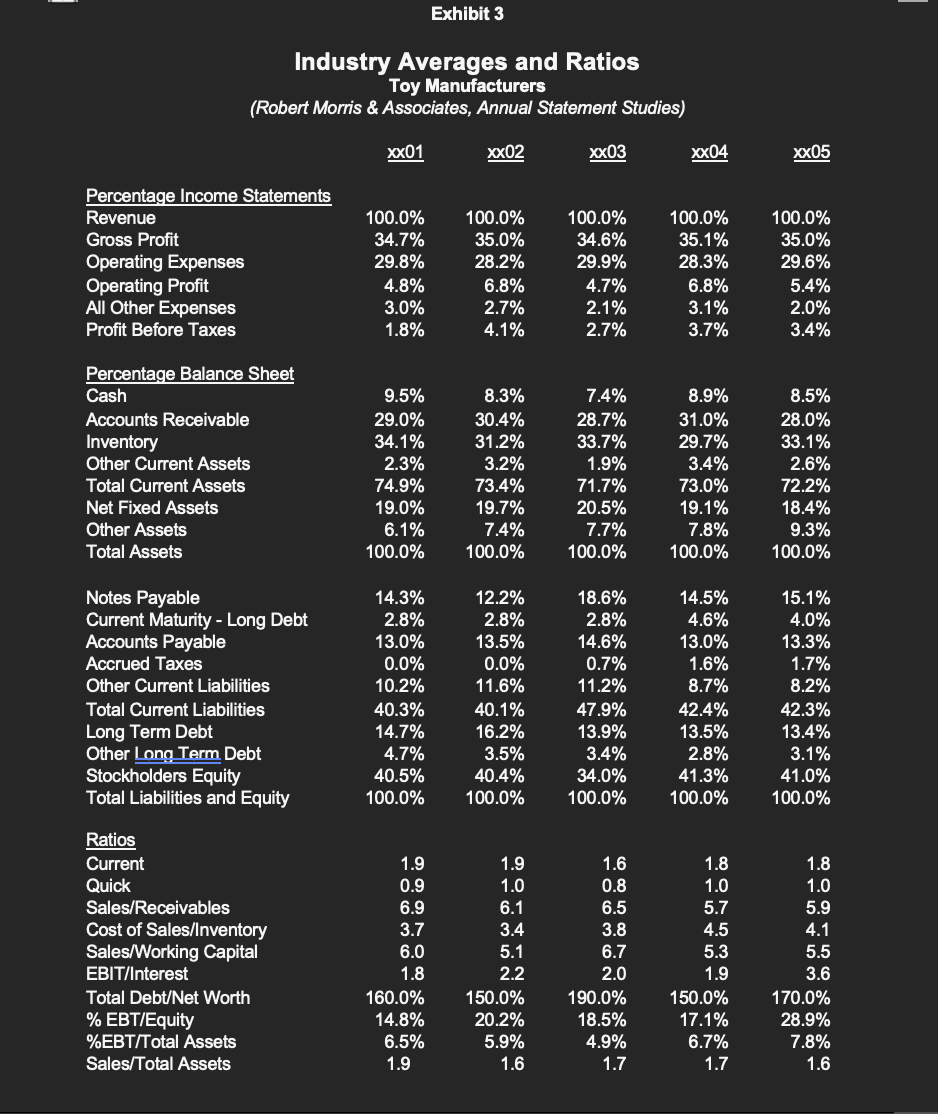

Exhibit 1 HiTop Toys, Inc. Income Statements (thousands) RevenueCostofGoodsSoldGrossProfitx01221,522107,136114,386xx02714,392340,007374,385xx031,220,352556,192664,160xx041,329,631605,071724,560xx051,345,089647,342697,747 Operating Expense General, Administrative, and Selling Expenses Research \& Development Depreciation Total Operating Expenses Operating Profit Other Income Earnings Before Intere Interest Expense Earnings Before Taxes Income Taxes Net Income Preferred Dividends Earnings Available to Common Dividend Retained Earnings OutstandingSharesEarningsPerShareAveragePricePerShare32,550$0.47$3.8546,230$1.13$8.5548,220$$15.5552,6632.00$23.7552,850$1.83$18.25$0.86 Liabilities and Stockholders Equity Exhibit 3 Industry Averages and Ratios Toy Manufacturers (Robert Morris \& Associates, Annual Statement Studies)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts