Question: Using the excerpt from the case study below discussing cost allocation and the charts provided from the case study, did I complete the cost allocation

Using the excerpt from the case study below discussing cost allocation and the charts provided from the case study, did I complete the cost allocation chart in the bottom left of the uploaded image correctly? I can't change the format or layout of the cost allocation chart, but Id like to know if the numbers I inputted into the blank template provided to me are correct. Excerpt: COST ALLOCATION

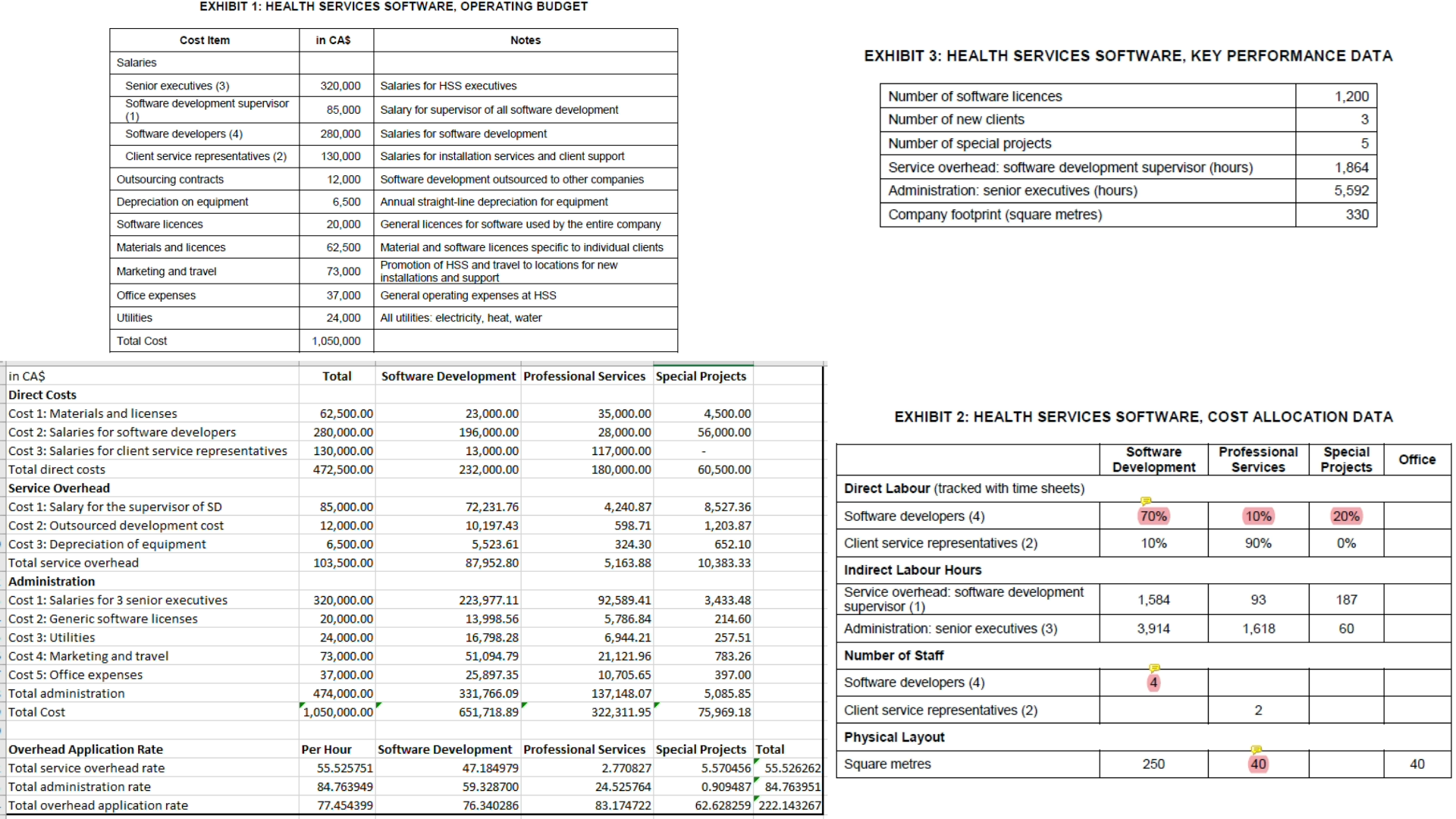

The challenge facing HSS was how to allocate costs to the three lines of service so that each could be competitively priced.

The company did not have a standard costing system. Direct materials and licences were charged to the service area that incurred the costs. The actual direct materials costs in had been allocated as $ for software development, $ for professional services, and $ for special projects. Direct labour hours for the software developers and client service representatives were tracked using time tracking software and assioned directly to the business lines see Exhibit

Under HSSs old costing setup, indirect labour costs were not allocated to the business lines. But to be profitable and to properly price the company's software licences, the company needed to allocate indirect costs to the appropriate business lines. HSS considered three possible cost drivers for its indirect costs: the number of staff performing each task, the indirect labour hours, and the space occupied by each service area. The use of each of these potential cost drivers is outlined in Exhibit

Service overhead included salary for the supervisor of the software development, all outsourced development costs, and depreciation for the equipment see Exhibit The supervisor of the development staff worked a standard eighthour day and received days hours of vacation and days hours of statutory holidays. The maximum number of hours that the supervisor worked was in a given year see Exhibit

Administration overhead included salaries for the three semior executives in the company, generic software licences, marketing and travel, office expenses, and utilities see Exhibit The senior executives had fixed salaries, and each worked the same number of hours per year see Exhibit The office footprint for the executives totalled square metres.

The company also had some key performance data from : the projected number of licences for the year, the number of new clients and special projects, and the number of labour hours available for the supervisor of software development and for the corporate administrative executive personnel see Exhibit The number of available labour hours was net of vacation days and statutory holidays.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock