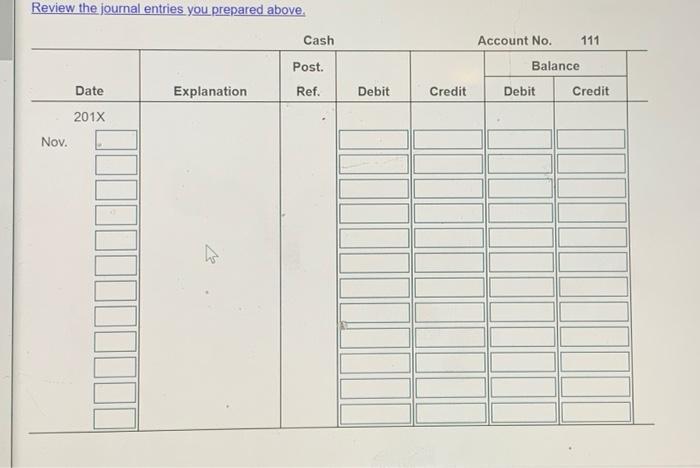

Question: using the filled in tables complete the empty chart Review the journal entries you prepared above. Cash Account No. 111 Post. Balance Date Explanation Ref.

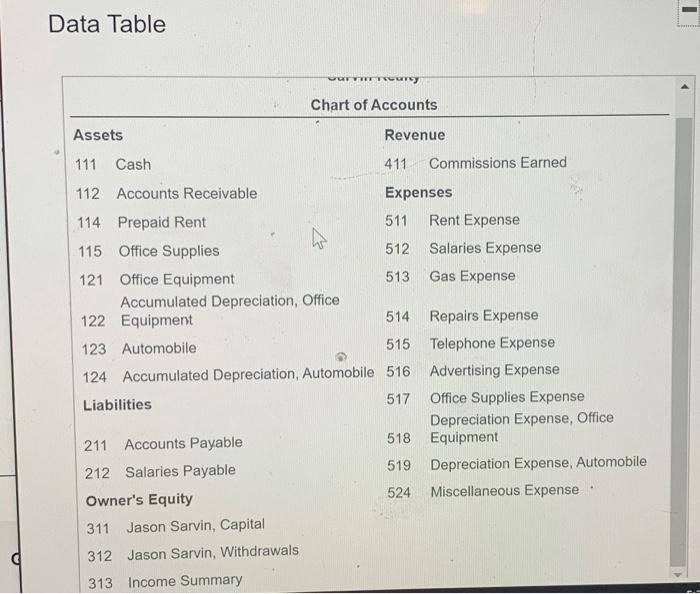

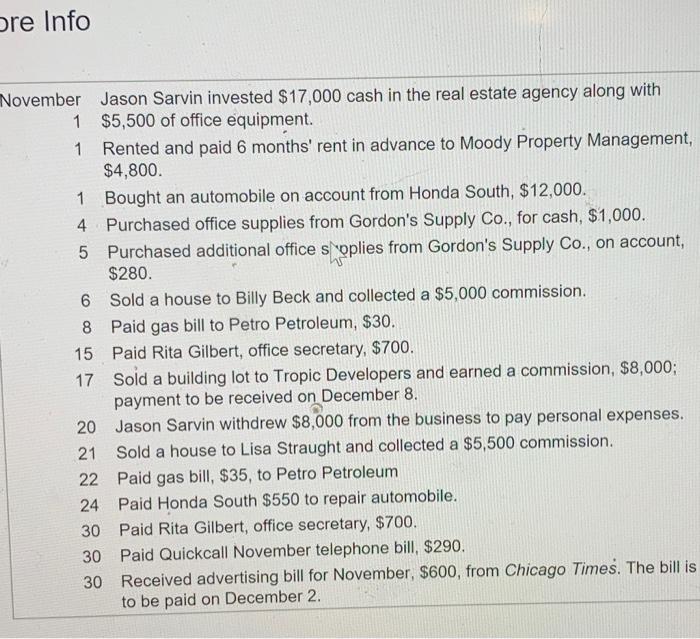

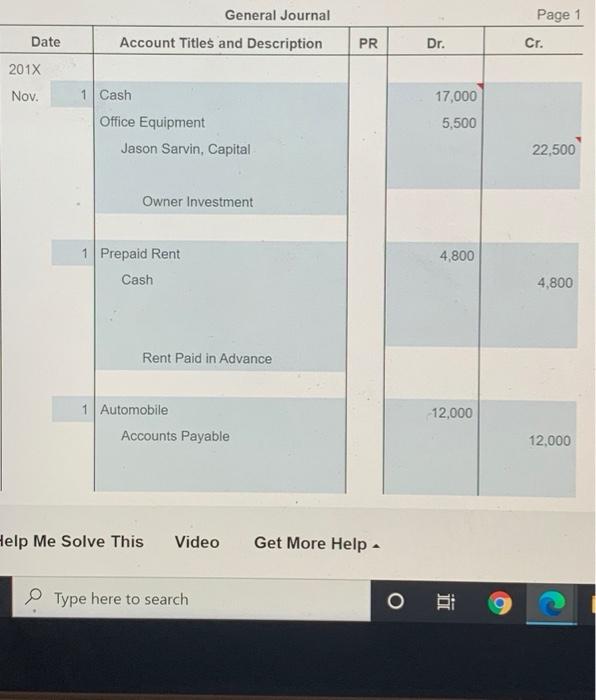

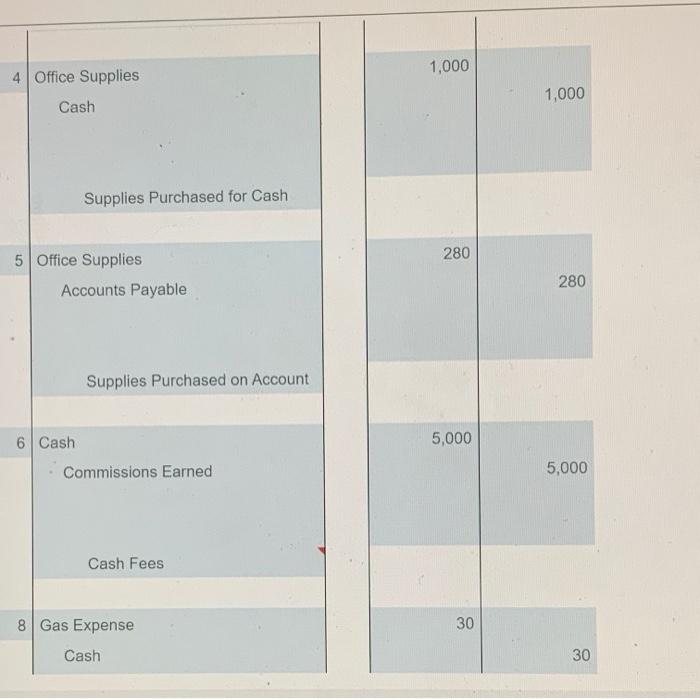

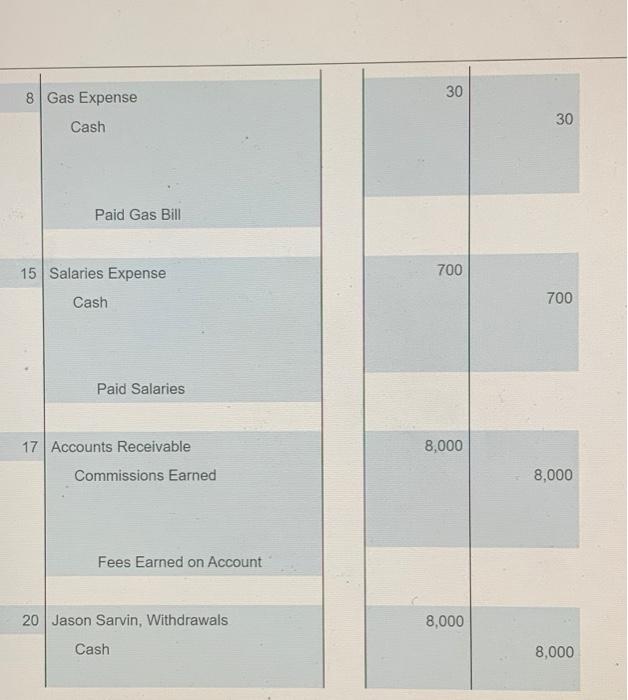

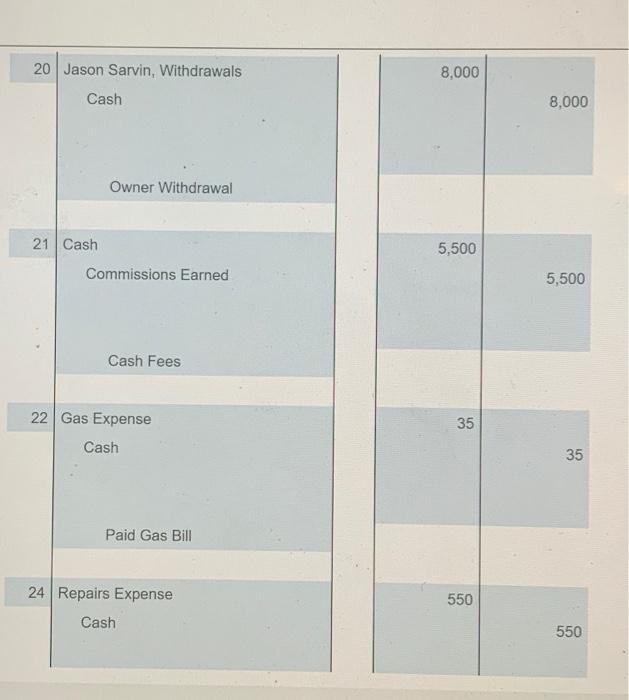

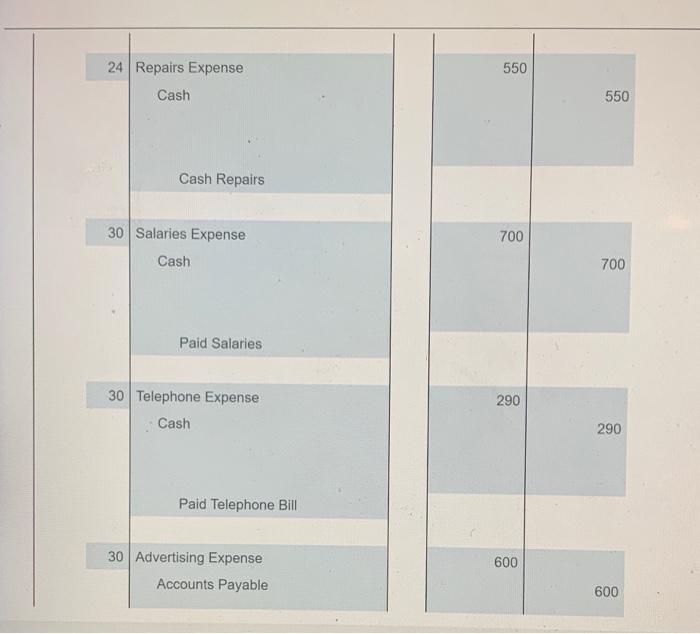

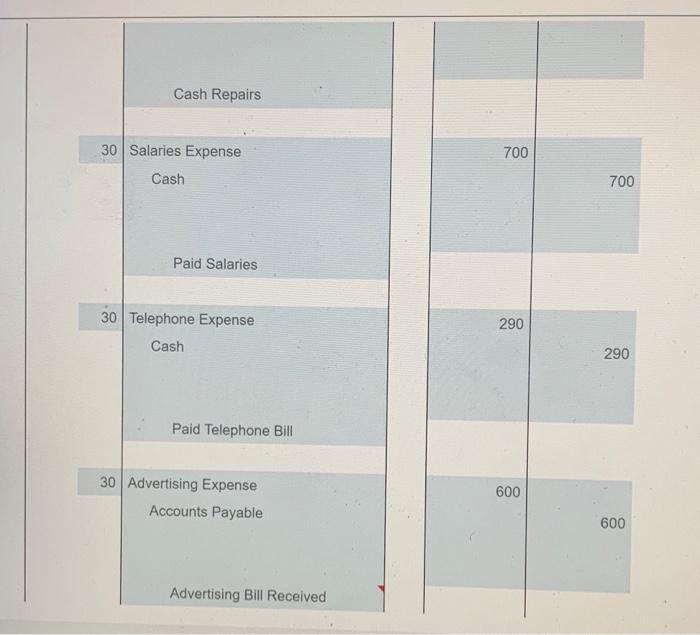

Review the journal entries you prepared above. Cash Account No. 111 Post. Balance Date Explanation Ref. Debit Credit Debit Credit 2018 Nov. 1 1 Data Table wureur Chart of Accounts Assets Revenue 111 Cash 411 Commissions Earned 112 Accounts Receivable Expenses 114 Prepaid Rent 511 Rent Expense 115 Office Supplies 512 Salaries Expense 121 Office Equipment 513 Gas Expense Accumulated Depreciation, Office 122 Equipment 514 Repairs Expense 123 Automobile 515 Telephone Expense 124 Accumulated Depreciation, Automobile 516 Advertising Expense Liabilities 517 Office Supplies Expense Depreciation Expense, Office 211 Accounts Payable 518 Equipmer 212 Salaries Payable 519 Depreciation Expense, Automobile Owner's Equity 524 Miscellaneous Expense. 311 Jason Sarvin, Capital 312 Jason Sarvin, Withdrawals 313 Income Summary Ore Info November Jason Sarvin invested $17,000 cash in the real estate agency along with 1 $5,500 of office equipment. 1 Rented and paid 6 months' rent in advance to Moody Property Management, $4,800. 1 Bought an automobile on account from Honda South, $12,000. 4 Purchased office supplies from Gordon's Supply Co., for cash, $1,000. 5 Purchased additional office s oplies from Gordon's Supply Co., on account, $280. 6 Sold a house to Billy Beck and collected a $5,000 commission. 8 Paid gas bill to Petro Petroleum, $30. 15 Paid Rita Gilbert, office secretary, $700. 17 Sold a building lot to Tropic Developers and earned a commission, $8,000; payment to be received on December 8. 20 Jason Sarvin withdrew $8,000 from the business to pay personal expenses. 21 Sold a house to Lisa Straught and collected a $5,500 commission. 22 Paid gas bill, $35, to Petro Petroleum 24 Paid Honda South $550 to repair automobile. 30 Paid Rita Gilbert, office secretary, $700. 30 Paid Quickcall November telephone bill, $290. 30 Received advertising bill for November, $600, from Chicago Times. The bill is to be paid on December 2. General Journal Page 1 Date Account Titles and Description PR Dr. Cr. 201X Nov. 1 Cash 17,000 5,500 Office Equipment Jason Sarvin, Capital 22.500 Owner Investment 4,800 1 Prepaid Rent Cash 4,800 Rent Paid in Advance 12,000 1 Automobile Accounts Payable 12.000 Help Me Solve This Video Get More Help Type here to search o 1,000 4 Office Supplies 1,000 Cash Supplies Purchased for Cash 280 5 Office Supplies Accounts Payable 280 Supplies Purchased on Account 6 Cash 5,000 Commissions Earned 5,000 Cash Fees 8 Gas Expense 30 Cash 30 30 8 Gas Expense 30 Cash Paid Gas Bill 700 15 Salaries Expense Cash 700 Paid Salaries 17 Accounts Receivable 8,000 Commissions Earned 8,000 Fees Earned on Account 20 Jason Sarvin, Withdrawals 8,000 Cash 8,000 20 Jason Sarvin, Withdrawals 8,000 Cash 8.000 Owner Withdrawal 21 Cash 5,500 Commissions Earned 5,500 Cash Fees 22 Gas Expense 35 Cash 35 Paid Gas Bill 24 Repairs Expense 550 Cash 550 550 24 Repairs Expense Cash 550 Cash Repairs 700 30 Salaries Expense Cash 700 Paid Salaries 290 30 Telephone Expense Cash 290 Paid Telephone Bill 600 30 Advertising Expense Accounts Payable 600 Cash Repairs 30 Salaries Expense 700 Cash 700 Paid Salaries 30 Telephone Expense 290 Cash 290 Paid Telephone Bill 30 Advertising Expense Accounts Payable 600 600 Advertising Bill Received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts