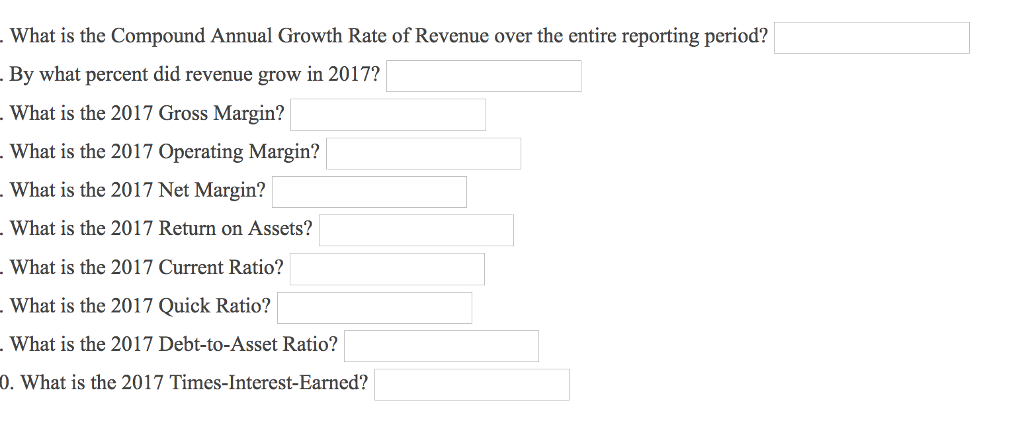

Question: Using the financial data below, answer the following questions to assess the financial strength of this company. 2015 2014 2017 2016 $25,778$27,079$28,105 $27,931 Sales Cost

Using the financial data below, answer the following questions to assess the financial strength of this company. 2015 2014 2017 2016 $25,778$27,079$28,105 $27,931 Sales Cost of Goods Sold 15,62116,49616,86316,725 $10,157$10,583 $11,242 $11,206 8,8428,5448,4598,528 $1,315$2,039$2,783%2,678 388 804 $6111,070$1,526 $1,486 Gross Income rating Expenses erating Income Interest Expense Taxes Net Income 363 341 361 608 393 864 Cash Receivables Invento Total Current Assets Total Assets $1.297$1,109 $2,246 $2,273 438 5,8075,9855,9105,977 $7,626$7,652S8,580$8,688 $19,851$20,576 $21,330 $21,620 Total Current Liabilities $5,647 $5,728$5,075 $5,726 $15,528$16,326 $15,952| $15,371 522 558 424 Total Liabilities Using the financial data below, answer the following questions to assess the financial strength of this company. 2015 2014 2017 2016 $25,778$27,079$28,105 $27,931 Sales Cost of Goods Sold 15,62116,49616,86316,725 $10,157$10,583 $11,242 $11,206 8,8428,5448,4598,528 $1,315$2,039$2,783%2,678 388 804 $6111,070$1,526 $1,486 Gross Income rating Expenses erating Income Interest Expense Taxes Net Income 363 341 361 608 393 864 Cash Receivables Invento Total Current Assets Total Assets $1.297$1,109 $2,246 $2,273 438 5,8075,9855,9105,977 $7,626$7,652S8,580$8,688 $19,851$20,576 $21,330 $21,620 Total Current Liabilities $5,647 $5,728$5,075 $5,726 $15,528$16,326 $15,952| $15,371 522 558 424 Total Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts