Question: Using the facts stated in Exercise, what would be the tax effects of the transfer pricing action if corporate income tax rates were 30 percent

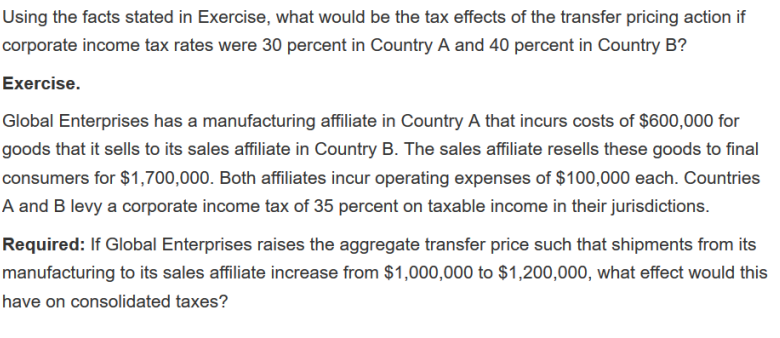

Using the facts stated in Exercise, what would be the tax effects of the transfer pricing action if corporate income tax rates were 30 percent in Country A and 40 percent in Country B? Global Enterprises has a manufacturing affiliate in Country A that incurs costs of $600,000 for goods that it sells to its sales affiliate in Country B. The sales affiliate resells these goods to final consumers for $1,700,000. Both affiliates incur operating expenses of $100,000 each. Countries A and B levy a corporate income tax of 35 percent on taxable income in their jurisdictions. Required: If Global Enterprises raises the aggregate transfer price such that shipments from its manufacturing to its sales affiliate increase from $1,000,000 to $1,200,000, what effect would this have on consolidated taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts