Question: Using the fact pattern presented in Exercise 8-15 but assuming that the restructured loan called for a single payment of $60,000 on January 1, 2021,

Using the fact pattern presented in Exercise 8-15 but assuming that the restructured loan called for a single payment of $60,000 on January 1, 2021, prepare journal entries for CVC and Buffalo Supply on the following dates:

a. 1/1/2019

b. 1/1/2020

c. 1/1/2021

Reference:

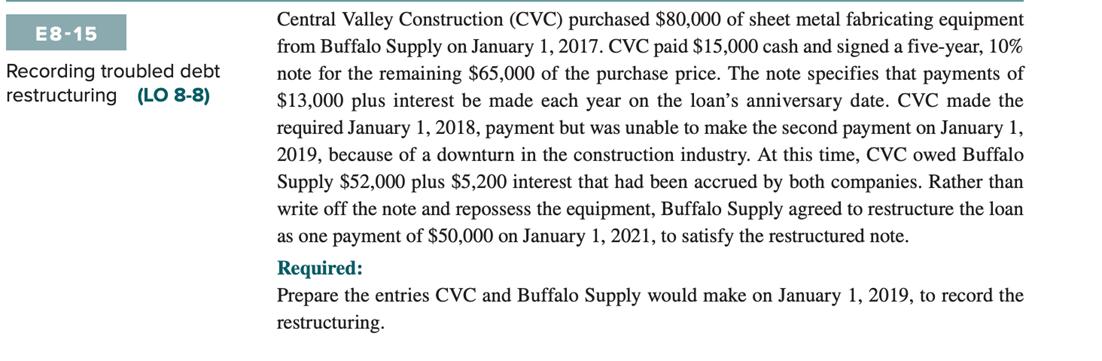

Central Valley Construction (CVC) purchased $80,000 of sheet metal fabricating equipment from Buffalo Supply on January 1, 2017. CVC paid $15,000 cash and signed a five-year, 10% note for the remaining $65,000 of the purchase price. The note specifies that payments of $13,000 plus interest be made each year on the loan's anniversary date. CVC made the E8-15 Recording troubled debt restructuring (LO 8-8) required January 1, 2018, payment but was unable to make the second payment on January 1, 2019, because of a downturn in the construction industry. At this time, CVC owed Buffalo Supply $52,000 plus $5,200 interest that had been accrued by both companies. Rather than write off the note and repossess the equipment, Buffalo Supply agreed to restructure the loan as one payment of $50,000 on January 1, 2021, to satisfy the restructured note. Required: Prepare the entries CVC and Buffalo Supply would make on January 1, 2019, to record the restructuring.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Please hit LIKE button if this helped For any further explanation please put your query in comment w... View full answer

Get step-by-step solutions from verified subject matter experts