Question: Using the equity valuation methods from class, answer Part 1, Part 2, and Part 3 below with the following set of information: Note: do not

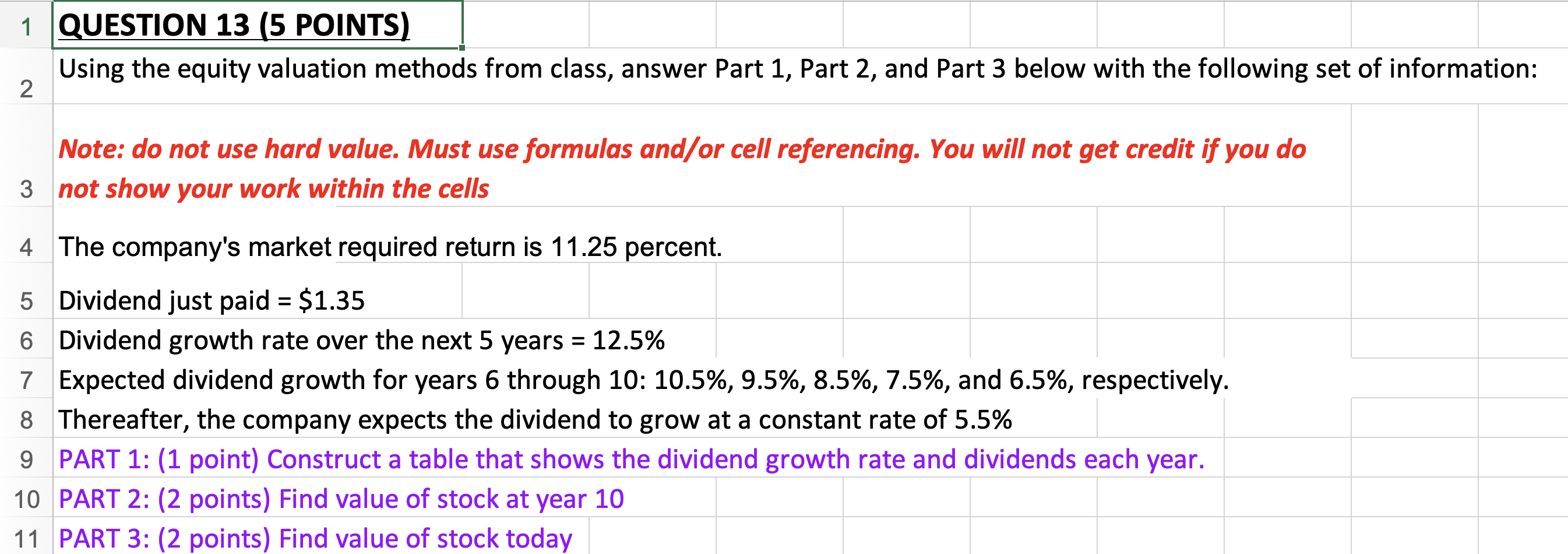

Using the equity valuation methods from class, answer Part 1, Part 2, and Part 3 below with the following set of information: Note: do not use hard value. Must use formulas and/or cell referencing. You will not get credit if you do not show your work within the cells The company's market required return is 11.25 percent. Dividend just paid =$1.35 Dividend growth rate over the next 5 years =12.5% Expected dividend growth for years 6 through 10: 10.5\%, 9.5\%, 8.5\%, 7.5\%, and 6.5%, respectively. Thereafter, the company expects the dividend to grow at a constant rate of 5.5% PART 1: (1 point) Construct a table that shows the dividend growth rate and dividends each year. PART 2: (2 points) Find value of stock at year 10 PART 3: (2 points) Find value of stock today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts