Question: Using the Events outlined Below create financial Statements( income statement ,statement of changes in stock holders' Equity and balance sheet ) and a Horizontal Worksheet

Using the Events outlined Below create financial Statements( income statement ,statement of changes in stock holders' Equity and balance sheet ) and a Horizontal Worksheet to journalize each trasaction listed.

Events

January 1 You started the business by contributing $100,000 of personal capital in exchange for common stock

January 1 Paid $5,000 to the lawyers to incorporate your business entity

January 2 Acquired computers for the business for $5,000

January 3 Acquired inventory held for re-sale for $20,000

January 4 First sale took place, as you sold half of the inventory originally purchased. You sold it for $50,000 cash.

January 14 Customer in event #5 realized an error he made in his order and returned inventory, which is still in great condition, which had a revenue value of $2,000. You added this returned product to inventory and returned the $2,000 cash.

January 31 - You made your first month payment for accounting software, which you will continue to pay monthly, on the last day of each month for the remainder of the year. The monthly fee is $95.

March 1 Pre-Paid $12,000 for a one-year lease of a small office to be used for administrative work only.

March 1 Acquired office furniture for $10,000 cash. Estimated useful life is five years with a $200 salvage value, using straight-line depreciation.

February 15 Sold the rest of the inventory for $75,000 cash

March 15 You were sued by an outside party, and received an invoice from lawyers for $2,000 for legal work performed, due in April.

April 1 Paid the legal invoice due

April 15 Paid an IT contractor $500 to repair your computer.

April 25 Bought more inventory from your supplier, for $20,000 on credit

May 1 Borrowed $100,000 from the bank at a simple interest annual rate of 10%. No principle or interest is due this year.

May 31 Sold all remaining inventory for $50,000, on credit.

June 30 Collected on all outstanding Accounts Receivable.

July 1 Paid all $20,000 of accounts payable from April 25.

July 15 Sold all of the computers for $1,000 in cash.

September 1 Bought more inventory, for $30,000 using a one-year note payable, which has a 12% annual simple interest rate.

October 1 Sold inventory all that you had on hand, for $50,000 on credit.

October 1 You hired your first employee to perform administrative work.

November 5 You paid $5,000 cash for wages that were earned in October. You continue to pay the same amount on the 5th of each month for wages earned the previous month.

November 1 Collected on accounts receivable, in all cash.

November 18 Bought inventory for $25,000 on credit

December 1 You had $2,000 of you inventory stolen.

December 15 You were declared business-of-the-Month by your local Chamber of Commerce. You paid $110 to attend a banquet in your honor.

December 20 Your employee qualified for health insurance. You paid $1,000 directly to the insurance company for December health insurance coverage.

December 31 Recorded accrued interest from the bank loan.

December 31 Paid $5,000 bonus in cash to employee.

December 31 Recorded depreciation on office furniture (record a full year of depreciation)

December 31 Recorded lease/rent expense from pre-payment.

December 31 Recorded accrued salary

December 31 Recorded accrued interest on the note payable.

December 31 After books were closed, you paid 50% of all the remaining profit as cash dividend.

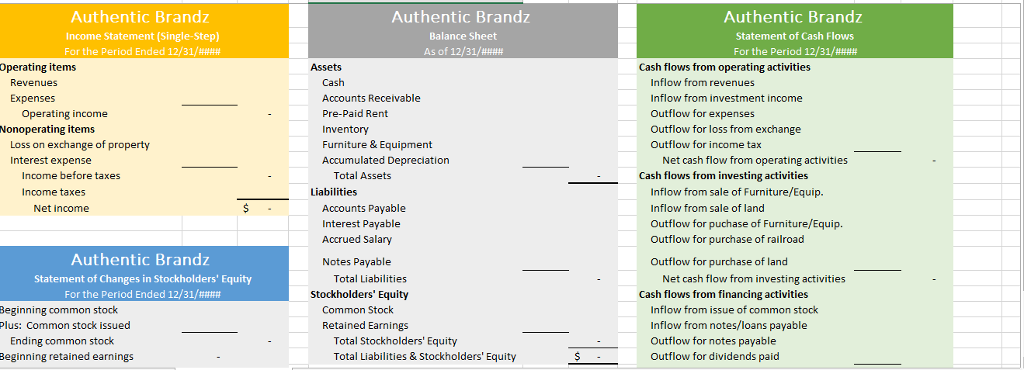

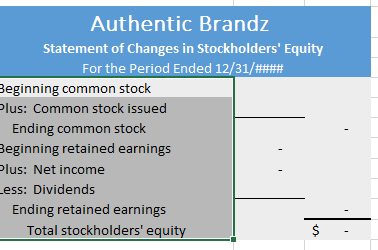

here is the provided template financial statements

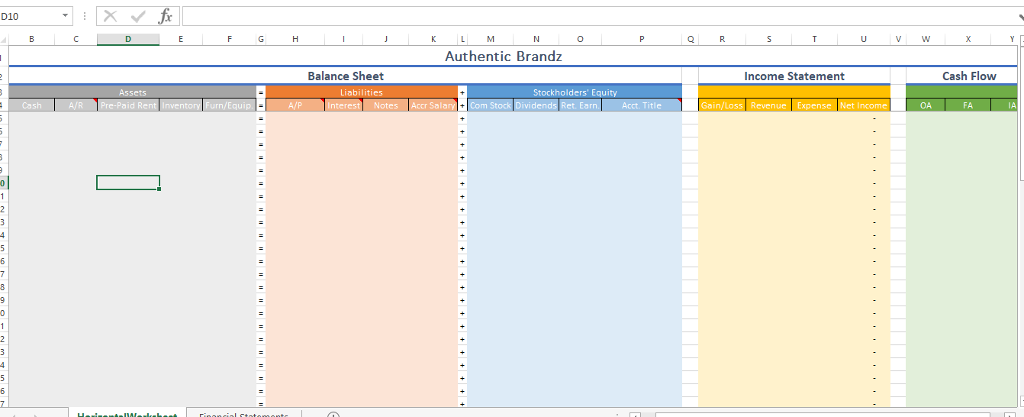

here is the provided template Horizontal Worksheet

Authentic Brandz Income Statement(Single-Step) For the Period Ended 12/31/#### Authentic Brandz Balance Sheet As of 12/31/ #### Authentic Brandz Statement of Cash Flows For the period 12/31/#### Operating items Assets Cash flows from operating activities Cash Accounts Receivable Pre-Paid Rent Inventory Furniture & Equipment Accumulated Depreciation Inflow from revenues Inflow from investment income Outflow for expenses Outflow for loss from exchange Outflow for income tax Revenues Expenses Operating income Nonoperating items Loss on exchange of property Interest expense Net cash flow from operating activities Income before taxes Total Assets Cash flows from investing activities Inflow from sale of Furniture/Equip. Inflow from sale of land Outflow for puchase of Furniture/Equip. Outflow for purchase of railroad Outflow for purchase of land Income taxes Liabilities Accounts Payable Interest Payable Accrued Salary Notes Payable Net income Authentic Brandz Total Liabilities Net cash flow from investing activities Statement of Changes in Stockholders' Equity For the Period Ended 12/31/#### Stockholders' Equity Cash flows from financing activities Beginning common stock Plus: Common stock issued Common Stock Retained Earnings Inflow from issue of common stock Inflow from notes/loans payable Outflow for notes payable Outflow for dividends paid Ending common stock Beginning retained earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity Authentic Brandz Income Statement(Single-Step) For the Period Ended 12/31/#### Authentic Brandz Balance Sheet As of 12/31/ #### Authentic Brandz Statement of Cash Flows For the period 12/31/#### Operating items Assets Cash flows from operating activities Cash Accounts Receivable Pre-Paid Rent Inventory Furniture & Equipment Accumulated Depreciation Inflow from revenues Inflow from investment income Outflow for expenses Outflow for loss from exchange Outflow for income tax Revenues Expenses Operating income Nonoperating items Loss on exchange of property Interest expense Net cash flow from operating activities Income before taxes Total Assets Cash flows from investing activities Inflow from sale of Furniture/Equip. Inflow from sale of land Outflow for puchase of Furniture/Equip. Outflow for purchase of railroad Outflow for purchase of land Income taxes Liabilities Accounts Payable Interest Payable Accrued Salary Notes Payable Net income Authentic Brandz Total Liabilities Net cash flow from investing activities Statement of Changes in Stockholders' Equity For the Period Ended 12/31/#### Stockholders' Equity Cash flows from financing activities Beginning common stock Plus: Common stock issued Common Stock Retained Earnings Inflow from issue of common stock Inflow from notes/loans payable Outflow for notes payable Outflow for dividends paid Ending common stock Beginning retained earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts