Question: Using the Excel spreadsheet developed for the implied views method, set the target expected log return () for the Russell 1000 Value index and the

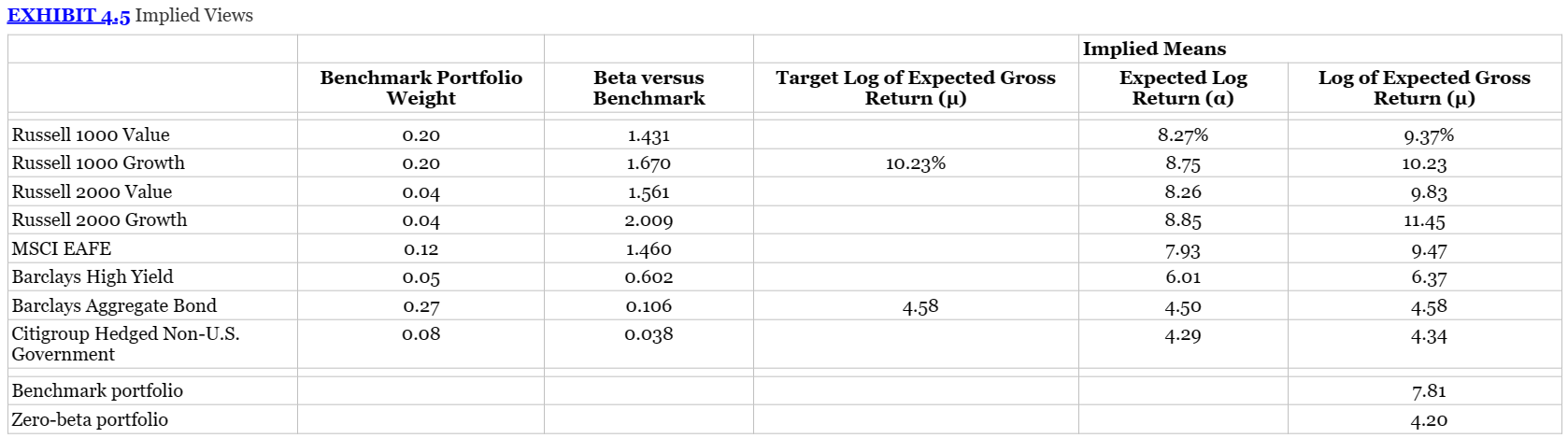

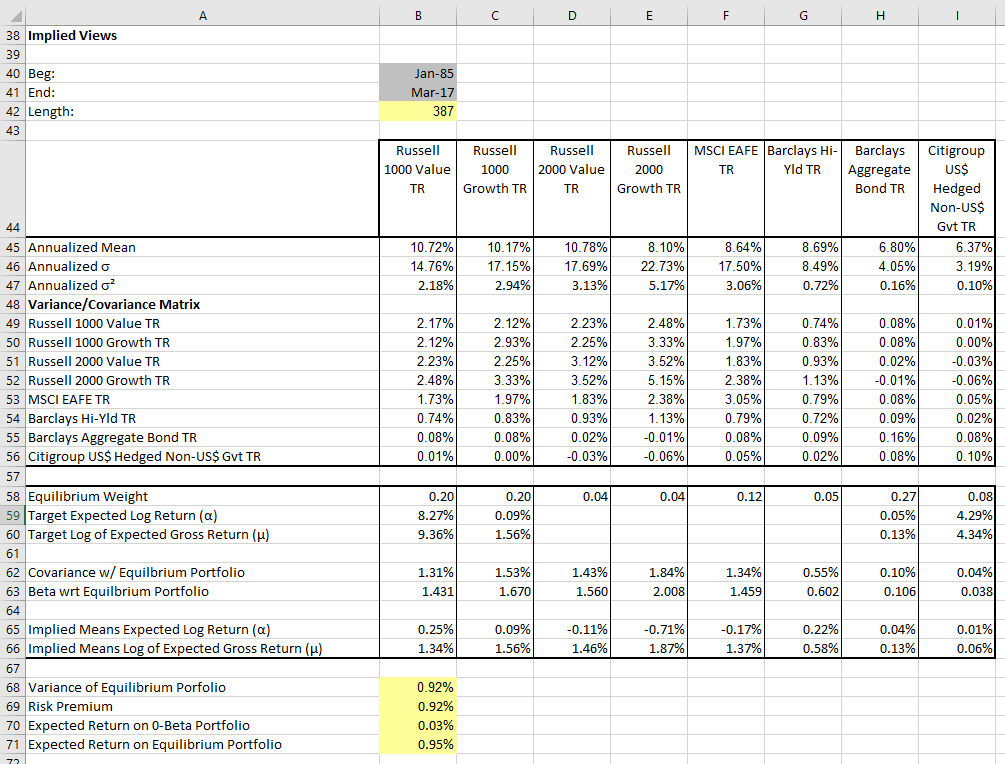

Using the Excel spreadsheet developed for the implied views method, set the target expected log return () for the Russell 1000 Value index and the Citigroup U.S. $-hedged Non-U.S. $ Government index to 8.27 percent and 4.29 percent respectively. Compare the implied expected returns for the other asset classes with those in Exhibit 4.5. Are they same? Why or why not?

EXHIBIT 4_5 Implied Views EXHIBIT 4_5 Implied Views

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts