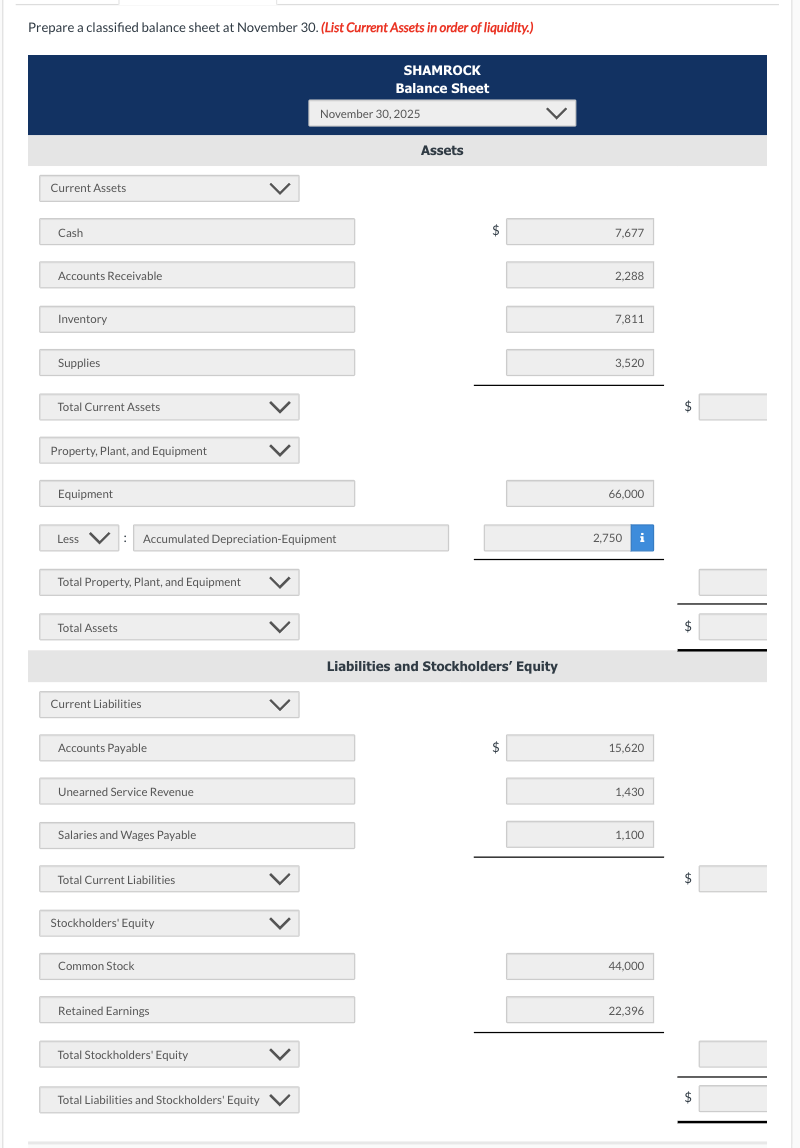

Question: Using the financial data and closing entries provided below for Shamrock as of November 3 0 , 2 0 2 5 , complete the posting

Using the financial data and closing entries provided below for Shamrock as of November complete the posting of the closing entries into the following ledger accounts. These accounts should reflect the closing journal entries already completed with proper dates, descriptions, and updated balances.

The accounts to post closing entries for are:

Retained Earnings

Service Revenue

Depreciation Expense

Supplies Expense

Salaries and Wages Expense

Rent Expense

Sales Revenue

Cost of Goods Sold

Sales Discounts

Income Summary

Supporting Information:

Closing Entries Already Journalized:

Close Revenues to Income Summary

Debit Service Revenue: $

Debit Sales Revenue: $

Credit Sales Discounts: $

Credit Income Summary: $

Close Expenses to Income Summary

Debit Income Summary: $

Credit Cost of Goods Sold: $

Credit Salaries and Wages Expense: $

Credit Supplies Expense: $

Credit Depreciation Expense: $

Credit Rent Expense: $

Close Income Summary to Retained Earnings

Debit Income Summary: $

Credit Retained Earnings: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock